Question

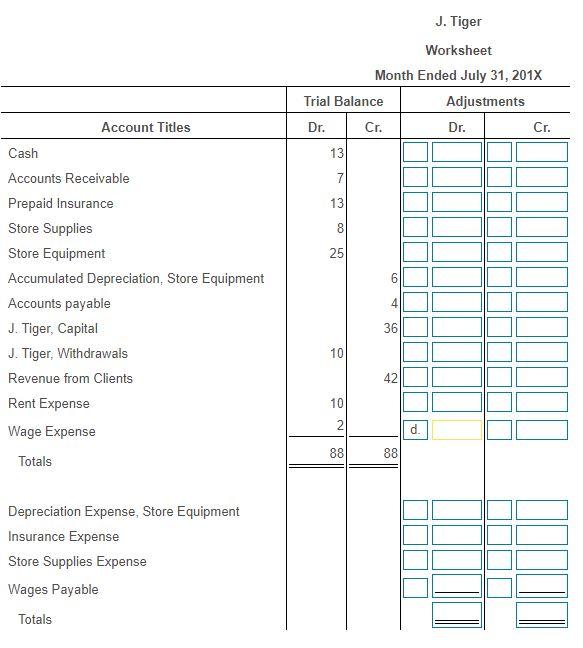

From the following trial balance and adjustment data, complete a worksheet for J. Tiger as of July 31, 201X: Complete the worksheet one section at

From the following trial balance and adjustment data, complete a worksheet for J. Tiger as of July 31, 201X:

Complete the worksheet one section at a time, beginning with the Adjustments columns. When completing the Adjustments column, enter a posting reference along with each debit or credit amount that corresponds to the letter of the adjusting entry (a., b., c., etc.) For the Income Statement and Balance Sheet columns, remember to include the net income or loss after the totals and then total the columns again. (Leave unused cells blank. Do not enter a "0" for any zero balances.)

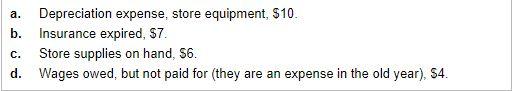

Adjustment data:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started