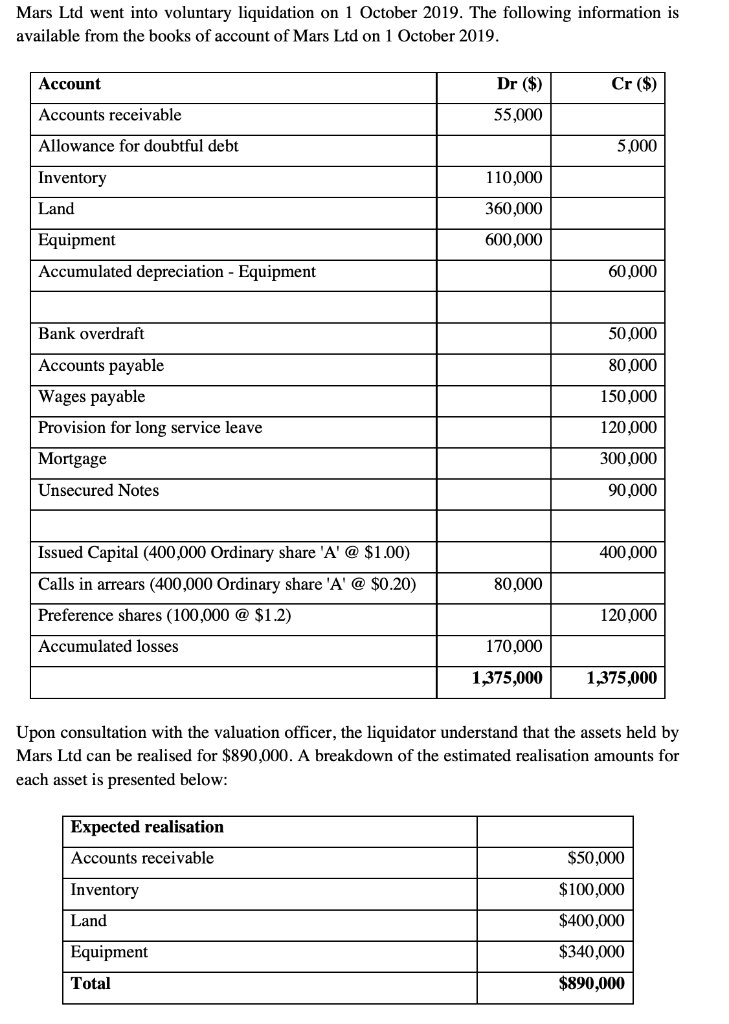

Question

From the Report as to Affairs, the liquidator also notices the following: The bank overdraft is secured by a floating charge against the Accounts Receivable.

From the Report as to Affairs, the liquidator also notices the following:

-

The bank overdraft is secured by a floating charge against the Accounts Receivable.

-

Mars Ltd has 5 current directors when it enters into liquidation. Out of the $150,000 wages payable, the total amount of wages owing to all of the five current directors of Mars Ltd is $50,000 (i.e. $10,000 owed to each director). Since one of the company director Leo was only appointed two years ago, there is no long service leave entitlement for Leo. Therefore, out of the $120,000 provision for long service leave, the total long service leave entitlement owing to the remaining four directors amount to $40,000 (i.e. $10,000 owed to each eligible director). The remaining wages payable and long service leave payable are owed to other employees.

-

The mortgage is secured by a security interest against the Land.

-

The constitution of Mars Ltd provides that all shares (including all preference and ordinary

shares) are ranked equally in winding up.

-

It is expected that all calls in arrears will pay the amount owing to the company should the

liquidator pursue shareholders for payment.

The liquidator will charge a liquidation fee of $20,000

Required

-

a) Prepare a list of creditors, in strict payment order, showing the order of payment, thename and amount owing prior to any payments from the sale of assets;

-

b) Prepare a General Ledger Account in the running balance format for the Liquidation Account, Receipts and Payments Account, Creditors Control Account and the Members Distribution Account prepared by the Liquidator. Show the complete liquidation process in your ledger accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started