From this 6 questions I need:

Justified of Decision Criteria of each cases questions?

-The picture at above is the questions. I need the decision for each cases and the questions. There are 6 questions, so i need 6 decision. Please see attachment of the case study.

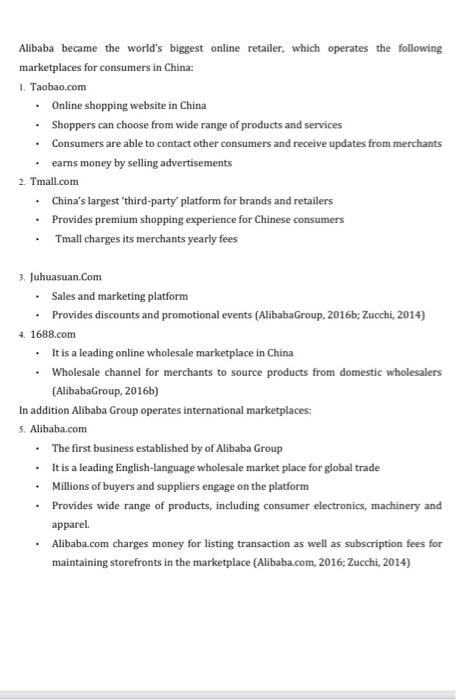

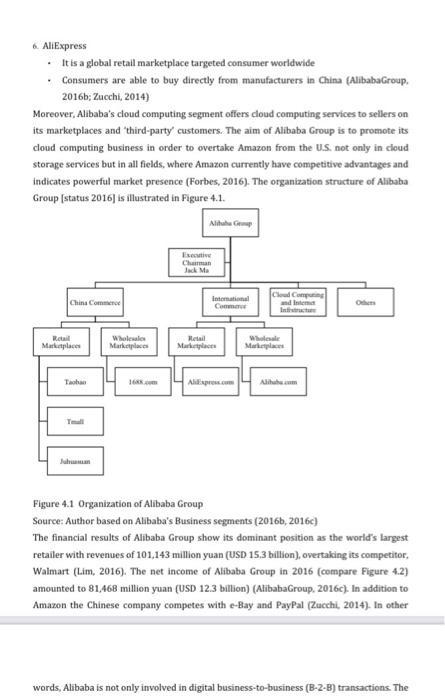

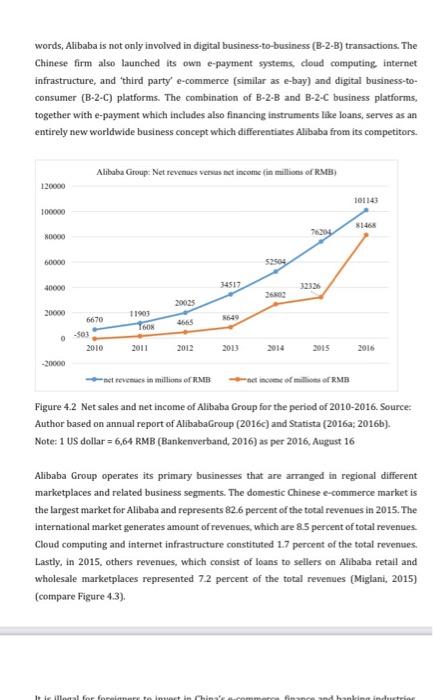

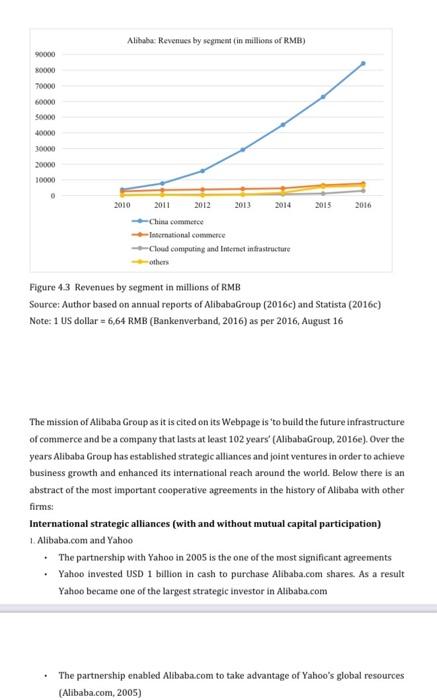

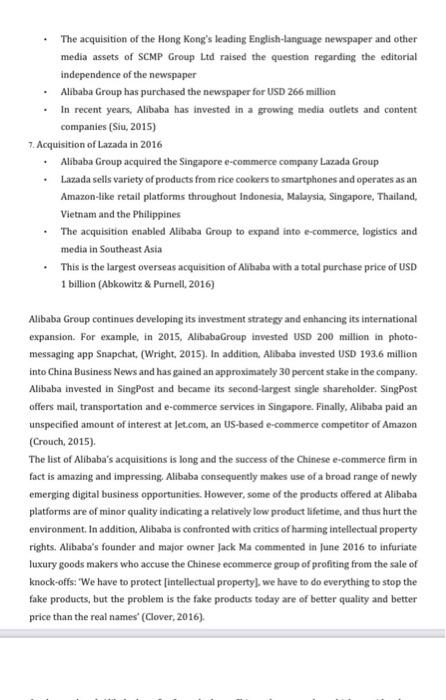

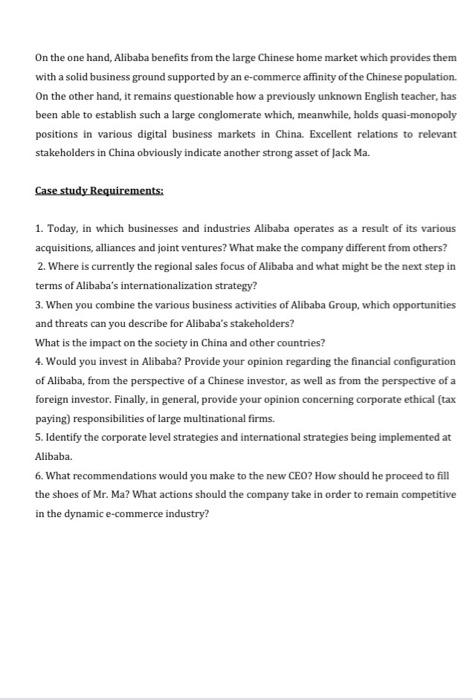

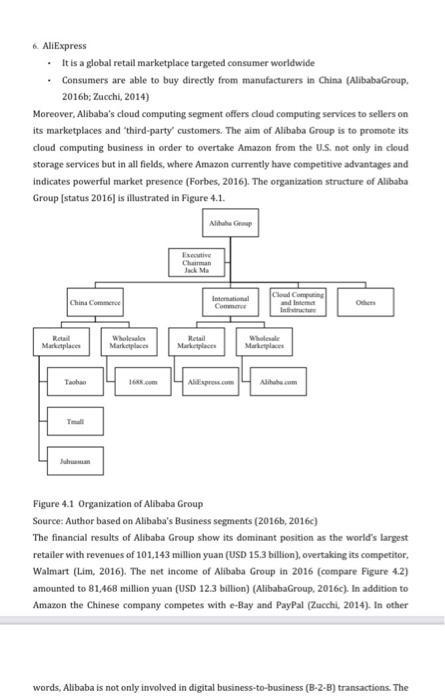

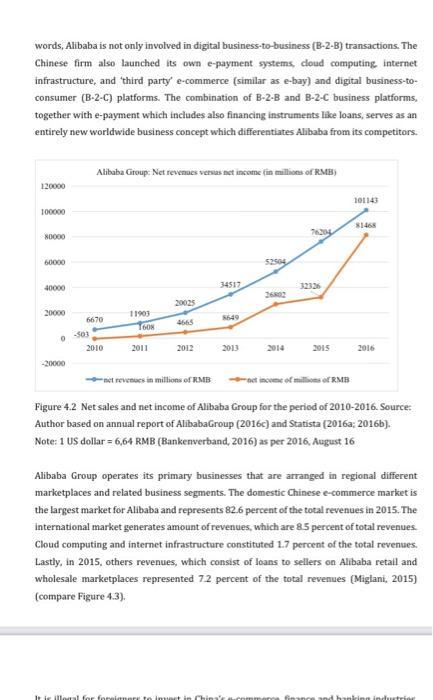

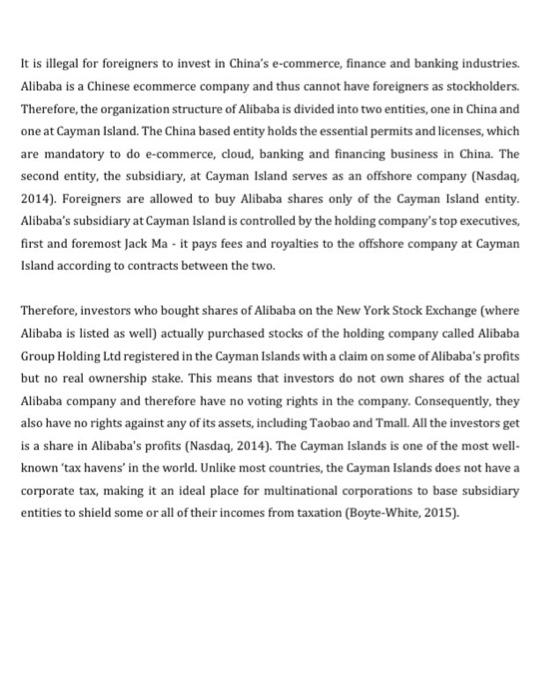

Case study-1 The Alibaba Group Company background and business segments Alibaba Group has become one of the most powerful e-commerce business company. The firm was established by an English teacher named Jack Ma in 1999 and is headquartered in Hangzhou, China. The idea was to lunch website that would help small Chinese exporters and entrepreneurs to sell their products, An important millstone occurred in 2005, when Alibaba Group formed a strategic partnership with Yahoo, Alibaba.com an online marketing technology platform was launched in 2007 and after two years Alibaba Cloud was established. Moreover, another landmark in this year was the acquisition of Hichina, China's leading Internet infrastructure service provider. In 2010, AliExpress site was launched and enabled exporters in China to reach consumers all over the world. The largest online commerce company went public in 2014, when it launched its IPO. The Chinese company expanded overseas and founded offices abroad in Hong Kong, USA, UK, Taiwan and India (Alibaba Group, 2016a: Alibaba Group. 2016d). Today, the company and its segment businesses operate wholesale and retail online marketplaces additionally to internet-based businesses, which offer advertising electronic payment, cloud-based computing and network services and others (Alibaba Group. 2016a). Its dominant operations run through three web sites: Tmall, which offers online sales of branded products and focuses on China's middle class; Taobao, China's biggest shopping site; and Alibaba.com, which connects Chinese exporters with other companies worldwide (Wright, 2015) Alibaba became the world's biggest online retailer, which operates the following marketplaces for consumers in China: Taobao.com Online shopping website in China Alibaba became the world's biggest online retailer, which operates the following marketplaces for consumers in China: 1. Taobao.com Online shopping website in China Shoppers can choose from wide range of products and services Consumers are able to contact other consumers and receive updates from merchants earns money by selling advertisements 2. Tmall.com China's largest third-party' platform for brands and retailers Provides premium shopping experience for Chinese consumers Tmall charges its merchants yearly fees . . . 3. Juhuasuan.Com Sales and marketing platform Provides discounts and promotional events (Alibaba Group, 2016b; Zucchi, 2014) 4. 1688.com It is a leading online wholesale marketplace in China Wholesale channel for merchants to source products from domestic wholesalers (AlibabaGroup, 2016b) In addition Alibaba Group operates international marketplaces: 5. Alibaba.com The first business established by of Alibaba Group It is a leading English-language wholesale market place for global trade Millions of buyers and suppliers engage on the platform Provides wide range of products, including consumer electronics, machinery and apparel. Alibaba.com charges money for listing transaction as well as subscription fees for maintaining storefronts in the marketplace (Alibaba.com, 2016; Zucchi, 2014) . . 6. AliExpress It is a global retail marketplace targeted consumer worldwide Consumers are able to buy directly from manufacturers in China (Alibaba Group, 2016b, Zucchi, 2014) Moreover, Alibaba's cloud computing segment offers cloud computing services to sellers on its marketplaces and third-party customers. The aim of Alibaba Group is to promote its cloud computing business in order to overtake Amazon from the U.S. not only in cloud storage services but in all fields, where Amazon currently have competitive advantages and indicates powerful market presence (Forbes, 2016). The organization structure of Alibaba Group status 2016) is illustrated in Figure 4.1. Ali Jack Me Cut Cavang China Comment Internal Commer Marketplace Wholesale Marketplace Metal Marlene Whale More Tech A. Figure 4.1 Organization of Alibaba Group Source: Author based on Alibaba's Business segments (2016), 2016) The financial results of Alibaba Group show its dominant position as the world's largest retailer with revenues of 101.143 million yuan (USD 15.3 billion), overtaking its competitor, Walmart (Lim, 2016). The net income of Alibaba Group in 2016 (compare Figure 4.2) amounted to 81468 million yuan (USD 12.3 billion) (Alibaba Group. 2016). In addition to Amazon the Chinese company competes with e-Bay and PayPal (Zucchi, 2014). In other words, Alibaba is not only involved in digital business-to-business (B-2-B) transactions. The words, Alibaba is not only involved in digital business-to-business (B-2-B) transactions. The Chinese firm also launched its own e-payment systems, cloud computing internet infrastructure, and third party' e-commerce (similar as e-bay) and digital business-to- consumer (B-2-0) platforms. The combination of B-2-B and B-2-C business platforms, together with e-payment which includes also financing instruments like loans, serves as an entirely new worldwide business concept which differentiates Alibaba from its competitors. Alibaba Group: Net revenues Versas net incotre fin millions of RMB) 120000 101143 100000 $1465 0000 60000 40000 34517 20000 1190 6670 7608 . -503 2010 2011 2012 2013 2014 2015 2016 -20000 net revenues in millions of RMB et income of millions of RMB Figure 4.2 Net sales and net income of Alibaba Group for the period of 2010-2016. Source: Author based on annual report of Alibaba Group (2016c) and Statista (2016a: 2016b). Note: 1 US dollar = 6,64 RMB (Bankenverband, 2016) as per 2016 August 16 Alibaba Group operates its primary businesses that are arranged in regional different marketplaces and related business segments. The domestic Chinese e-commerce market is the largest market for Alibaba and represents 82.6 percent of the total revenues in 2015. The international market generates amount of revenues, which are 85 percent of total revenues. Cloud computing and internet infrastructure constituted 1.7 percent of the total revenues. Lastly, in 2015, others revenues, which consist of loans to sellers on Alibaba retail and wholesale marketplaces represented 72 percent of the total revenues (Miglani, 2015) (compare Figure 4.3). lille for fantast Chine halinde It is illegal for foreigners to invest in China's e-commerce, finance and banking industries. Alibaba is a Chinese ecommerce company and thus cannot have foreigners as stockholders. Therefore, the organization structure of Alibaba is divided into two entities, one in China and one at Cayman Island. The China based entity holds the essential permits and licenses, which are mandatory to do e-commerce, cloud, banking and financing business in China. The second entity, the subsidiary, at Cayman Island serves as an offshore company (Nasdaq, 2014). Foreigners are allowed to buy Alibaba shares only of the Cayman Island entity. Alibaba's subsidiary at Cayman Island is controlled by the holding company's top executives, first and foremost Jack Ma - it pays fees and royalties to the offshore company at Cayman Island according to contracts between the two. Therefore, investors who bought shares of Alibaba on the New York Stock Exchange (where Alibaba is listed as well) actually purchased stocks of the holding company called Alibaba Group Holding Ltd registered in the Cayman Islands with a claim on some of Alibaba's profits but no real ownership stake. This means that investors do not own shares of the actual Alibaba company and therefore have no voting rights in the company. Consequently, they also have no rights against any of its assets, including Taobao and Tmall. All the investors get is a share in Alibaba's profits (Nasdaq, 2014). The Cayman Islands is one of the most well- known 'tax havens' in the world. Unlike most countries, the Cayman Islands does not have a corporate tax, making it an ideal place for multinational corporations to base subsidiary entities to shield some or all of their incomes from taxation (Boyte-White, 2015). Alibaba: Revenues by segment (in millions of RMB) 90000 70000 60000 30000 10000 0 2010 2011 2012 2013 2014 2015 2016 - China commerce International commerce Cloud computing and Internet infrastructure Figure 4.3 Revenues by segment in millions of RMB Source: Author based on annual reports of Alibaba Group (2016) and Statista (2016) Note: 1 US dollar = 6,64 RMB (Bankenverband, 2016) as per 2016 August 16 The mission of Alibaba Group as it is cited on its Webpage is to build the future infrastructure of commerce and be a company that lasts at least 102 years' (AlibabaGroup, 2016e). Over the years Alibaba Group has established strategic alliances and joint ventures in order to achieve business growth and enhanced its international reach around the world. Below there is an abstract of the most important cooperative agreements in the history of Alibaba with other firms: International strategic alliances (with and without mutual capital participation) 1 Alibaba.com and Yahoo The partnership with Yahoo in 2005 is the one of the most significant agreements Yahoo invested USD 1 billion in cash to purchase Alibaba.com shares. As a result Yahoo became one of the largest strategic investor in Alibaba.com The partnership enabled Alibaba.com to take advantage of Yahoo's global resources (Alibaba.com, 2005) . The partnership enabled Alibaba.com to take advantage of Yahoo's global resources (Alibaba.com, 2005) In 2012, Alibaba Group repurchased shares from Yahoo (AlibabaGroup, 2016) 2. Alibaba.com and Infomedia Collaboration with India's largest B-2-B media company in 2009 Infomedia is the largest Yellow Pages and special interest publishing company in India The aim of the collaboration is to provide a business platform for small and medium- size enterprises (SMEs) in India The collaboration enabled Alibaba Group to improve its online B2B marketplace in India (Alibaba.com 2009) 3. Alibaba Group and Sina Weibo Alibaba Group acquired 18 percent stake in Sina Weibo for $586 million in 2013 Sina Weibo is a microblogging service provider similar as Twitter. The alliance aimed to connect China's largest Twitter-like service and the biggest e. commerce company Alibaba Group strengthened its presence in social networks and started to advertise on a Chinese social platform. The partnership drives more web traffic to Alibaba's Taobao Marketplace (Mozur & Osawa, 2013; Ghosh & Ramakrishnan, 2013) 4. Alibaba Group and Suning Commerce Suning Commerce is one of the largest consumer electronics retail chains in China Alibaba invested in 2015 approximately RMB 28.3 billion (USD 4.63 billion) for a 19.99 percnet stake in Suning Commerce Alibaba and Suning have entered into a strategic collaboration agreement to build on synergies in ecommerce, logistics and incremental business through joint omni- channel initiatives' (Yahoo, 2015) 5. Alibaba Group and New Zealand Trade and Enterprise In 2016, Alibaba Group and New Zealand Trade and Enterprise formed a partnership 5. Alibaba Group and New Zealand Trade and Enterprise In 2016, Alibaba Group and New Zealand Trade and Enterprise formed a partnership This strategic alliance aims to strengthen the trade between China and New Zealand and supports the communication of New Zealand brands in China (Businesswire. 2016) Joint Ventures In 2014, Alibaba Group and Intime established a joint venture in order to develop an online-to-offline (020) business in China. Alibaba invested USD 692 million in Intime China's biggest e-commerce operator integrating online and offline shopping Alibaba as majority shareholder owns about 80 percent of the venture assets while Intime holds 20 percent. (Barreto, 2014). Moreover, in 2015, Alibaba Group and Ant Financial Services Group formed a joint venture. Both parties invested USD 483.3 million and established "New Company Koubei' that aimed at capturing offline consumption opportunities and focus on the food and beverage segment Koubei integrates aspects of mobile commerce and big data to transform and upgrade China's local services sector, including dining and shopping experiences (Alibaba Group, 2015) In May 2016, Alibaba Group and SoftBank established joint venture which aims to launch cloud computing services in Japan. SoftBank promotes Alibaba cloud business presence on the Japanese market (AlibabaGroup. 2016) Acquisitions In 2015, Alibaba Group invested around USD 15 billion in mergers and acquisitions (Abkowitz & Purnell, 2016; Salter-Robins, 2015). As for example: 1. Acquisition of HiChina in 2009 HiChina Web Solutions provides domain name registration The aim of this purchase was to gain knowledge regarding web domain technology and management The acquisition provided great benefits to Alibaba such as a new, large customer base; newly developed value-added applications, advanced web site technology, and well advanced knowledge of employees and management in terms of web domain business The total purchase volume amounted RMB 539.98 million (USD 79.06 million) (Alibaba Group, 2009) The total purchase volume amounted RMB 539.98 million (USD 79.06 million) (Alibaba Group, 2009) 2. Acquisition of Vendio in 2010 Alibaba.com acquired Vendio, a multi-channel e-commerce company The company provides an one-stop solution for small business firms which sell across multiple channels Alibaba.com gained access to small businesses in the US with potential sourcing needs from suppliers on Alibaba.com's sourcing platform and AliExpress It was the first acquisition in the US-American market, which opens opportunities for new partnerships (Alibaba.com, 2010) 3. Acquisition of Shenzhen One-Touch Enterprise in 2010 One-Touch is a provider of one-stop services for exporters in China One-Touch is a leading provider of export-related services tailored to the needs of small businesses in China Through the acquisition, Alibaba.com gained a wide range of export-related value added services (AlibabaGroup, 2010) 4. Acquisition of China Vision in 2014 Alibaba Group bought controlling stake in ChinaVision, a media firm which produces TV and movie content Alibaba Group paid USD 804 million, which gave the company access to ChinaVision's movie contents The aim of this purchase was to attract more users to watch Ali TV (Reuters, 2014). 5. Acquisition of Youku Tudou in 2015 Youku Tudou is considered as China's "YouTube" Alibaba Group acquired the video site for a total equity purchase price of USD 4.8 Billion This acquisition enabled Alibaba to offer high quality U.S films and series to its consumers and strengthen its dominant position in Chinese e-commerce (Chen & Katz, 2015) 6. Acquisition of the South China Morning Post in 2015 The acquisition of the Hong Kong's leading English-language newspaper and other media assets of SCMP Ground raised the westion regarding the editorial The acquisition of the Hong Kong's leading English-language newspaper and other media assets of SCMP Group Ltd raised the question regarding the editorial independence of the newspaper Alibaba Group has purchased the newspaper for USD 266 million . In recent years, Alibaba has invested in a growing media outlets and content companies (Slu, 2015) 7. Acquisition of Lazada in 2016 Alibaba Group acquired the Singapore e-commerce company Lazada Group Lazada sells variety of products from rice cookers to smartphones and operates as an Amazon-like retail platforms throughout Indonesia, Malaysia, Singapore, Thailand, Vietnam and the Philippines The acquisition enabled Alibaba Group to expand into e-commerce, logistics and media in Southeast Asia This is the largest overseas acquisition of Alibaba with a total purchase price of USD 1 billion (Abkowitz & Purnell, 2016) Alibaba Group continues developing its investment strategy and enhancing its international expansion. For example, in 2015, AlibabaGroup invested USD 200 million in photo- messaging app Snapchat (Wright, 2015). In addition, Alibaba invested USD 193.6 million into China Business News and has gained an approximately 30 percent stake in the company. Alibaba invested in SingPost and became its second-largest single shareholder. SingPost offers mail, transportation and e-commerce services in Singapore. Finally, Alibaba paid an unspecified amount of interest at et.com, an US-based e-commerce competitor of Amazon (Crouch, 2015) The list of Alibaba's acquisitions is long and the success of the Chinese e-commerce firm in fact is amazing and impressing. Alibaba consequently makes use of a broad range of newly emerging digital business opportunities. However, some of the products offered at Alibaba platforms are of minor quality indicating a relatively low product lifetime, and thus hurt the environment. In addition, Alibaba is confronted with critics of harming intellectual property rights. Alibaba's founder and major owner Jack Ma commented in June 2016 to infuriate luxury goods makers who accuse the Chinese ecommerce group of profiting from the sale of knock-offs: "We have to protect [intellectual property), we have to do everything to stop the fake products, but the problem is the fake products today are of better quality and better price than the real names' (Clover, 2016). On the one hand, Alibaba benefits from the large Chinese home market which provides them with a solid business ground supported by an e-commerce affinity of the Chinese population. On the other hand, it remains questionable how a previously unknown English teacher, has been able to establish such a large conglomerate which, meanwhile, holds quasi-monopoly positions in various digital business markets in China. Excellent relations to relevant stakeholders in China obviously indicate another strong asset of Jack Ma. Case study Requirements: 1. Today, in which businesses and industries Alibaba operates as a result of its various acquisitions, alliances and joint ventures? What make the company different from others? 2. Where is currently the regional sales focus of Alibaba and what might be the next step in terms of Alibaba's internationalization strategy? 3. When you combine the various business activities of Alibaba Group, which opportunities and threats can you describe for Alibaba's stakeholders? What is the impact on the society in China and other countries? 4. Would you invest in Alibaba? Provide your opinion regarding the financial configuration of Alibaba, from the perspective of a Chinese investor, as well as from the perspective of a foreign investor. Finally, in general, provide your opinion concerning corporate ethical (tax paying) responsibilities of large multinational firms. 5. Identify the corporate level strategies and international strategies being implemented at Alibaba. 6. What recommendations would you make to the new CEO? How should he proceed to fill the shoes of Mr. Ma? What actions should the company take in order to remain competitive in the dynamic e-commerce industry? Case study-1 The Alibaba Group Company background and business segments Alibaba Group has become one of the most powerful e-commerce business company. The firm was established by an English teacher named Jack Ma in 1999 and is headquartered in Hangzhou, China. The idea was to lunch website that would help small Chinese exporters and entrepreneurs to sell their products, An important millstone occurred in 2005, when Alibaba Group formed a strategic partnership with Yahoo, Alibaba.com an online marketing technology platform was launched in 2007 and after two years Alibaba Cloud was established. Moreover, another landmark in this year was the acquisition of Hichina, China's leading Internet infrastructure service provider. In 2010, AliExpress site was launched and enabled exporters in China to reach consumers all over the world. The largest online commerce company went public in 2014, when it launched its IPO. The Chinese company expanded overseas and founded offices abroad in Hong Kong, USA, UK, Taiwan and India (Alibaba Group, 2016a: Alibaba Group. 2016d). Today, the company and its segment businesses operate wholesale and retail online marketplaces additionally to internet-based businesses, which offer advertising electronic payment, cloud-based computing and network services and others (Alibaba Group. 2016a). Its dominant operations run through three web sites: Tmall, which offers online sales of branded products and focuses on China's middle class; Taobao, China's biggest shopping site; and Alibaba.com, which connects Chinese exporters with other companies worldwide (Wright, 2015) Alibaba became the world's biggest online retailer, which operates the following marketplaces for consumers in China: Taobao.com Online shopping website in China Alibaba became the world's biggest online retailer, which operates the following marketplaces for consumers in China: 1. Taobao.com Online shopping website in China Shoppers can choose from wide range of products and services Consumers are able to contact other consumers and receive updates from merchants earns money by selling advertisements 2. Tmall.com China's largest third-party' platform for brands and retailers Provides premium shopping experience for Chinese consumers Tmall charges its merchants yearly fees . . . 3. Juhuasuan.Com Sales and marketing platform Provides discounts and promotional events (Alibaba Group, 2016b; Zucchi, 2014) 4. 1688.com It is a leading online wholesale marketplace in China Wholesale channel for merchants to source products from domestic wholesalers (AlibabaGroup, 2016b) In addition Alibaba Group operates international marketplaces: 5. Alibaba.com The first business established by of Alibaba Group It is a leading English-language wholesale market place for global trade Millions of buyers and suppliers engage on the platform Provides wide range of products, including consumer electronics, machinery and apparel. Alibaba.com charges money for listing transaction as well as subscription fees for maintaining storefronts in the marketplace (Alibaba.com, 2016; Zucchi, 2014) . . 6. AliExpress It is a global retail marketplace targeted consumer worldwide Consumers are able to buy directly from manufacturers in China (Alibaba Group, 2016b, Zucchi, 2014) Moreover, Alibaba's cloud computing segment offers cloud computing services to sellers on its marketplaces and third-party customers. The aim of Alibaba Group is to promote its cloud computing business in order to overtake Amazon from the U.S. not only in cloud storage services but in all fields, where Amazon currently have competitive advantages and indicates powerful market presence (Forbes, 2016). The organization structure of Alibaba Group status 2016) is illustrated in Figure 4.1. Ali Jack Me Cut Cavang China Comment Internal Commer Marketplace Wholesale Marketplace Metal Marlene Whale More Tech A. Figure 4.1 Organization of Alibaba Group Source: Author based on Alibaba's Business segments (2016), 2016) The financial results of Alibaba Group show its dominant position as the world's largest retailer with revenues of 101.143 million yuan (USD 15.3 billion), overtaking its competitor, Walmart (Lim, 2016). The net income of Alibaba Group in 2016 (compare Figure 4.2) amounted to 81468 million yuan (USD 12.3 billion) (Alibaba Group. 2016). In addition to Amazon the Chinese company competes with e-Bay and PayPal (Zucchi, 2014). In other words, Alibaba is not only involved in digital business-to-business (B-2-B) transactions. The words, Alibaba is not only involved in digital business-to-business (B-2-B) transactions. The Chinese firm also launched its own e-payment systems, cloud computing internet infrastructure, and third party' e-commerce (similar as e-bay) and digital business-to- consumer (B-2-0) platforms. The combination of B-2-B and B-2-C business platforms, together with e-payment which includes also financing instruments like loans, serves as an entirely new worldwide business concept which differentiates Alibaba from its competitors. Alibaba Group: Net revenues Versas net incotre fin millions of RMB) 120000 101143 100000 $1465 0000 60000 40000 34517 20000 1190 6670 7608 . -503 2010 2011 2012 2013 2014 2015 2016 -20000 net revenues in millions of RMB et income of millions of RMB Figure 4.2 Net sales and net income of Alibaba Group for the period of 2010-2016. Source: Author based on annual report of Alibaba Group (2016c) and Statista (2016a: 2016b). Note: 1 US dollar = 6,64 RMB (Bankenverband, 2016) as per 2016 August 16 Alibaba Group operates its primary businesses that are arranged in regional different marketplaces and related business segments. The domestic Chinese e-commerce market is the largest market for Alibaba and represents 82.6 percent of the total revenues in 2015. The international market generates amount of revenues, which are 85 percent of total revenues. Cloud computing and internet infrastructure constituted 1.7 percent of the total revenues. Lastly, in 2015, others revenues, which consist of loans to sellers on Alibaba retail and wholesale marketplaces represented 72 percent of the total revenues (Miglani, 2015) (compare Figure 4.3). lille for fantast Chine halinde It is illegal for foreigners to invest in China's e-commerce, finance and banking industries. Alibaba is a Chinese ecommerce company and thus cannot have foreigners as stockholders. Therefore, the organization structure of Alibaba is divided into two entities, one in China and one at Cayman Island. The China based entity holds the essential permits and licenses, which are mandatory to do e-commerce, cloud, banking and financing business in China. The second entity, the subsidiary, at Cayman Island serves as an offshore company (Nasdaq, 2014). Foreigners are allowed to buy Alibaba shares only of the Cayman Island entity. Alibaba's subsidiary at Cayman Island is controlled by the holding company's top executives, first and foremost Jack Ma - it pays fees and royalties to the offshore company at Cayman Island according to contracts between the two. Therefore, investors who bought shares of Alibaba on the New York Stock Exchange (where Alibaba is listed as well) actually purchased stocks of the holding company called Alibaba Group Holding Ltd registered in the Cayman Islands with a claim on some of Alibaba's profits but no real ownership stake. This means that investors do not own shares of the actual Alibaba company and therefore have no voting rights in the company. Consequently, they also have no rights against any of its assets, including Taobao and Tmall. All the investors get is a share in Alibaba's profits (Nasdaq, 2014). The Cayman Islands is one of the most well- known 'tax havens' in the world. Unlike most countries, the Cayman Islands does not have a corporate tax, making it an ideal place for multinational corporations to base subsidiary entities to shield some or all of their incomes from taxation (Boyte-White, 2015). Alibaba: Revenues by segment (in millions of RMB) 90000 70000 60000 30000 10000 0 2010 2011 2012 2013 2014 2015 2016 - China commerce International commerce Cloud computing and Internet infrastructure Figure 4.3 Revenues by segment in millions of RMB Source: Author based on annual reports of Alibaba Group (2016) and Statista (2016) Note: 1 US dollar = 6,64 RMB (Bankenverband, 2016) as per 2016 August 16 The mission of Alibaba Group as it is cited on its Webpage is to build the future infrastructure of commerce and be a company that lasts at least 102 years' (AlibabaGroup, 2016e). Over the years Alibaba Group has established strategic alliances and joint ventures in order to achieve business growth and enhanced its international reach around the world. Below there is an abstract of the most important cooperative agreements in the history of Alibaba with other firms: International strategic alliances (with and without mutual capital participation) 1 Alibaba.com and Yahoo The partnership with Yahoo in 2005 is the one of the most significant agreements Yahoo invested USD 1 billion in cash to purchase Alibaba.com shares. As a result Yahoo became one of the largest strategic investor in Alibaba.com The partnership enabled Alibaba.com to take advantage of Yahoo's global resources (Alibaba.com, 2005) . The partnership enabled Alibaba.com to take advantage of Yahoo's global resources (Alibaba.com, 2005) In 2012, Alibaba Group repurchased shares from Yahoo (AlibabaGroup, 2016) 2. Alibaba.com and Infomedia Collaboration with India's largest B-2-B media company in 2009 Infomedia is the largest Yellow Pages and special interest publishing company in India The aim of the collaboration is to provide a business platform for small and medium- size enterprises (SMEs) in India The collaboration enabled Alibaba Group to improve its online B2B marketplace in India (Alibaba.com 2009) 3. Alibaba Group and Sina Weibo Alibaba Group acquired 18 percent stake in Sina Weibo for $586 million in 2013 Sina Weibo is a microblogging service provider similar as Twitter. The alliance aimed to connect China's largest Twitter-like service and the biggest e. commerce company Alibaba Group strengthened its presence in social networks and started to advertise on a Chinese social platform. The partnership drives more web traffic to Alibaba's Taobao Marketplace (Mozur & Osawa, 2013; Ghosh & Ramakrishnan, 2013) 4. Alibaba Group and Suning Commerce Suning Commerce is one of the largest consumer electronics retail chains in China Alibaba invested in 2015 approximately RMB 28.3 billion (USD 4.63 billion) for a 19.99 percnet stake in Suning Commerce Alibaba and Suning have entered into a strategic collaboration agreement to build on synergies in ecommerce, logistics and incremental business through joint omni- channel initiatives' (Yahoo, 2015) 5. Alibaba Group and New Zealand Trade and Enterprise In 2016, Alibaba Group and New Zealand Trade and Enterprise formed a partnership 5. Alibaba Group and New Zealand Trade and Enterprise In 2016, Alibaba Group and New Zealand Trade and Enterprise formed a partnership This strategic alliance aims to strengthen the trade between China and New Zealand and supports the communication of New Zealand brands in China (Businesswire. 2016) Joint Ventures In 2014, Alibaba Group and Intime established a joint venture in order to develop an online-to-offline (020) business in China. Alibaba invested USD 692 million in Intime China's biggest e-commerce operator integrating online and offline shopping Alibaba as majority shareholder owns about 80 percent of the venture assets while Intime holds 20 percent. (Barreto, 2014). Moreover, in 2015, Alibaba Group and Ant Financial Services Group formed a joint venture. Both parties invested USD 483.3 million and established "New Company Koubei' that aimed at capturing offline consumption opportunities and focus on the food and beverage segment Koubei integrates aspects of mobile commerce and big data to transform and upgrade China's local services sector, including dining and shopping experiences (Alibaba Group, 2015) In May 2016, Alibaba Group and SoftBank established joint venture which aims to launch cloud computing services in Japan. SoftBank promotes Alibaba cloud business presence on the Japanese market (AlibabaGroup. 2016) Acquisitions In 2015, Alibaba Group invested around USD 15 billion in mergers and acquisitions (Abkowitz & Purnell, 2016; Salter-Robins, 2015). As for example: 1. Acquisition of HiChina in 2009 HiChina Web Solutions provides domain name registration The aim of this purchase was to gain knowledge regarding web domain technology and management The acquisition provided great benefits to Alibaba such as a new, large customer base; newly developed value-added applications, advanced web site technology, and well advanced knowledge of employees and management in terms of web domain business The total purchase volume amounted RMB 539.98 million (USD 79.06 million) (Alibaba Group, 2009) The total purchase volume amounted RMB 539.98 million (USD 79.06 million) (Alibaba Group, 2009) 2. Acquisition of Vendio in 2010 Alibaba.com acquired Vendio, a multi-channel e-commerce company The company provides an one-stop solution for small business firms which sell across multiple channels Alibaba.com gained access to small businesses in the US with potential sourcing needs from suppliers on Alibaba.com's sourcing platform and AliExpress It was the first acquisition in the US-American market, which opens opportunities for new partnerships (Alibaba.com, 2010) 3. Acquisition of Shenzhen One-Touch Enterprise in 2010 One-Touch is a provider of one-stop services for exporters in China One-Touch is a leading provider of export-related services tailored to the needs of small businesses in China Through the acquisition, Alibaba.com gained a wide range of export-related value added services (AlibabaGroup, 2010) 4. Acquisition of China Vision in 2014 Alibaba Group bought controlling stake in ChinaVision, a media firm which produces TV and movie content Alibaba Group paid USD 804 million, which gave the company access to ChinaVision's movie contents The aim of this purchase was to attract more users to watch Ali TV (Reuters, 2014). 5. Acquisition of Youku Tudou in 2015 Youku Tudou is considered as China's "YouTube" Alibaba Group acquired the video site for a total equity purchase price of USD 4.8 Billion This acquisition enabled Alibaba to offer high quality U.S films and series to its consumers and strengthen its dominant position in Chinese e-commerce (Chen & Katz, 2015) 6. Acquisition of the South China Morning Post in 2015 The acquisition of the Hong Kong's leading English-language newspaper and other media assets of SCMP Ground raised the westion regarding the editorial The acquisition of the Hong Kong's leading English-language newspaper and other media assets of SCMP Group Ltd raised the question regarding the editorial independence of the newspaper Alibaba Group has purchased the newspaper for USD 266 million . In recent years, Alibaba has invested in a growing media outlets and content companies (Slu, 2015) 7. Acquisition of Lazada in 2016 Alibaba Group acquired the Singapore e-commerce company Lazada Group Lazada sells variety of products from rice cookers to smartphones and operates as an Amazon-like retail platforms throughout Indonesia, Malaysia, Singapore, Thailand, Vietnam and the Philippines The acquisition enabled Alibaba Group to expand into e-commerce, logistics and media in Southeast Asia This is the largest overseas acquisition of Alibaba with a total purchase price of USD 1 billion (Abkowitz & Purnell, 2016) Alibaba Group continues developing its investment strategy and enhancing its international expansion. For example, in 2015, AlibabaGroup invested USD 200 million in photo- messaging app Snapchat (Wright, 2015). In addition, Alibaba invested USD 193.6 million into China Business News and has gained an approximately 30 percent stake in the company. Alibaba invested in SingPost and became its second-largest single shareholder. SingPost offers mail, transportation and e-commerce services in Singapore. Finally, Alibaba paid an unspecified amount of interest at et.com, an US-based e-commerce competitor of Amazon (Crouch, 2015) The list of Alibaba's acquisitions is long and the success of the Chinese e-commerce firm in fact is amazing and impressing. Alibaba consequently makes use of a broad range of newly emerging digital business opportunities. However, some of the products offered at Alibaba platforms are of minor quality indicating a relatively low product lifetime, and thus hurt the environment. In addition, Alibaba is confronted with critics of harming intellectual property rights. Alibaba's founder and major owner Jack Ma commented in June 2016 to infuriate luxury goods makers who accuse the Chinese ecommerce group of profiting from the sale of knock-offs: "We have to protect [intellectual property), we have to do everything to stop the fake products, but the problem is the fake products today are of better quality and better price than the real names' (Clover, 2016). On the one hand, Alibaba benefits from the large Chinese home market which provides them with a solid business ground supported by an e-commerce affinity of the Chinese population. On the other hand, it remains questionable how a previously unknown English teacher, has been able to establish such a large conglomerate which, meanwhile, holds quasi-monopoly positions in various digital business markets in China. Excellent relations to relevant stakeholders in China obviously indicate another strong asset of Jack Ma. Case study Requirements: 1. Today, in which businesses and industries Alibaba operates as a result of its various acquisitions, alliances and joint ventures? What make the company different from others? 2. Where is currently the regional sales focus of Alibaba and what might be the next step in terms of Alibaba's internationalization strategy? 3. When you combine the various business activities of Alibaba Group, which opportunities and threats can you describe for Alibaba's stakeholders? What is the impact on the society in China and other countries? 4. Would you invest in Alibaba? Provide your opinion regarding the financial configuration of Alibaba, from the perspective of a Chinese investor, as well as from the perspective of a foreign investor. Finally, in general, provide your opinion concerning corporate ethical (tax paying) responsibilities of large multinational firms. 5. Identify the corporate level strategies and international strategies being implemented at Alibaba. 6. What recommendations would you make to the new CEO? How should he proceed to fill the shoes of Mr. Ma? What actions should the company take in order to remain competitive in the dynamic e-commerce industry? 36% ..I KEKAL SELAMAT... 4G 7:54 PM