From the Intermediate Financial Management class. Please solve it with appropriate explanations.

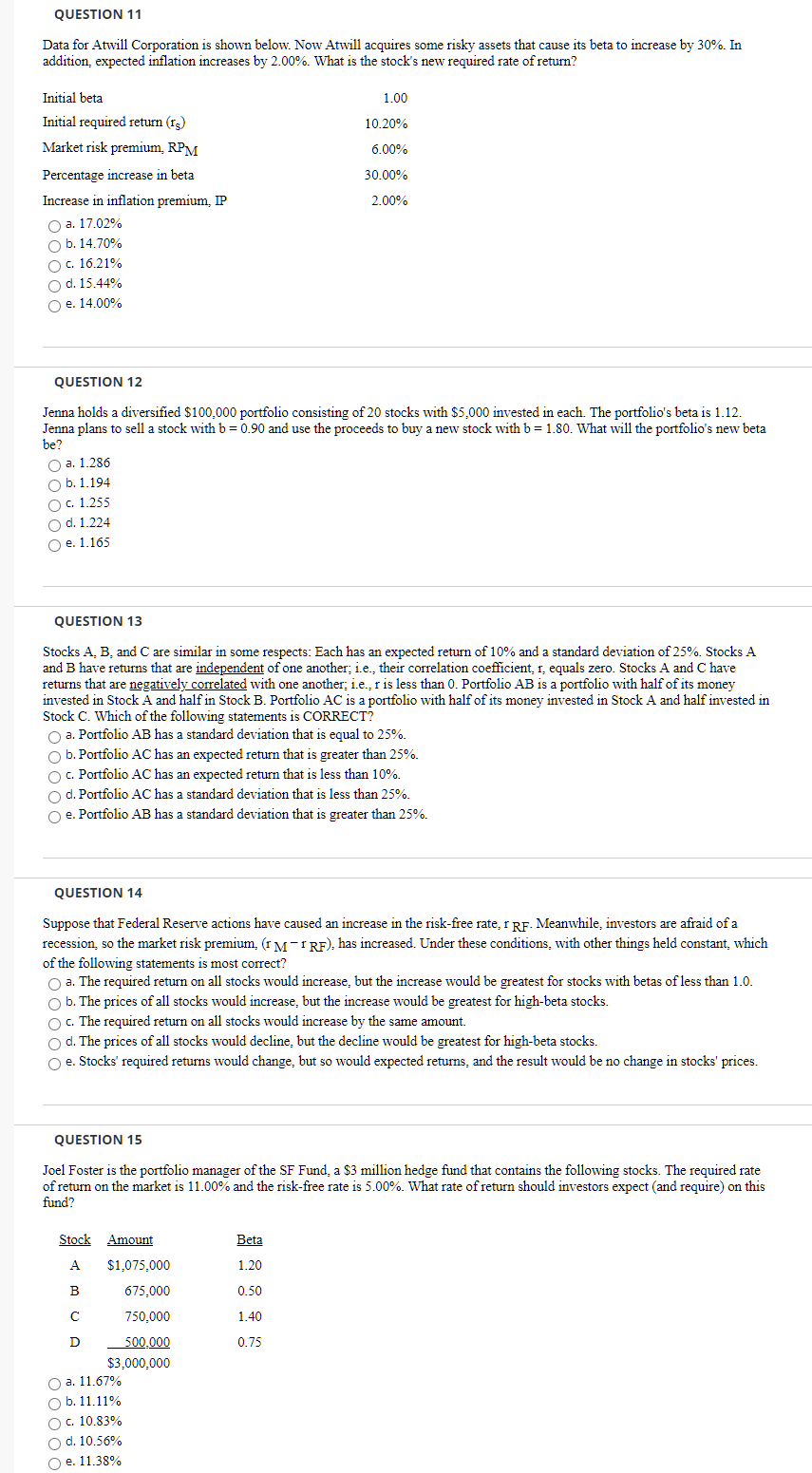

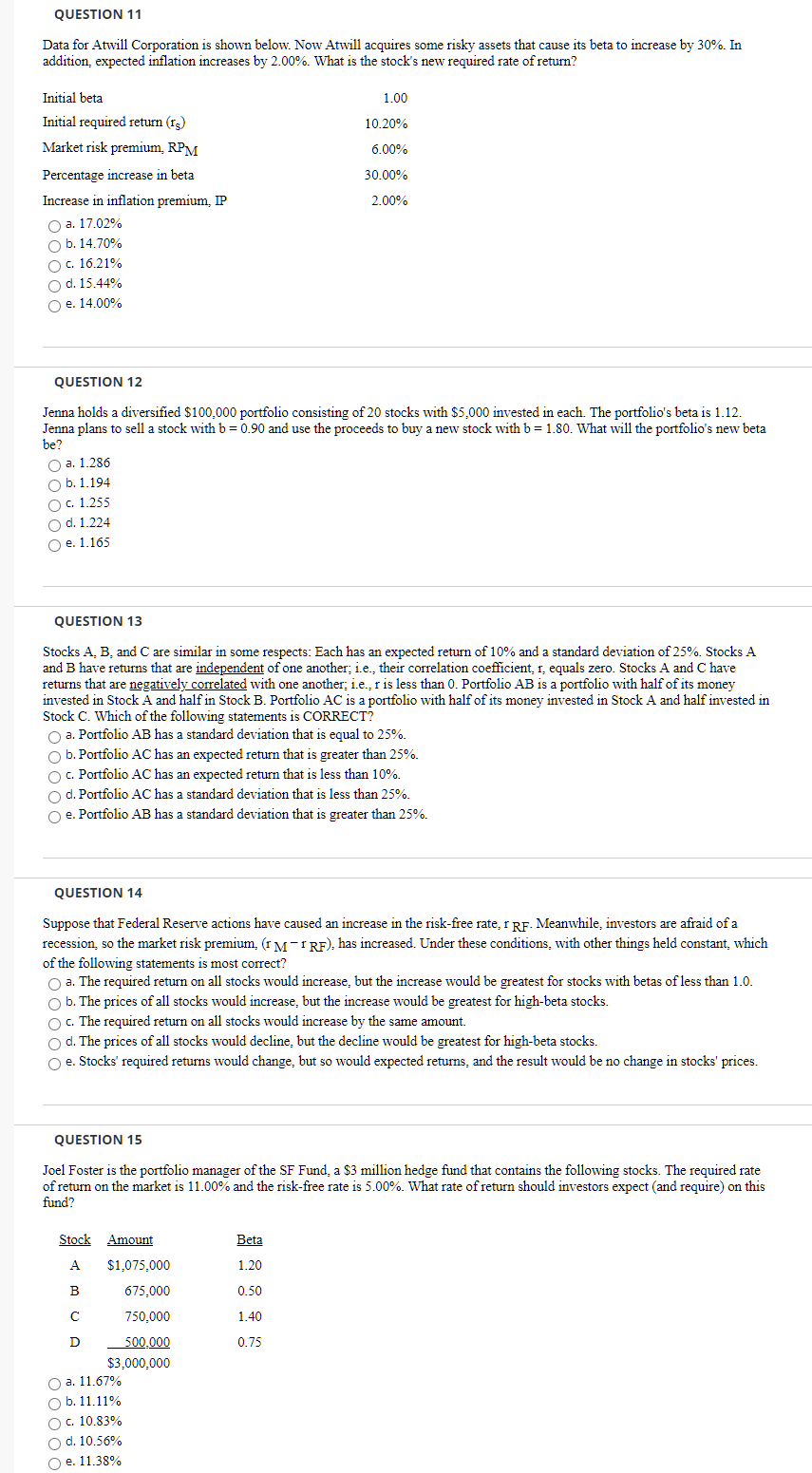

QUESTION 11 Data for Atwill Corporation is shown below. Now Atwill acquires some risky assets that cause its beta to increase by 30%. In addition, expected inflation increases by 2.00%. What is the stock's new required rate of return? 1.00 10.20% 6.00% Initial beta Initial required return (rs) Market risk premium, RPM Percentage increase in beta Increase in inflation premium, IP a. 17.02% ob. 14.70% c. 16.21% d. 15.44% e. 14.00% 30.00% 2.00% QUESTION 12 Jenna holds a diversified $100.000 portfolio consisting of 20 stocks with $5,000 invested in each. The portfolio's beta is 1.12. Jenna plans to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.80. What will the portfolio's new beta be? O a. 1.286 b. 1.194 c. 1.255 d. 1.224 O e. 1.165 QUESTION 13 Stocks A, B, and C are similar in some respects: Each has an expected return of 10% and a standard deviation of 25%. Stocks A and B have returns that are independent of one another; i.e., their correlation coefficient, T. equals zero. Stocks A and C have returns that are negatively correlated with one another, i.e., r is less than 0. Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B. Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C. Which of the following statements is CORRECT? a. Portfolio AB has a standard deviation that is equal to 25%. b. Portfolio AC has an expected return that is greater than 25%. c. Portfolio AC has an expected return that is less than 10%. d. Portfolio AC has a standard deviation that is less than 25%. e. Portfolio AB has a standard deviation that is greater than 25%. QUESTION 14 Suppose that Federal Reserve actions have caused an increase in the risk-free rate, I RF. Meanwhile, investors are afraid of a recession, so the market risk premium, (TM-IRF), has increased. Under these conditions, with other things held constant, which of the following statements is most correct? a. The required return on all stocks would increase, but the increase would be greatest for stocks with betas of less than 1.0. b. The prices of all stocks would increase, but the increase would be greatest for high-beta stocks. c. The required return on all stocks would increase by the same amount. d. The prices of all stocks would decline, but the decline would be greatest for high-beta stocks. Oe. Stocks' required returns would change, but so would expected returns, and the result would be no change in stocks' prices. QUESTION 15 Joel Foster is the portfolio manager of the SF Fund a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect and require) on this fund? Stock Amount Beta A $1,075,000 1.20 B 675,000 0.50 1.40 0.75 750,000 D 500.000 $3,000,000 a. 11.67% b. 11.11% O c. 10.83% d. 10.56% O e. 11.38%