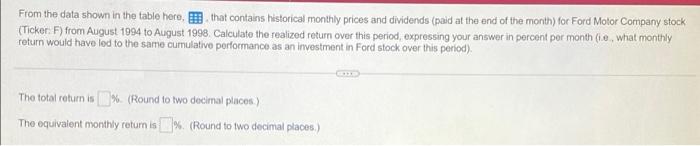

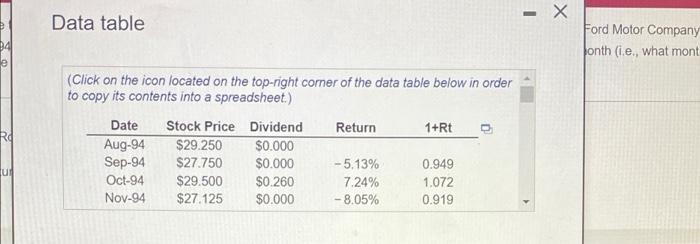

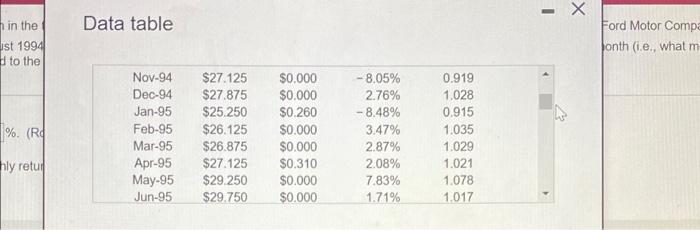

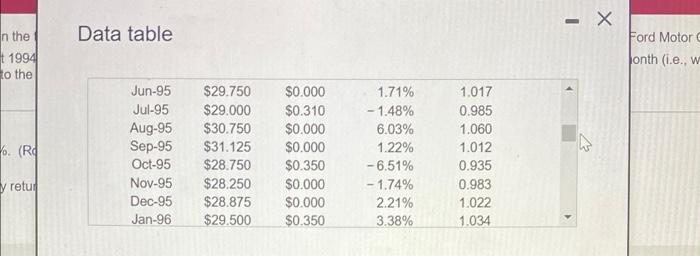

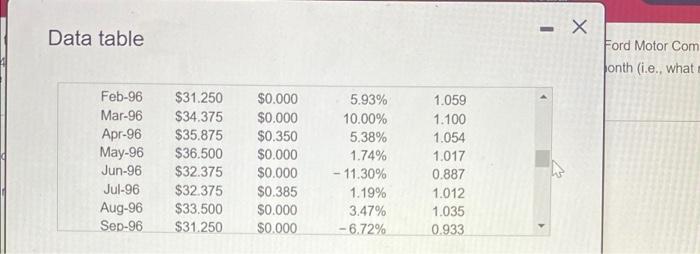

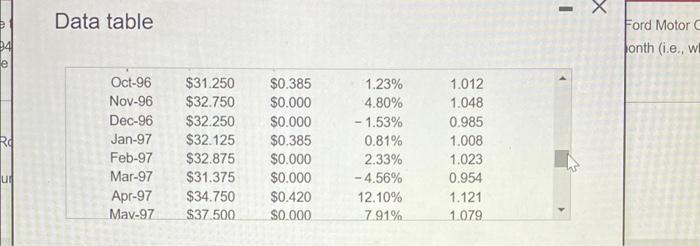

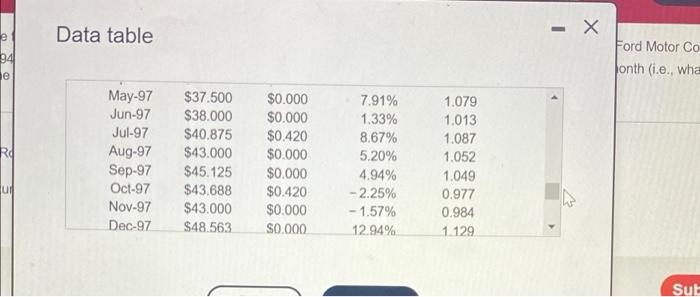

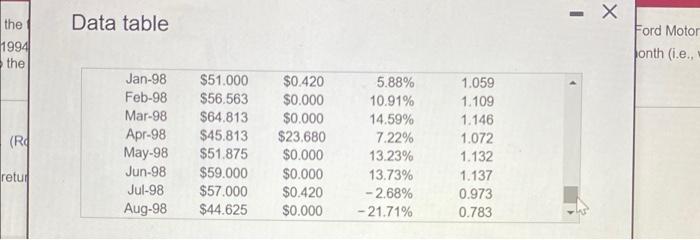

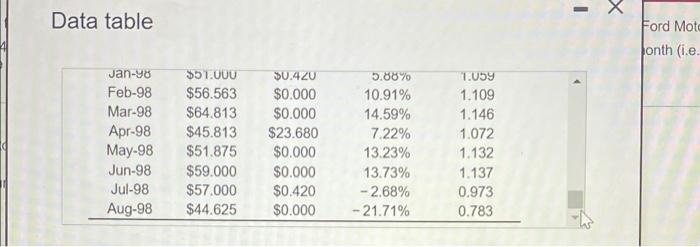

From the data shown in the table here, that contains historical monthly prices and dividends (paid at the end of the month) for Ford Motor Company stock (Ticker:F) from August 1094 to August 1998. Calculate the realized return over this period, expressing your answer in percent per month (ie, what monthly return would have led to the same cumulativo porformance as an investment in Ford stock over this period). The total coturn is 1% (Round to two decimal places) The equivalent monthly return is % (Round to two decimal places) - Data table 34 e Ford Motor Company onth (ie., what mont (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Date Stock Price Dividend Return 1+Rt Aug-94 $29.250 $0.000 Sep-94 $27.750 $0.000 -5,13% 0.949 Oct-94 $29.500 $0.260 7.24% 1.072 Nov-94 $27.125 $0.000 -8.05% 0.919 1 h in the Data table Ford Motor Compa onth (ie., what m Ust 1994 to the %. (Rd Nov-94 Dec-94 Jan-95 Feb-95 Mar-95 Apr-95 May-95 Jun-95 $27.125 $27.875 $25.250 $26.125 $26.875 $27.125 $29.250 $29.750 $0.000 $0.000 $0.260 $0.000 $0.000 $0.310 $0.000 $0.000 - 8.05% 2.76% -8.48% 3.47% 2.87% 2.08% 7.83% 1.71% 0.919 1.028 0.915 1.035 1.029 1.021 1.078 1.017 hly retur - Data table In the 1994 to the Ford Motor Jonth (i.e., w 6. (Rd Jun-95 Jul-95 Aug-95 Sep-95 Oct-95 Nov-95 Dec-95 Jan-96 $29.750 $29.000 $30.750 $31.125 $28.750 $28.250 $28.875 $29.500 $0.000 $0.310 $0.000 $0.000 $0.350 $0.000 $0.000 $0.350 1.71% -1.48% 6.03% 1.22% -6.51% -1.74% 2.21% 3.38% 1.017 0.985 1.060 1.012 0.935 0.983 1.022 1.034 y retur - X Data table Ford Motor Com Jonth (i.e. what Feb-96 Mar-96 Apr-96 May-96 Jun-96 Jul-96 Aug-96 Sep-96 $31.250 $34.375 $35.875 $36.500 $32.375 $32.375 $33.500 $31.250 $0.000 $0.000 $0.350 $0.000 $0.000 $0.385 $0.000 $0.000 5.93% 10.00% 5.38% 1.74% - 11.30% 1.19% 3.47% -6.72% 1.059 1.100 1.054 1.017 0.887 1.012 1.035 0.933 - Data table Ford Motor Jonth (ie., WI 94 le R Oct-96 Nov-96 Dec-96 Jan-97 Feb-97 Mar-97 Apr-97 Mav-97 $31.250 $32.750 $32.250 $32.125 $32.875 $31.375 $34.750 $37.500 $0.385 $0.000 $0.000 $0.385 $0.000 $0.000 $0.420 $0.000 1.23% 4.80% -1.53% 0.81% 2.33% - 4.56% 12.10% 791% 1.012 1.048 0.985 1.008 1.023 0.954 1.121 1.079 ur -X Data table e 94 e Ford Motor Co onth (i.e., wha RI May-97 Jun-97 Jul-97 Aug-97 Sep-97 Oct-97 Nov-97 Dec-97 $37.500 $38.000 $40.875 $43.000 $45.125 $43.688 $43.000 $48.563 $0.000 $0.000 $0.420 $0.000 $0.000 $0.420 $0.000 S0.000 7.91% 1.33% 8.67% 5.20% 4.94% -2.25% -1.57% 12.94% 1.079 1.013 1.087 1.052 1.049 0.977 0.984 1129 uil Sut Data table the 1994 the Ford Motor onth (i.e. (RP Jan-98 Feb-98 Mar-98 Apr-98 May-98 Jun-98 Jul-98 Aug-98 $51.000 $56.563 $64.813 $45.813 $51.875 $59.000 $57.000 $44.625 $0.420 $0.000 $0.000 $23.680 $0.000 $0.000 $0.420 $0.000 5.88% 10.91% 14.59% 7.22% 13.23% 13.73% -2.68% - 21.71% 1.059 1.109 1.146 1.072 1.132 1.137 0.973 0.783 retul - X Data table Ford Moto bonth (ie. Jan-98 Feb-98 Mar-98 Apr-98 May-98 Jun-98 Jul-98 Aug-98 $51.000 $56.563 $64.813 $45.813 $51.875 $59.000 $57.000 $44.625 $0.420 $0.000 $0.000 $23.680 $0.000 $0.000 $0.420 $0.000 5.88% 10.91% 14.59% 7.22% 13.23% 13.73% -2.68% - 21.71% 1.059 1.109 1.146 1.072 1.132 1.137 0.973 0.783