Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the information, 1.Create a loan amortization schedule 2. What happens if I pay $50 more? Loan is amortized over 15 years but maturity is

From the information, 1.Create a loan amortization schedule 2. What happens if I pay $50 more?

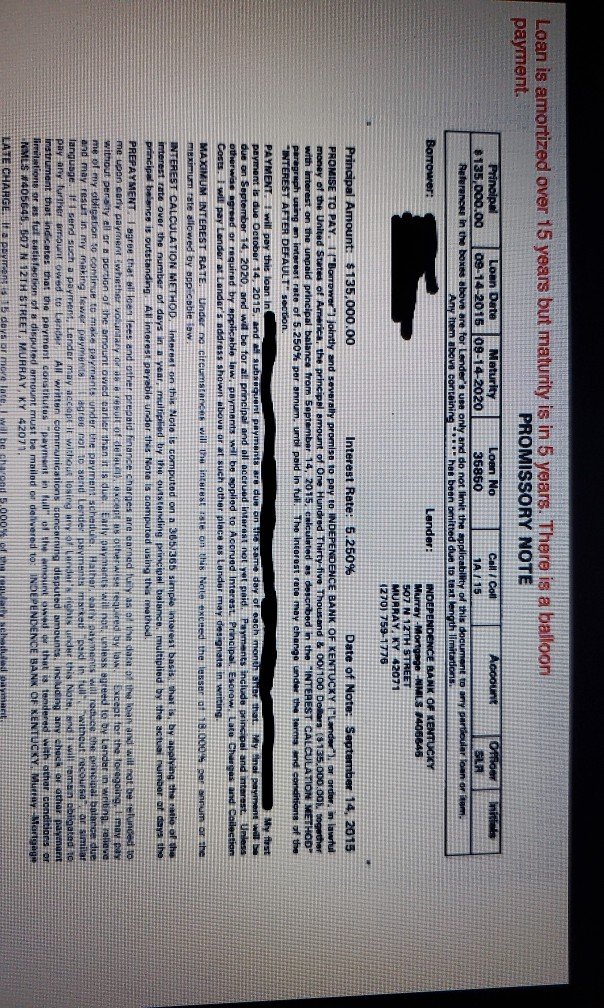

Loan is amortized over 15 years but maturity is in 5 years. There is a balloon payment. PROMISSORY NOTE Principal Loan Date Maturity Loan No CARI Coll Account Officer $135,000.00 09-14-2015 09-14-2020 35850 1A/ 15 SLR References in the boxes above are for Lander's use only and do not limit the applicability of this document to any particular Town or item. Any item above containing has been omitted due to teal length limitations Borrower: Lander: INDEPENDENCE BANK OF KENTUCKY Murray -Mortgage NMLS 1406645 507 N 12TH STREET MURRAY, KY 42071 1270) 759-1776 Principal Amount: $135,000.00 Interest Rate: 5.250% Date of Note: September 14, 2015 PROMISE TO PAY. 1/Bondwer" jointly and severally promise to pay to INDEPENDENCE BANK OF KENTUCKY Landex) or order in lawful money of the United States of America, the principal amount of One Hundred Thirty-five Thousand & 00/100 Dollars ($135.000.00%. Together with interest on the unpaid principal balance from September 14, 2015, calculated as described in the "INTEREST CALCULATION METHOD" paragraph using interest rate of 5.250% per annum. Until paid in full. The Incorest rate may change under the terms and conditions of the INTEREST AFTER DEFAULT" section. PAYMENT. I will pay this loan in My first payment is due October 14, 2015, and all subsequent payments wc duo on some day of each month to that. My final payment will be due on September 14, 2020, and we be for all principal and all accrued Interest not yet paid. Payments include principal and interest. Unless otherwise agreed or required by applicable iw, payments will be applied to Acorved Interest. Principal. Escrow. Late Changes and Collection Coses. I will pay Lender at Landar's address shown above or at such other place as Londer may designate in writing. MAXIMUM INTEREST RATE. Under no circumstances will inu interest rate on this Nole exceed the lesser at 10.000 per annum or the maximum rate allowed by appicable law INTEREST CALCULATION METHOD. Interest on this Noto is computod on a 305/365 simple interest basis that is, by applying the ratio of the interest rate over the number of days in a year, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is outstanding All interesi payable under this Note is computed using this method PREPAYMENT. I agree that will loan lees and other prepaid finance charges are earned fully as of the date of the loan and will not be refunded to me upon early payment whether voluntary or as a result of detace) cent as otherwise required by law. Except for the foregoing, li may day without persity all or a portion of the amount owed earlier than it is due. Early payments will now.cnless agreed to dy Lander in writing relieve me of my obligation to continue to make payments under the payment schedule. Hather, atly payments will raduee the original balance due and may result in my making fewer payment are not to sund Lender Payments marked paid in for without recourse, an similar language. I send such a payment, Lender may accept it without losing weight unded this Note, and I will remain obilnated to pay any further amount owed to London All written communications concerning disputed amounts, including any check other payment instrument that indicates that the payment constitutos "payment in full of the Nowed that is tendered with other conditions or lilations or as ful satisfaction of a disputed amount must be mailed or delivered to: INDEPENDENCE BANK OF KENTUCKY. Murray Mortgage NOMES W405645, 507 N 12TH STREET, MUAHAY, KY 42071 LATE CHARGE. It payment is 15 days or more Loan is amortized over 15 years but maturity is in 5 years. There is a balloon payment. PROMISSORY NOTE Principal Loan Date Maturity Loan No CARI Coll Account Officer $135,000.00 09-14-2015 09-14-2020 35850 1A/ 15 SLR References in the boxes above are for Lander's use only and do not limit the applicability of this document to any particular Town or item. Any item above containing has been omitted due to teal length limitations Borrower: Lander: INDEPENDENCE BANK OF KENTUCKY Murray -Mortgage NMLS 1406645 507 N 12TH STREET MURRAY, KY 42071 1270) 759-1776 Principal Amount: $135,000.00 Interest Rate: 5.250% Date of Note: September 14, 2015 PROMISE TO PAY. 1/Bondwer" jointly and severally promise to pay to INDEPENDENCE BANK OF KENTUCKY Landex) or order in lawful money of the United States of America, the principal amount of One Hundred Thirty-five Thousand & 00/100 Dollars ($135.000.00%. Together with interest on the unpaid principal balance from September 14, 2015, calculated as described in the "INTEREST CALCULATION METHOD" paragraph using interest rate of 5.250% per annum. Until paid in full. The Incorest rate may change under the terms and conditions of the INTEREST AFTER DEFAULT" section. PAYMENT. I will pay this loan in My first payment is due October 14, 2015, and all subsequent payments wc duo on some day of each month to that. My final payment will be due on September 14, 2020, and we be for all principal and all accrued Interest not yet paid. Payments include principal and interest. Unless otherwise agreed or required by applicable iw, payments will be applied to Acorved Interest. Principal. Escrow. Late Changes and Collection Coses. I will pay Lender at Landar's address shown above or at such other place as Londer may designate in writing. MAXIMUM INTEREST RATE. Under no circumstances will inu interest rate on this Nole exceed the lesser at 10.000 per annum or the maximum rate allowed by appicable law INTEREST CALCULATION METHOD. Interest on this Noto is computod on a 305/365 simple interest basis that is, by applying the ratio of the interest rate over the number of days in a year, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is outstanding All interesi payable under this Note is computed using this method PREPAYMENT. I agree that will loan lees and other prepaid finance charges are earned fully as of the date of the loan and will not be refunded to me upon early payment whether voluntary or as a result of detace) cent as otherwise required by law. Except for the foregoing, li may day without persity all or a portion of the amount owed earlier than it is due. Early payments will now.cnless agreed to dy Lander in writing relieve me of my obligation to continue to make payments under the payment schedule. Hather, atly payments will raduee the original balance due and may result in my making fewer payment are not to sund Lender Payments marked paid in for without recourse, an similar language. I send such a payment, Lender may accept it without losing weight unded this Note, and I will remain obilnated to pay any further amount owed to London All written communications concerning disputed amounts, including any check other payment instrument that indicates that the payment constitutos "payment in full of the Nowed that is tendered with other conditions or lilations or as ful satisfaction of a disputed amount must be mailed or delivered to: INDEPENDENCE BANK OF KENTUCKY. Murray Mortgage NOMES W405645, 507 N 12TH STREET, MUAHAY, KY 42071 LATE CHARGE. It payment is 15 days or moreStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started