Answered step by step

Verified Expert Solution

Question

1 Approved Answer

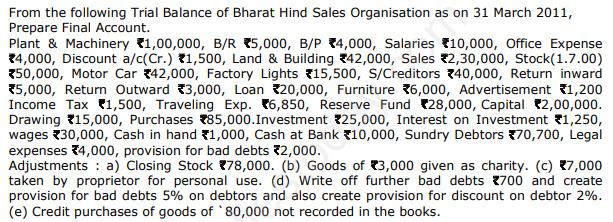

From the following Trial Balance of Bharat Hind Sales Organisation as on 31 March 2011, Prepare Final Account. Plant & Machinery 1,00,000, B/R 5,000,

From the following Trial Balance of Bharat Hind Sales Organisation as on 31 March 2011, Prepare Final Account. Plant & Machinery 1,00,000, B/R 5,000, B/P 4,000, Salaries 10,000, Office Expense *4,000, Discount a/c(Cr.) 1,500, Land & Building 42,000, Sales 2,30,000, Stock(1.7.00) *50,000, Motor Car 42,000, Factory Lights 15,500, S/Creditors 40,000, Return inward *5,000, Return Outward 3,000, Loan 20,000, Furniture 6,000, Advertisement 1,200 Income Tax 1,500, Traveling Exp. 6,850, Reserve Fund 28,000, Capital 2,00,000. Drawing 15,000, Purchases 85,000. Investment 25,000, Interest on Investment 1,250, wages 30,000, Cash in hand 1,000, Cash at Bank 10,000, Sundry Debtors 70,700, Legal expenses 4,000, provision for bad debts 2,000. Adjustments: a) Closing Stock 78,000. (b) Goods of 3,000 given as charity. (c) 7,000 taken by proprietor for personal use. (d) Write off further bad debts 700 and create provision for bad debts 5% on debtors and also create provision for discount on debtor 2%. (e) Credit purchases of goods of '80,000 not recorded in the books.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Trial Balance Account Title Debit Credit Plant Machinery 100000 BR 5000 BP 4000 Salaries 10000 Office Expense 4000 Discount ac Cr 1500 Land Building 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started