Answered step by step

Verified Expert Solution

Question

1 Approved Answer

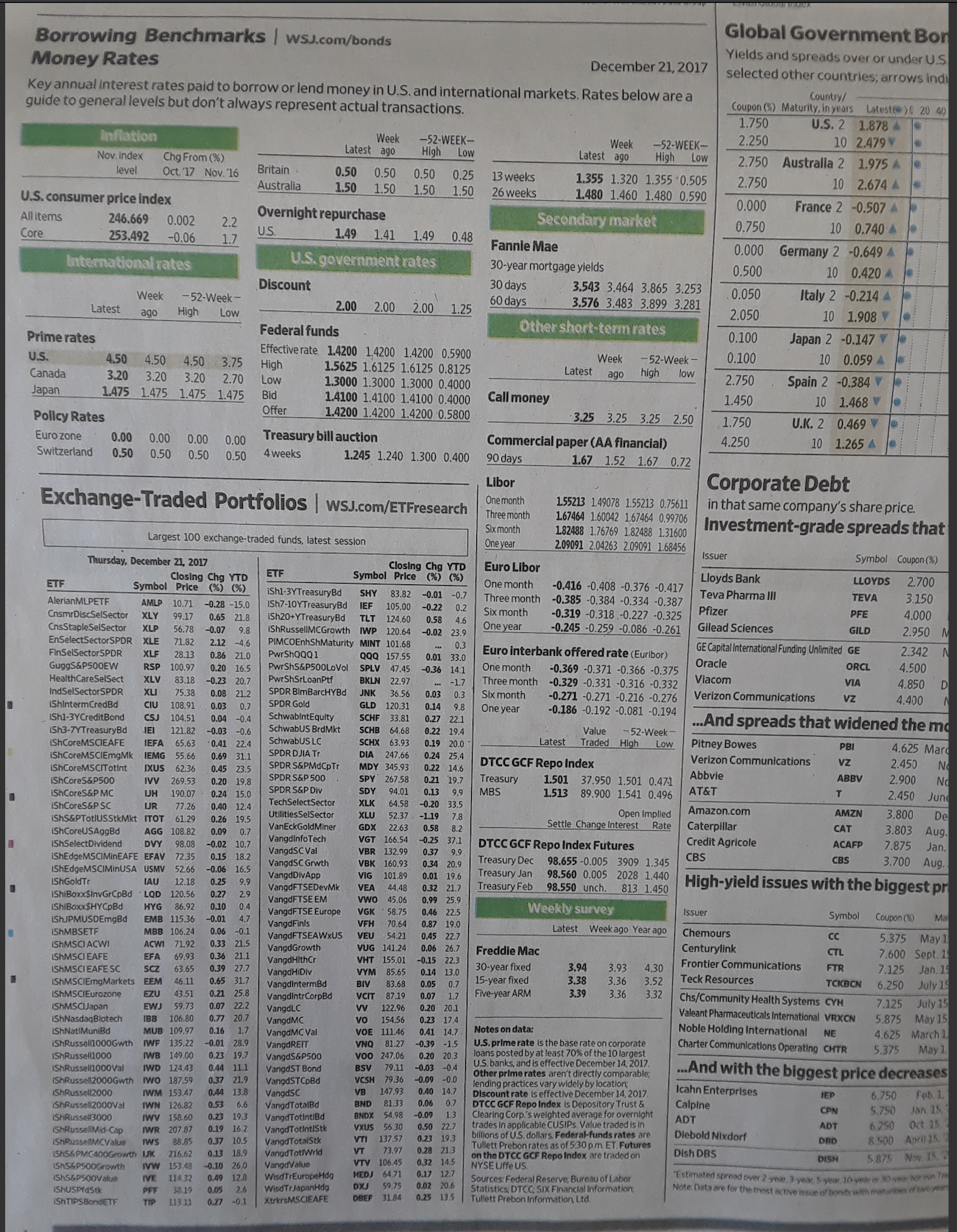

From the following quotes in the WSJ, at about what annual rate could a US bank based in London borrow US Dollars for 6 months?

- From the following quotes in the WSJ, at about what annual rate could a US bank based in London borrow US Dollars for 6 months?

- From the following quotes in the WSJ, at about what discount yield could a US bank issue 3-month bonds?

- From the following quotes in the WSJ, at about what discount yield could the US Treasury issue 1-month bonds?

- From the following quotes in the WSJ, at about what interest rate could a US bank borrow unsecured overnight from other US-based banks

- From the following quotes in the WSJ, at about what interest rate could a US bank borrow overnight from other banks using US T-Bills as collateral?

- From the following quotes in the WSJ, at about what annual rate could a US bank based in London borrow Euros for 6 months?

- From the following quotes in the WSJ, at about what annual rate could a US bank based in Paris borrow Euros for 6 months?

Borrowing Benchmarks | WSJ.com/bonds Money Rates Key annual interest rates paid to borrow or lend money in U.S. and international markets. Rates below are a guide to general levels but don't always represent actual transactions. 1.750 Inflation Week Latest ago 2.250 level Nov. Index Chg From (%) Oct. 17 Nov. 16 Britain Australia 0.50 0.50 1.50 1.50 -52-WEEK- High Low 0.50 0.25 1.50 1.50 Week Latest ago High Low -52-WEEK- December 21, 2017 Global Government Bor Yields and spreads over or under U.S selected other countries; arrows indi Country/ Coupon (%) Maturity, in years Latest)0 20 40 U.S. 2 1.878 10 2.479 2.750 Australia 2 1.975 A 13 weeks 26 weeks 1.355 1.320 1.355 0.505 2.750 10 2.674 A 1.480 1.460 1.480 0.590 U.S. consumer price index 0.000 France 2 -0.507 A All items Core 246.669 0.002 2.2 253.492 -0.06 1.7 Overnight repurchase Secondary market 0.750 10 0.740. U.S. 1.49 1.41 1.49 0.48 Fannie Mae 0.000 Germany 2 -0.649 A International rates U.S.government rates 30-year mortgage yields 0.500 10 0.420 A Discount 30 days 3.543 3.464 3.865 3.253 0.050 Italy 2 -0.214 A Week -52-Week- 60 days 3.576 3.483 3.899 3.281 2.00 2.00 2.00 1.25 2.050 10 1.908 Latest ago High Low Federal funds Other short-term rates 0.100 Japan 2 -0.147 Prime rates U.S. Canada Japan 4.50 4.50 4.50 3.75 3.20 3.20 3.20 1.475 1.475 1.475 1.475 High 2.70 Low Bid Offer Effective rate 1.4200 1.4200 1.4200 0.5900 1.5625 1.6125 1.6125 0.8125 1.3000 1.3000 1.3000 0.4000 1.4100 1.4100 1.4100 0.4000 1.4200 1.4200 1.4200 0.5800 Week -52-Week- 0.100 10 0.059 A Latest ago high low 2.750 Spain 2 -0.384 Call money 1.450 10 1.468 V 3.25 3.25 3.25 2.50 1.750 U.K. 2 0.469 V Policy Rates Euro zone 0.00 0.00 0.00 0.00 Switzerland 0.50 0.50 0.50 0.50 4 weeks Treasury bill auction 1.245 1.240 1.300 0.400 Commercial paper (AA financial) 90 days 4.250 10 1.265 A 1.67 1.52 1.67 0.72 B Exchange-Traded Portfolios | WSJ.com/ETFresearch Largest 100 exchange-traded funds, latest session Thursday, December 21, 2017 Closing Chg YTD ETF ETF Symbol Price (%) (%) Closing Chg YTD Symbol Price (%) (%) iSh1-3YTreasuryBd SHY 83.82 -0.01 -0.7 AlerianMLPETF AMLP 10.71 -0.28 -15.0 ISh7-10YTreasuryBd IEF 105.00 -0.22 0.2 CnsmrDiscSelSector XLY 99.17 iSh20+YTreasuryBd 0.65 21.8 TLT 124.60 0.58 4.6 CnsStapleSelSector XLP 56.78 -0.07 iShRussellMCGrowth IWP 120.64 -0.02 23.9 PIMCOEnhShMaturity MINT 101.68 0.3 PwrShQQQ1 QQQ 157.55 0.01 33.0 PwrShS&P500LoVol SPLV 47.45 -0.36 14.1 PwrShSrLoanPtf BKLN 2297 -1.7 JNK 36.561 GLD 120.31 SCHF 33.81 EnSelectSectorSPDR XLE 71.82 FinSelSectorSPDR GuggS&P500EW 9.8 2.12 -4.6 XLF 28.13 0.86 21.0 RSP 100.97 0.20 16.5 HealthCareSelSect XLV 83.18 -0.23 20.7 IndSelSectorSPDR XLI 75.38 0.08 21.2 IShIntermCredBd CIU 108.91 0.03 0.7 iSh1-3YCreditBond CSJ 104.51 0.04 -0.4 iSh3-7YTreasuryBd IEI 121.82 -0.03 -0.6 iShCoreS&P500 iShCoreMSCIEAFE IEFA 65.63 0.41 22.4 iShCoreMSCIEmgMk IEMG 55.66 0.69 31.1 iShCoreMSCITotint IXUS 0.45 23.5 IVV 269.53 0.20 19.8 iShCoreS&P MC IJH 190.07 0.24 15.0 iShCoreS&P SC UR 77.26 0.40 12.4 iShS&PTotlUSStkMkt ITOT 61.29 0.26 19.5 iShCoreUSAggBd AGG 108.82 0.09 0.7 IShSelect Dividend DVY 98.08 -0.02 10.7 iShEdgeMSCIMinEAFE EFAV 72.35 0.15 18.2 IShEdgeMSCIMinUSA USMV 52.66 -0.06 16.5 IAU 12.18 0.25 9.9 62.36 IShGoldTr iShiBoxx $InvGrCpBd LQD 120.56 0.27 2.9 iShiBoxx $HYCpBd iShJPMUSDEmgBd iShMBSETF iShMSCI ACWI HYG 86.92 0.10 0.4 EMB 115.36 -0.01 4.7 MBB 106.24 0.06 -0.1 ACWI 71.92 0.33 21.5 EFA 69.93 0.36 21.1 SCZ 63.65 0.39 27.7 (ShMSCIEmgMarkets EEM 46.11 0.65 31.7 EZU 43.51 0.21 25.8 EWJ 59.73 0.07 22.2 iShMSCI EAFE ISHMSCI EAFE SC IShMSCIEurozone ISHMSCIJapan IShNasdaqBiotech IBB 106.80 0.77 20.7 IShNatlMuniBd MUB 109.97 iShRussell1000Gwth IWF 135.22 IWB 149.00 0.16 1.7 -0.01 28.9 0.23 19.7 0.44 11.1 0.37 21.9 IWM 153.47 0.44 13.8 IShRussell1000 ShRussell1000Val IWD 124.43 (ShRussell2000Gwth IWO 187.59 ShRussell2000 ShRussell2000Val ShRussell3000 (ShRussellMCValue (ShRussell Mid-Cap IWS IWN 126.82 0.53 6.6 0.23 19.3 IWV 158.60 0.19 16.2 IWR 207.87 88.85 0.37 10.5 216.62 0.13 18.9 -0.10 26.0 IVE 114.32 0.49 12.8 PFF 32.19 0.05 2.6 TIP 113.11 0.27 -0.1 ISHS&PMC400Growth UK ISHS&P500Growth VW 153.48 ISHS&P500Value ISHUSPfdStk ISHTIPSBondETF SPDR BimBarcHYBd SPDR Gold Libor One month Three month Six month One year 155213 1.49078 1.55213 0.75611 Corporate Debt in that same company's share price. 1.67464 1.60042 1.67464 0.99706 Investment-grade spreads that 182488 1.76769 1.82488 1.31600 2.09091 2.04263 2.09091 1.68456 DTCC GCF Repo Index Treasury MBS Issuer Symbol Coupon (%) Vangar VangdFTSE Europe VangdFinis VHT 155.01 0.03 0.3 0.14 9.8 0.27 22.1 SCHB 64.68 0.22 19.4 SCHX 63.93 0.19 20.0 DIA 247.66 0.24 25.4 MDY 345.93 0.22 14.6 SPY 267.58 0.21 19.7 SDY 94.01 0.13 9.9 XLK 64.58 -0.20 33.5 XLU 52.37 -1.19 7.8 GDX 22.63 0.58 VGT 166.54 -0.25 VBR 132.99 0.37 9.9 VBK 160.93 0.34 20.9 100.75 VIG 101.89 0.01 19.6 VEA 44.48 0.32 21.7 vwo 45.06 0.99 25.9 VGK 58.75 0.46 22.5 VFH 70.64 0.87 19.0 VEU 54.21 0.45 22.7 VUG 141.24 0.06 262 26.7 -0.15 22.3 Euro Libor One month -0.416 -0.408 -0.376 -0.417 Three month -0.385 -0.384 -0.334 -0.387 Six month -0.319 -0.318 -0.227 -0.325 One year -0.245 -0.259 -0.086 -0.261 Euro interbank offered rate (Euribor) One month -0.369 -0.371 -0.366 -0.375 Three month -0.329 -0.331 -0.316 -0.332 Six month One year Lloyds Bank Teva Pharma III Pfizer Gilead Sciences LLOYDS 2.700 TEVA 3.150 PFE 4.000 GILD 2.950 M GE Capital International Funding Unlimited GE 2.342 N Oracle ORCL 4.500 Viacom VIA 4.850 D -0.271 -0.271 -0.216 -0.276 -0.186 -0.192 -0.081 -0.194 Verizon Communications VZ 4.400 N Value -52-Week- Latest Traded High Low ...And spreads that widened the mo Pitney Bowes Verizon Communications PBI VZ 4.625 Marc 2.450 No 1.501 37.950 1.501 0.471 1.513 89.900 1.541 0.496 Abbvie AT&T ABBV 2.900 No T 2.450 June Amazon.com Caterpillar Credit Agricole CBS AMZN 3.800 CAT 3.803 Aug. ACAFP 7.875 Jan. CBS 3.700 Aug. De Weekly survey Issuer Symbol Coupon (%) Mal Latest Week ago Year ago Chemours CC 5.375 May 1 Freddie Mac 30-year fixed Centurylink CTL 7.600 Sept. 1 3.94 3.93 4.30 Frontier Communications FTR 7.125 Jan. 19 VYM 85.65 85 65 0.14 13.0 RIV BIV 0.05 83.68 0.05 07 0.7 15-year fixed 3.38 3.36 3.52 Teck Resources TCKBCN 6.250 July 19 Five-year ARM 3.39 3.36 3.32 7.125 July 15 5.875 May 15 4.625 March 1 5.375 May 1 SchwabintEquity SchwabUS BrdMkt SchwabUS LC SPDR DJIA Tr SPDR S&PMdCpTr SPDR S&P 500 SPDR S&P Div TechSelectSector UtilitiesSelSector VanEckGoldMiner VangdinfoTech VangdSC Val VangdSC Grwth VangdDivApp VangdFTSEDevMk VangdFTSE EM VangdFTSEAWXUS VangdGrowth VangdHlthCr VangdHiDiv VangdintermBd VangdintrCorpBd VangdLC VangdMC VangdMC Val VangdREIT VangdS&P500 VangdST Bond VangdSTCpBd VangdSC VangdTotalBd VangdTotintiBd VangdTotint/Stk VangdTotalStk VangdTot/Wrld VangdValue WisdTrEuropeHdg WisdTrJapanHdg XtrkrsMSCIEAFE VUG 141.24 VHI 155.01 VCIT 87.19 0.07 122.96 W 122.96 0.20 20.1 YO 154.56 Vo VOE 111.46 VNQ 81.27 VOO 247.06 BSV 79.11 VCSH 79.36 147.93 VB BND 81.33 BNDX 54,98 VXUS 56.30 VTI 137.57 73.97 VTV 106.45 MEDJ 64.71 DXJ 59.75 DBEF 31.84 0.22 124 0.23 17.4 0.41 14.7 -0.39 -1.5 0.20 20.3 -0.03 -0.4 -0.09 -0.0 0.40 14.7 0.06 0.7 -0.09 1.3 0.50 22.7 0.23 19.3 0.28 21.3 0.32 14.5 0.17 12.7 0.02 20.6 0.25 13.5 Open Implied Settle Change Interest Rate DTCC GCF Repo Index Futures Treasury Dec 98.655-0.005 3909 1.345 Treasury Jan Treasury Feb 98.550 unch. 813 1.450 98.560 0.005 2028 1.440 High-yield issues with the biggest pr Notes on data: U.S.prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S.banks, and is effective December 14, 2017. Other prime rates aren't directly comparable; lending practices vary widely by location Discount rate is effective December 14, 2017. DTCC GCF Repo Index is Depository Trust & Clearing Corp.'s weighted average for overnight trades in applicable CUSIPS. Value traded is in billions of U.S. dollars. Federal-funds rates are Tullett Prebon rates as of 530 pm ET. Futures on the DTCC GCF Repo Index are traded on NYSE Liffe US Sources: Federal Reserve, Bureau of Labor Statistics; DTCC, SIX Financial Information Tullett Prebon Information, Ltd. Chs/Community Health Systems CYH Valeant Pharmaceuticals International VRXCN Noble Holding International NE Charter Communications Operating CHTR ...And with the biggest price decreases Icahn Enterprises Calpine ADT Diebold Nixdorf Dish DBS IEP 6.750 Feb. 1. CPN 5.750 Jan. 15, ADT 6.250 Oct 25 DRD 8.500 April 15 DISH 5.875 Nov 15, Estimated spread over 2 year, 3-year, 5 year 10-year or 30 seat Tre Note Data are for the most active issue of bonds with maturites of two year

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 At about what annual rate could a US bank based in London borrow US Dollars for 6 months 3month LI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started