Answered step by step

Verified Expert Solution

Question

1 Approved Answer

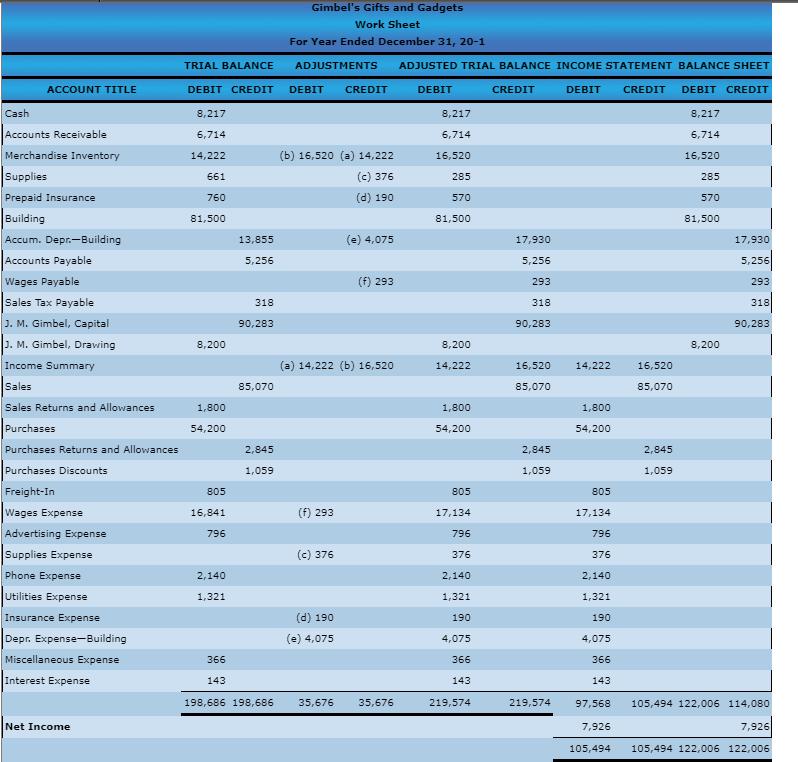

From the worksheet shown below, prepare the following: 1. Prepare closing entries for Gimbel's Gifts and Gadgets in a general journal. If an amount box

From the worksheet shown below, prepare the following:

1. Prepare closing entries for Gimbel's Gifts and Gadgets in a general journal. If an amount box does not require an entry, leave it blank.

2. Prepare a post-closing trial balance.

Gimbel's Gifts and Gadgets Work Sheet For Year Ended December 31, 20-1 TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 8,217 8,217 8,217 Accounts Receivable 6,714 6,714 6,714 Merchandise Inventory 14,222 (b) 16,520 (a) 14,222 16,520 16,520 Supplies 661 (c) 376 285 285 Prepaid Insurance (d) 190 760 570 570 Building 81,500 81,500 81,500 Accum. Depr.-Building 13,855 4,075 17,930 17,930 Accounts Payable 5,256 5,256 5,256 Wages Payable (f) 293 293 293 Sales Tax Payable 318 318 318 J. M. Gimbel, Capital 90,283 90,283 90,283 J. M. Gimbel, Drawing Income Summary 8,200 8,200 8,200 (a) 14,222 (b) 16,520 14,222 16,520 14,222 16,520 Sales 85,070 85,070 85,070 Sales Returns and Allowances 1,800 1,800 1,800 Purchases 54,200 54,200 54,200 Purchases Returns and Allowances 2,845 2,845 2,845 Purchases Discounts 1,059 1,059 1,059 Freight-In 805 805 805 Wages Expense 16,841 (f) 293 17,134 17,134 Advertising Expense 796 796 796 Supplies Expense (c) 376 376 376 Phone Expense 2,140 2,140 2,140 Utilities Expense 1,321 1,321 1,321 Insurance Expense (d) 190 190 190 Depr. Expense-Building (e) 4,075 4,075 4,075 Miscellaneous Expense 366 366 366 Interest Expense 143 143 143 198,686 198,686 35,676 35,676 219,574 219,574 97,568 105,494 122,006 114,080 Net Income 7,926 7,926 105,494 105,494 122,006 122,006

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Closing entries Journal 1 Debit All revenue and Conta expenses account for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started