Answered step by step

Verified Expert Solution

Question

1 Approved Answer

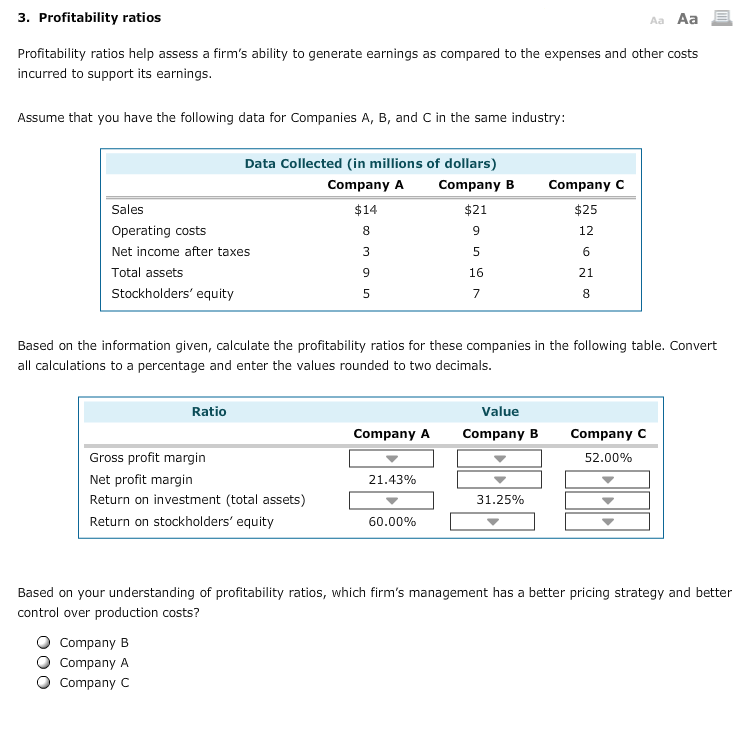

From top left, reading from left to right. Here is the options for the drop down menu 1.[64.29, 51.43, 34.29, 42.86] 2. [57.14, 40.00, 74.28,

From top left, reading from left to right. Here is the options for the drop down menu 1.[64.29, 51.43, 34.29, 42.86] 2. [57.14, 40.00, 74.28, 34.28] 3. [16.67, 14.29, 23.81, 30.95] 4. [26.4, 24.0, 38.4, 28.8] 5. [20, 43.33, 23.33, 33.33] 6. [45.71, 34.28, 31.43, 28.57] 7. [85.72, 107.15, 57.14, 71.43] 8. [75, 52.5, 45, 97.5]

3. Profitability ratios Aa Aa Profitability ratios help assess a firm's ability to generate earnings as compared to the expenses and other costs incurred to support its earnings Assume that you have the following data for Companies A, B, and C in the same industry: Data Collected (in millions of dollars) Company A $14 Company B $21 Company C $25 12 Sales Operating costs Net income after taxes Total assets Stockholders' equity 16 21 Based on the information given, calculate the profitability ratios for these companies in the following table. Convert all calculations to a percentage and enter the values rounded to two decimals Ratio Value Company A Company B Company C Gross profit margin Net profit margin Return on investment (total assets) Return on stockholders' equity 52.00% 21.43% 31.25% 60.00% Based on your understanding of profitability ratios, which firm's management has a better pricing strategy and better control over production costs? Company B O Company A O Company CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started