Answered step by step

Verified Expert Solution

Question

1 Approved Answer

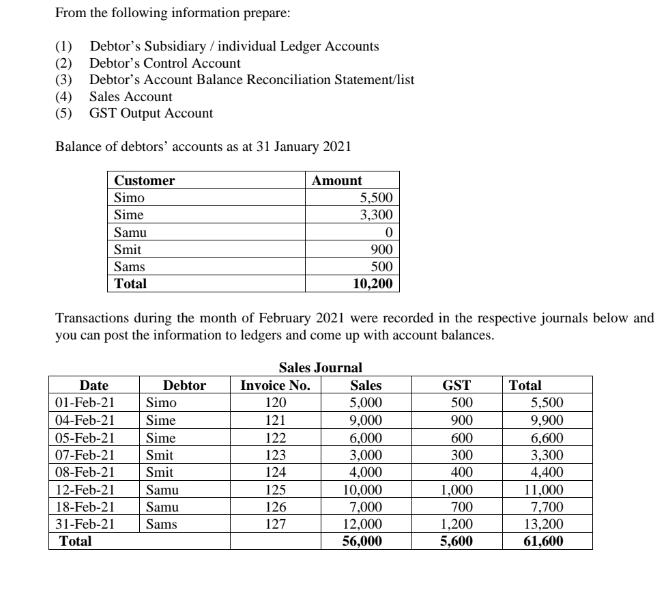

From the following information prepare: (1) Debtor's Subsidiary / individual Ledger Accounts (2) Debtor's Control Account (3) Debtor's Account Balance Reconciliation Statement/list (4) Sales

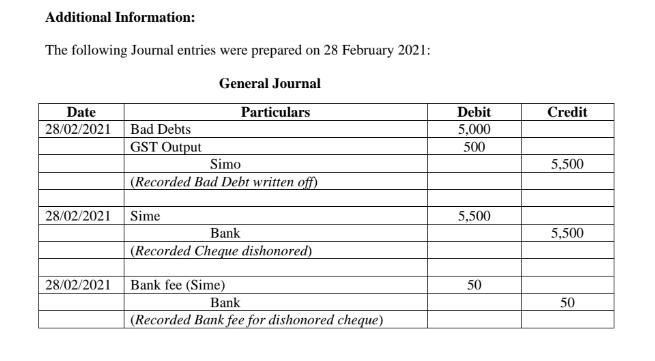

From the following information prepare: (1) Debtor's Subsidiary / individual Ledger Accounts (2) Debtor's Control Account (3) Debtor's Account Balance Reconciliation Statement/list (4) Sales Account (5) GST Output Account Balance of debtors' accounts as at 31 January 2021 Customer Simo Sime Samu Smit Sams Total Date 01-Feb-21 04-Feb-21 Debtor Transactions during the month of February 2021 were recorded in the respective journals below and you can post the information to ledgers and come up with account balances. Simo Sime Sime Smit Smit 05-Feb-21 07-Feb-21 08-Feb-21 12-Feb-21 Samu 18-Feb-21 Samu 31-Feb-21 Sams Total Amount Invoice No. 120 121 122 5,500 3,300 Sales Journal 123 124 125 126 127 0 900 500 10,200 Sales 5,000 9,000 6,000 3,000 4,000 10,000 7,000 12,000 56,000 GST 500 900 600 300 400 1,000 700 1,200 5,600 Total 5,500 9,900 6,600 3,300 4,400 11,000 7,700 13,200 61,600 Date 6-Feb-21 16-Feb-21 18-Feb-21 Total Date 08-Feb-21 10-Feb-21 10-Feb-21 12-Feb-21 16-Feb-21 18-Feb-21 19-Feb-21 Total Debtor Sime Samu Smit Sales Returns Journal Credit Note No. Sales Return 6 3,000 17 700 18 Particulars Simo Sime Samu Samu Sams Smit Sime 3,000 6,700 Cash Receipts Journal Receipt No. 800 801 802 803 804 805 806 GST 300 70 300 670 Total 3,300 770 3,300 7,370 Trade Debtors 5,500 3,300 3,300 10,300 500 4,400 9,900 37,200 Total 5,500 3,300 3,300 10,300 500 4,400 9,900 37,200 Additional Information: The following Journal entries were prepared on 28 February 2021: General Journal Date 28/02/2021 Bad Debts GST Output Particulars Simo (Recorded Bad Debt written off) 28/02/2021 Sime Bank (Recorded Cheque dishonored) 28/02/2021 Bank fee (Sime) Bank (Recorded Bank fee for dishonored cheque) Debit 5,000 500 5,500 50 Credit 5,500 5,500 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Debtors SubsidiaryIndividual Ledger Accounts Date Particulars Invoice No Sales GST Total Receipt N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started