Question

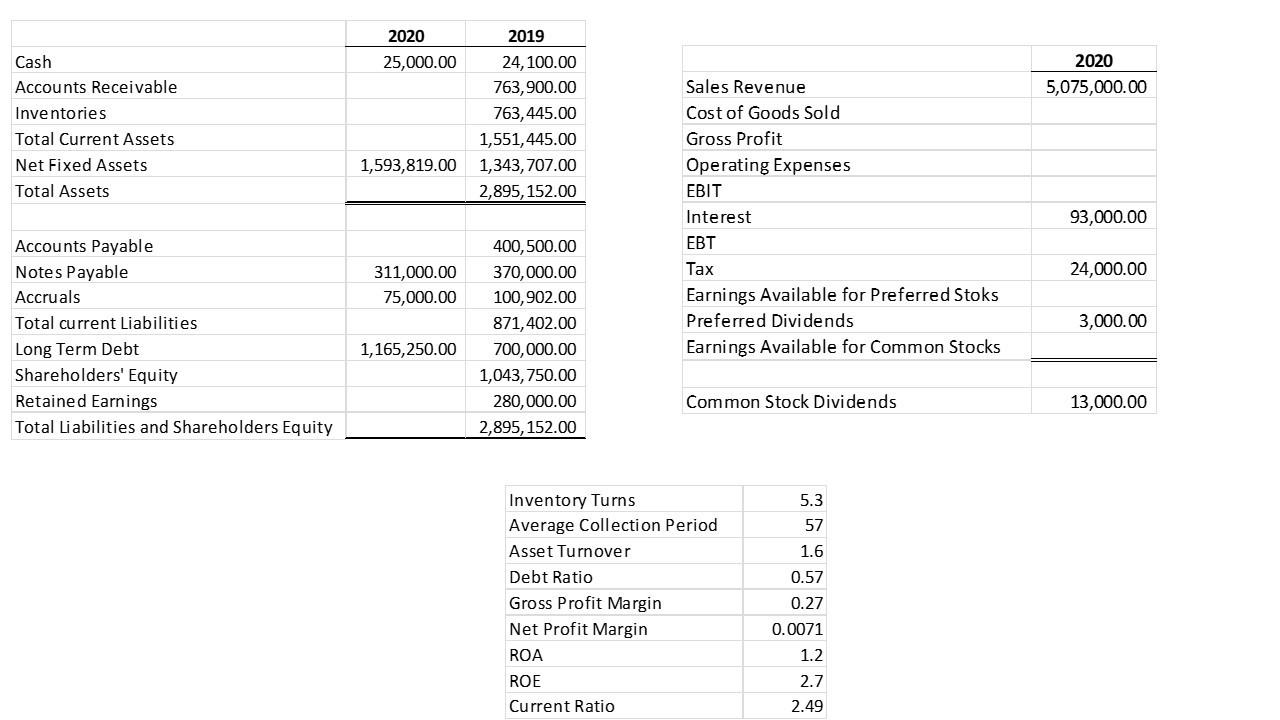

From the pictures above, please answer those qustions below and chose the correct answer : - Q 1 . Depreciation Expense for 2020 is at

From the pictures above, please answer those qustions below and chose the correct answer : -

From the pictures above, please answer those qustions below and chose the correct answer : -

Q 1. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Gross Profit

a. 2,341,100.00

b. 1,371,000.00

c. 1,250,000.00

Q 2. If depreciation expense for 2020 is at 500,000.00, how much is the net change in cash due to investing activity?

- -750,112.00

- -830,110.00

- -650,142.00

Q3. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Total Current Liabilities

- 416,500.00

- 415,040.00

- 616,000.00

Q4. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Inventory

- 700,625.00

- 720,525.00

- 230,655.00

Q5. Depreciation Expense for 2020 is at 500,000.00. Using the given data, compute for the net change in cash for 2020.

- 900.00

- 800.00

- 1,000.00

Q6. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Shareholder's Equity

- 2,045,650.00

- 1,043,750.00

- 1,333,650.00

Q7. The depreciation expense for 2020 is 500,000.00. Using the data available, compute for the 2020 change in cash due to operating activities.

- 360,762.00

- 550,662.00

- 465,752.00

Q8. The depreciation expense for 2020 is 500,000.00. Using the data above, compute for the company's 2020 Earnings available for common stocks

- 37,000.00

- 35,000.00

- 33,000.00

Q9. Depreciation expense for 2020 is at 500,000.00, compute for the company's 2020 quick ratio

- 1.2

- 1.7

- 1.8

Q10. Depreciation Expense for 2020 is at 500,000.00, compute for the 2020 Times interest earned

- 1.2

- 1.20

- 1.6

Q11. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Retained Earnings

- 400,000.00

- 350,200.00

- 300,000.00

Q12. Depreciation Expense for 2020 is at 500,000.00

Using the data above, compute for the company's 2020 Accounts payable?

- 240,050.00

- 450,000.00

- 230,000.00

Q13. Depreciation Expense for 2020 is 500,000.00

Using the data above, compute for the company's 2020 Earnings Before Tax

- 65,200.00

- 70,000.00

- 60,000.00

Q14. The depreciation expense for 2020 is 500,000.00. What is the 2020 change in cash position due to financing activities?

- 490,452.00

- 420,150.00

- 390,250.00

Q15. Depreciation Expense for 2020 is at 500,000.00

Using the Data above, compute for the company's 2020 Accounts Receivable.

- 805,556

- 875,656

- 835,545

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started