From the Mayberry Ltd. Financial Statement provided, calculate THREE (3) short term financial stability ratios for the years 2019 and 2020:

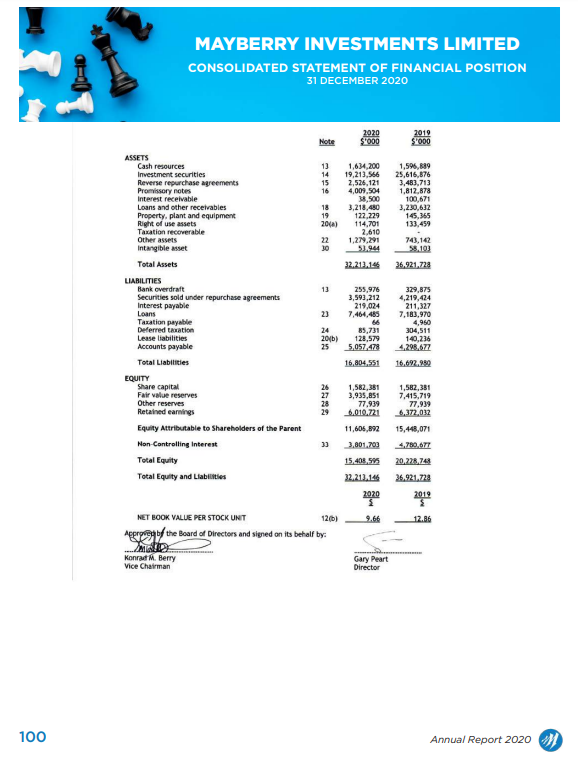

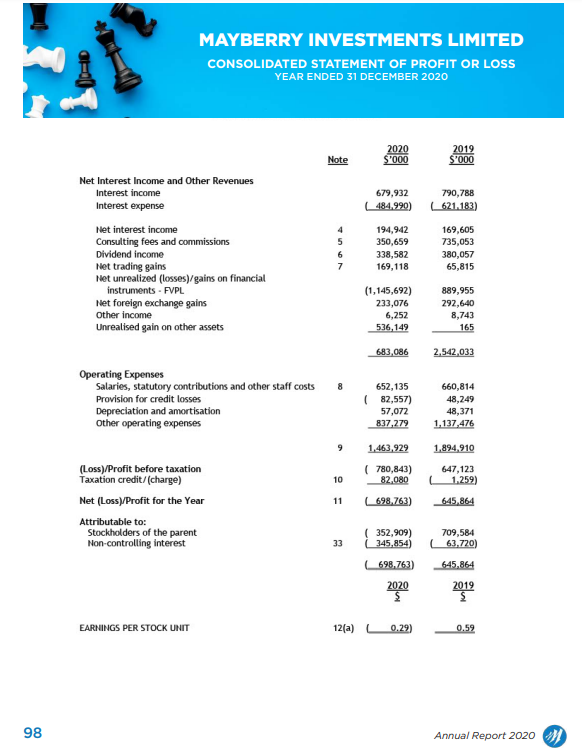

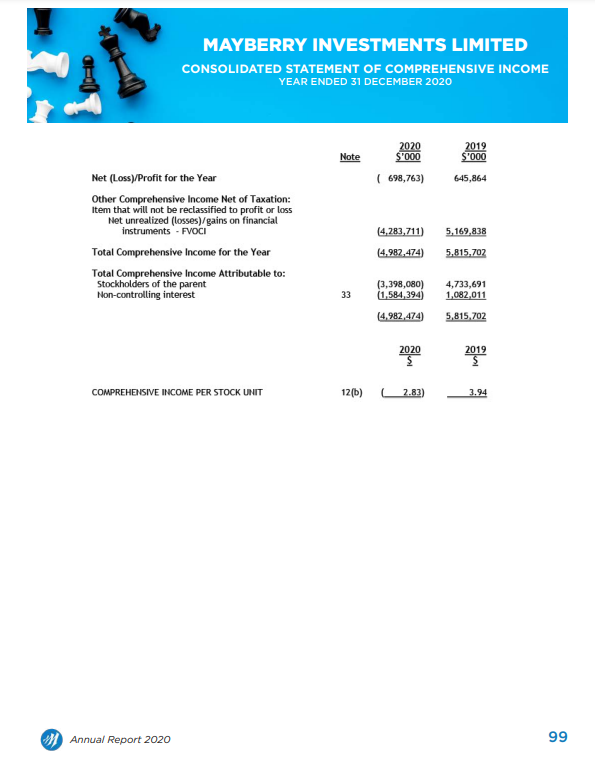

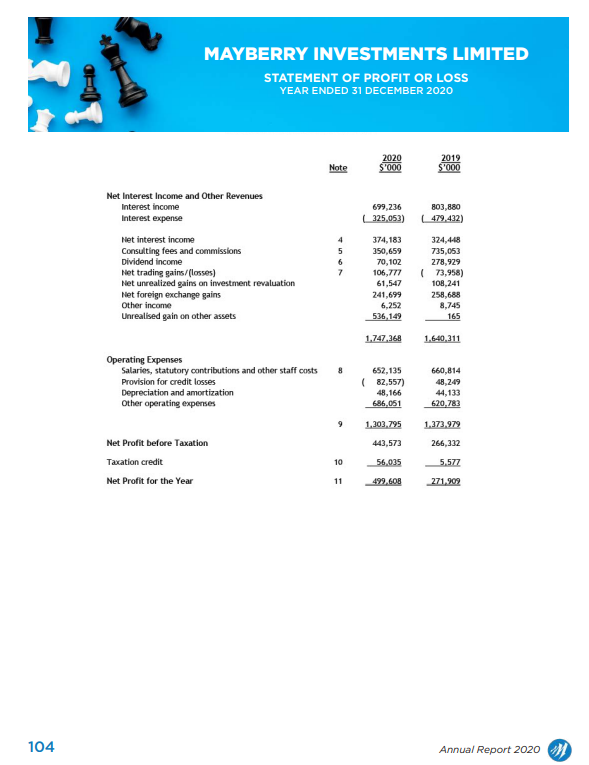

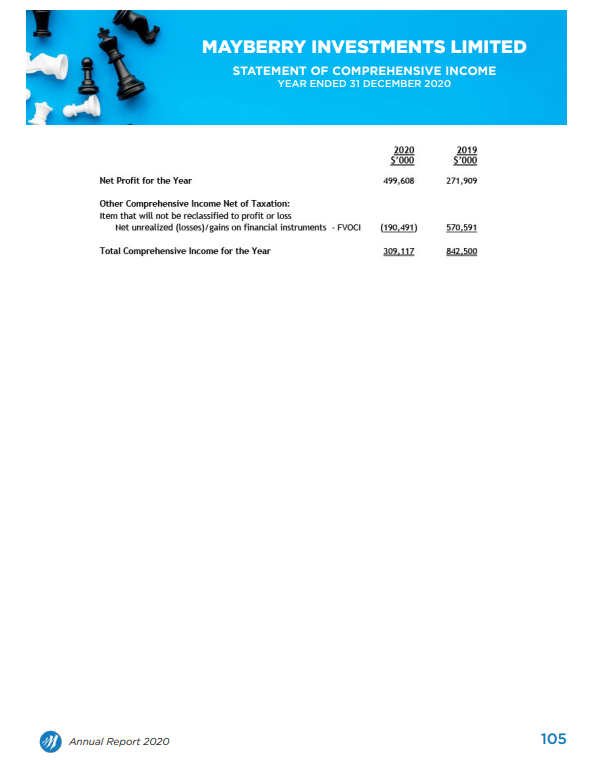

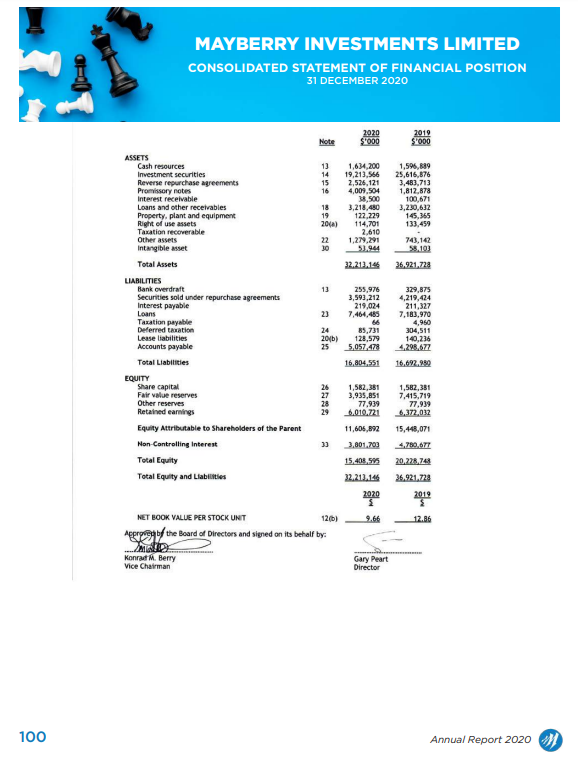

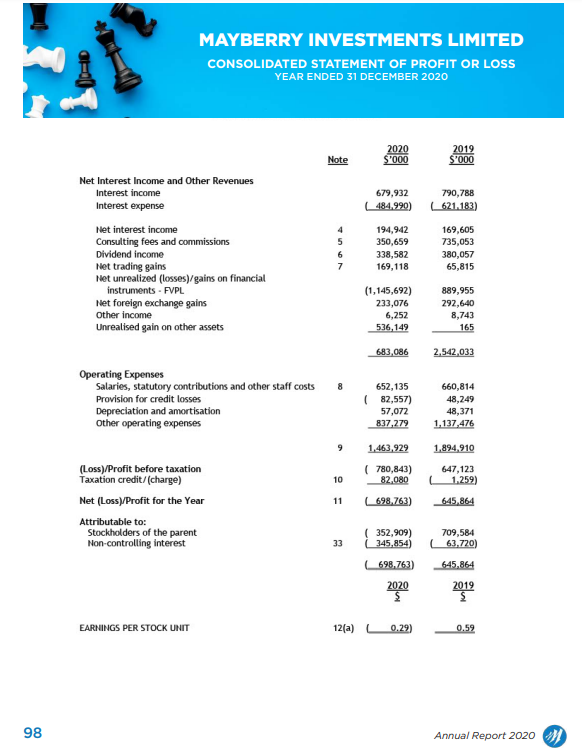

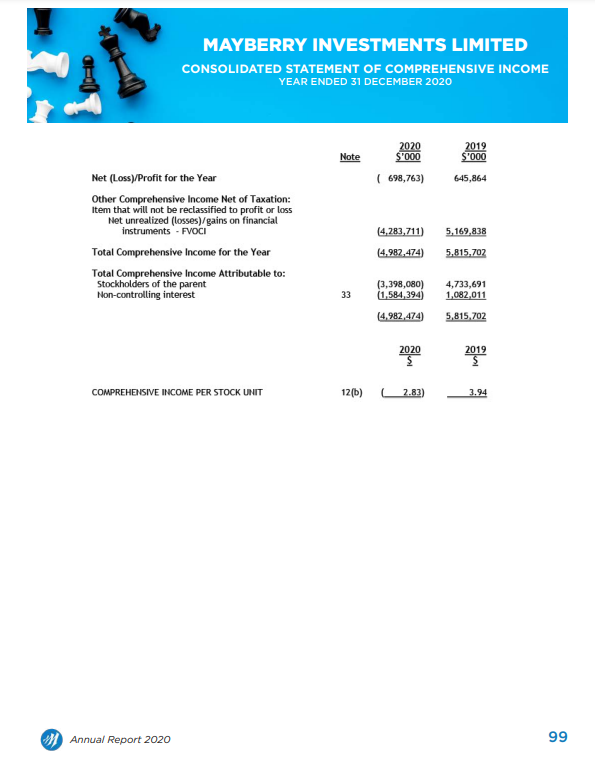

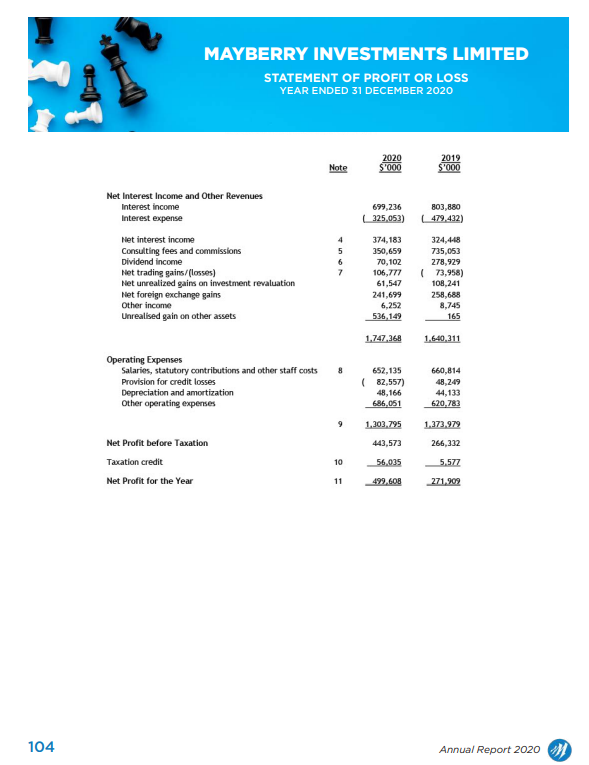

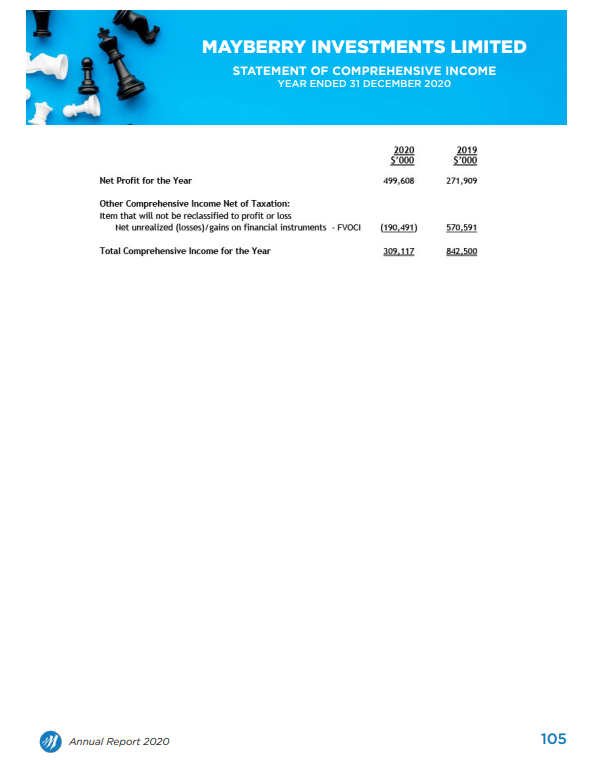

MAYBERRY INVESTMENTS LIMITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION 31 DECEMBER 2020 Note 2020 $'000 2019 $'000 13 14 15 16 1,634,200 19,213,566 2,526,121 4,009.504 38,500 3.218.480 122,229 114,701 2.610 1,279,291 5.964 32.217.146 1,596,689 25,616,876 3,483,713 1,812,878 100,671 3,230,632 145.5 18 19 204) 22 30 743,142 58.10 9 36,921,728 13 2) ASSETS Cash resources Investment securities Reverse repurchase agreements Promissory notes Interest receivable Loans and other receivables Property, plant and equipment Right of use assets Taxation recoverable Other assets Intangible asset Total Assets LIABILITIES Bank overdratt Securities sold under repurchase agreements Interest payable Loans Taxation payable Deferred tation Lease liabilities Accounts payable Total Liabilities EQUITY Share capital Fair value reserves Other reserves Retained earnings Equity Attributable to shareholders of the Parent Non-Controlling Interest Total Equity Total Equity and Liabilities 24 25 255,976 3,593,212 219,024 7,464,485 66 85,731 120,579 5,057.478 16,804,551 329,875 4,219,424 211,327 7.183.970 4,950 304,511 140,236 4.298,677 16,692,989 2016) 26 27 28 29 1,582,381 3,935,851 77.939 0.010,721 1,582,381 7,415,719 77.939 6,372,032 11,605,892 15,448,071 33 4,780,677 3,801,703 15,405,505 32.212.146 2010 20.228.74 36.921.728 2019 NET BOOK VALUE PER STOCK UNT 120) 12.86 Approval the Board of Directors and signed on its behalf by: Konra M. Berry Vice Chairman Gary Peart Director 100 Annual Report 2020 W MAYBERRY INVESTMENTS LIMITED CONSOLIDATED STATEMENT OF PROFIT OR LOSS YEAR ENDED 31 DECEMBER 2020 Note 2020 S'000 2019 S'000 679,932 | 484.990) 790,788 621.183) Net Interest Income and Other Revenues Interest income Interest expense Net interest income Consulting fees and commissions Dividend income Net trading gains Net unrealized (losses)/gains on financial instruments - FVPL Net foreign exchange gains Other income Unrealised gain on other assets 5 6 7 194,942 350,659 338,582 169,118 169,605 735,053 380,057 65,815 (1,145,692) 233,076 6,252 536,149 889,955 292,640 8,743 165 683,086 2.542,033 8 Operating Expenses Salaries, statutory contributions and other staff costs Provision for credit losses Depreciation and amortisation Other operating expenses 652,135 (82,557) 57,072 837,279 660,814 48,249 48,371 1,137,476 9 1,463,929 1.894.910 10 (780,843) 82.080 647,123 1,259) 11 (Loss)/Profit before taxation Taxation credit/(charge) Net (Loss)/Profit for the Year Attributable to: Stockholders of the parent Non-controlling interest 698.763) 645,864 33 709,584 63,720) (352,909) 345,854) 698.763) 2020 645.864 2019 $ EARNINGS PER STOCK UNIT 12(a) 0.29) 0.59 98 Annual Report 2020 DED MAYBERRY INVESTMENTS LIMITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME YEAR ENDED 31 DECEMBER 2020 2019 S'000 Note 2020 $'000 ( 698,763) 645,864 (4,283,711) 5,169,838 Net (Loss)/Profit for the Year Other Comprehensive Income Net of Taxation: Item that will not be reclassified to profit or loss Net unrealized (losses)/gains on financial instruments - FVOCI Total Comprehensive Income for the Year Total Comprehensive Income Attributable to: Stockholders of the parent Non-controlling interest 14.987,474) 5,815,702 33 (3,398,080) (1,584,394) 4,733,691 1,082,011 (4.982,474) 5,815,702 2020 $ 2019 S COMPREHENSIVE INCOME PER STOCK UNIT 12(b) 2.83) 3.94 Annual Report 2020 99 MAYBERRY INVESTMENTS LIMITED STATEMENT OF PROFIT OR LOSS YEAR ENDED 31 DECEMBER 2020 2020 $1000 Note 2019 $'000 Net Interest Income and Other Revenues Interest income Interest expense 699,236 325,053) 803,880 (479,432) 4 5 6 7 Net interest income Consulting fees and commissions Dividend income Net trading gains/(losses) Net unrealized gains on investment revaluation Net foreign exchange gains Other income Unrealised gain on other assets 374,183 350,659 70, 102 106,777 61,547 241,699 324,4-18 735,053 278,929 73,958) 108,241 258,688 8,745 165 6,252 536,149 1.747,368 1.640,311 8 Operating Expenses Salaries, statutory contributions and other staff costs Provision for credit losses Depreciation and amortization Other operating expenses 652,135 (82,557) 48,166 686.051 660,814 48,249 44,133 620.783 9 1,303,795 1,373,979 443,573 266,332 Net Profit before Taxation Taxation credit Net Profit for the Year 10 56,035 5,577 11 499,608 271.909 104 Annual Report 2020 00HD MAYBERRY INVESTMENTS LIMITED STATEMENT OF COMPREHENSIVE INCOME YEAR ENDED 31 DECEMBER 2020 2020 $'000 2019 $1000 499,608 271,909 Net Profit for the Year Other Comprehensive Income Net of Taxation: Item that will not be reclassified to profit or loss Net unrealized (losses) /gains on financial instruments - FOCI Total Comprehensive Income for the Year (190,491) 570,591 309,117 842.500 Annual Report 2020 105