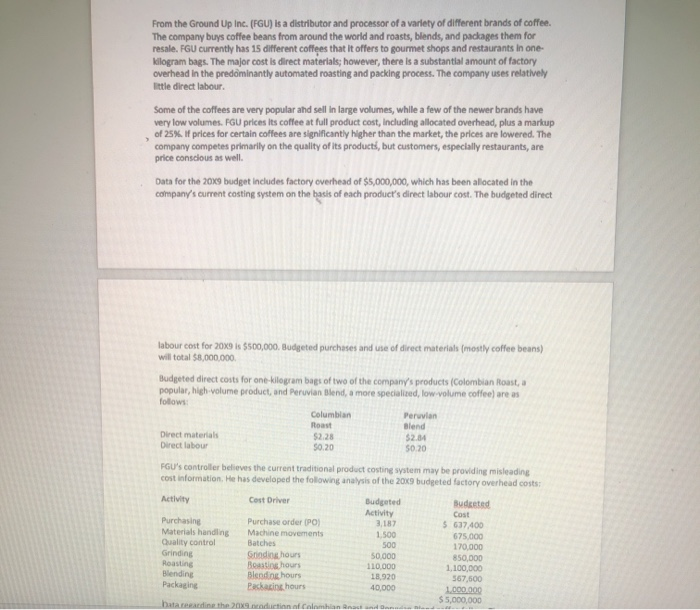

From the Ground Up Inc. (FGU) is a distributor and processor of a variety of different brands of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. FGU currently has 15 different coffees that It offers to gourmet shops and restaurants in one. kilogram bags. The major cost is direct materials; however, there is a substantial amount of factory overhead in the predominantly automated roasting and packing process. The company uses relatively little direct labour. Some of the coffees are very popular and sell in large volumes, while a few of the newer brands have very low volumes. FGU prices its coffee at full product cost, including allocated overhead, plus a markup of 25%. If prices for certain coffees are significantly higher than the market, the prices are lowered. The company competes primarily on the quality of its products, but customers, especially restaurants, are price conscious as well. Data for the 2019 budget Includes factory overhead of $5,000,000, which has been allocated in the company's current casting system on the basis of each product's direct labour cost. The budgeted direct labour cost for 20x9 is $500,000. Budgeted purchases and use of direct materials (mostly coffee beans) will total 58,000,000 Budgeted direct costs for one kilogram bags of two of the company's products (Colombian Roast, a popular, high volume product, and Peruvian Blend, a more specialized, low volume coffee) are us follows: Columbian Peruvian Blend Direct materials $2.28 $2.84 Direct labour 50.20 50.20 Roast FGU's controller believes the current traditional product costing system may be providing misleading cost information. He has developed the following analysis of the 2019 budgeted factory overhead costs: Activity Cost Driver Purchasing Purchase order (PO! Materials handling Machine movements Quality control Batches Grinding Grinding hours Roasting Beating hours Blending Blending hours Packaging Packating hours bata reading the 2009 noduction of Colombiana Budgeted Activity 3.187 1.500 500 50,000 110.000 18.920 40.000 Budeeted Cost $637,400 675.000 170,000 850,000 1,100,000 367,600 1.000.000 $5,000,000 From the Ground Up Inc. (FGU) is a distributor and processor of a variety of different brands of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. FGU currently has 15 different coffees that It offers to gourmet shops and restaurants in one. kilogram bags. The major cost is direct materials; however, there is a substantial amount of factory overhead in the predominantly automated roasting and packing process. The company uses relatively little direct labour. Some of the coffees are very popular and sell in large volumes, while a few of the newer brands have very low volumes. FGU prices its coffee at full product cost, including allocated overhead, plus a markup of 25%. If prices for certain coffees are significantly higher than the market, the prices are lowered. The company competes primarily on the quality of its products, but customers, especially restaurants, are price conscious as well. Data for the 2019 budget Includes factory overhead of $5,000,000, which has been allocated in the company's current casting system on the basis of each product's direct labour cost. The budgeted direct labour cost for 20x9 is $500,000. Budgeted purchases and use of direct materials (mostly coffee beans) will total 58,000,000 Budgeted direct costs for one kilogram bags of two of the company's products (Colombian Roast, a popular, high volume product, and Peruvian Blend, a more specialized, low volume coffee) are us follows: Columbian Peruvian Blend Direct materials $2.28 $2.84 Direct labour 50.20 50.20 Roast FGU's controller believes the current traditional product costing system may be providing misleading cost information. He has developed the following analysis of the 2019 budgeted factory overhead costs: Activity Cost Driver Purchasing Purchase order (PO! Materials handling Machine movements Quality control Batches Grinding Grinding hours Roasting Beating hours Blending Blending hours Packaging Packating hours bata reading the 2009 noduction of Colombiana Budgeted Activity 3.187 1.500 500 50,000 110.000 18.920 40.000 Budeeted Cost $637,400 675.000 170,000 850,000 1,100,000 367,600 1.000.000 $5,000,000