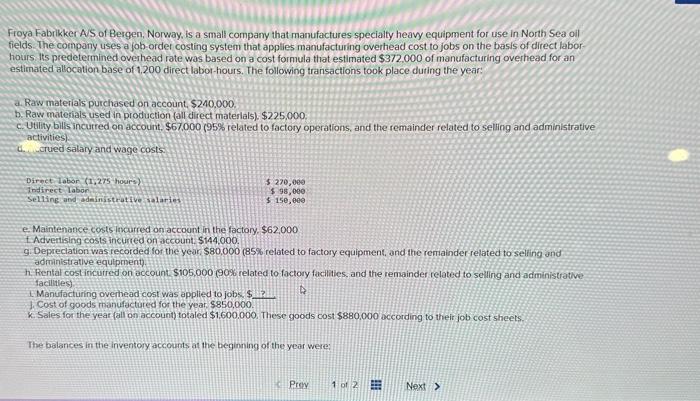

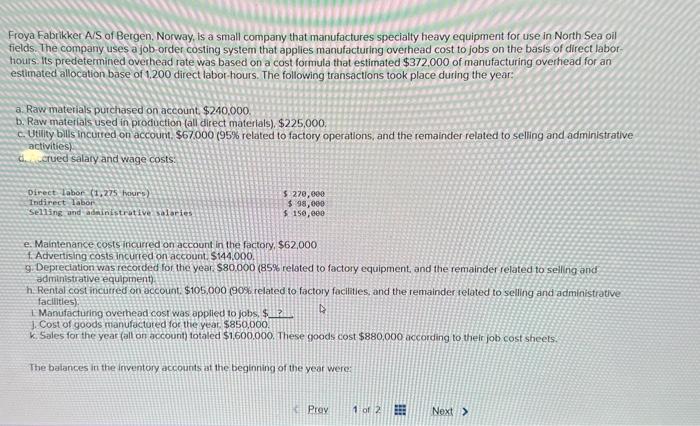

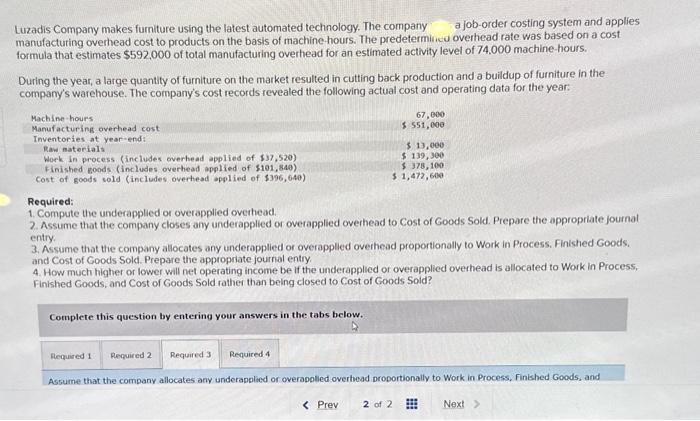

Froya Fabrikker As of Bergen, Norway. is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct laborhours. Its predetermined overhead rate was based on a cost formula that estimated $372.000 of manufacturing overhead for an estimated allocation base of 1,200 direct labor-hours. The following transactions took place duting the year: a. Raw materials purchased on account, $240.000. b. Raw materials used in production (all direct materlals), $225,000. c. Utility bills incurred on account. $67,000g95% related to factory operations, and the remainder related to seling and administrative activities). 4. crued salary and wage costs e. Maintenance costs incurred on account in the factory $62.000 tAdvenising costs incurred on account. $144,000. 9. Depreclation was recorded for the year $80,000 ( 85% related to factory equipment, and the remainder related to seling and adrinistrative equlpmenti). h. Fiental cost incurred on account $105,000(90% related to factory facilities, and the remainder related to selling and administrative facilities) 1. Manufacturing ovemead cost was applied to jobs: 1. Cost of goods manufactured for the year $850,000. K. Sales for the year (all on account) totaled $1,600.000. These goods cost $880,000 occording to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct laborhours. Its predetermined overhead rate was based on a cost formula that estimated $372.000 of manufacturing overhead for an estimated allocation base of 1,200 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $240,000. b. Raw materials used in production (all direct materials). $225,000. c. Utility bills incuired on account. $67.000(95% related to factory operations, and the remainder related to selling and administrative activities) c. crued salary and wage costs: e. Maintenance costs incurred on account in the factory, $62,000 4. Advertising costs incurred on account, $144,000, 9. Depreciation was recorded for the year. $80.000 ( 85% related to factory equipment, and the remainder related to selling and administrative equipinenti). h. Rental cost incurred on account. $105.000 (90\% related to factory facilities, and the remainder related to selling and administrative factlities) Manufacturing overhead cost was applied to jobs \$? 1. Cost of goods manufactured for the year. $850,000. k. Sales for the year (all on account) totaled $1,600,000. These goods cost $880,000 according to theirjob cost sheets. The baiances in the irventory accounts it the beginning of the year were: Luzadis Company makes furniture using the latest automated technology. The company a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours. The predetermincu overhead rate was based on a cost formula that estimates $592,000 of total manufacturing overhead for an estimated activity level of 74,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process. Finished Goods. and Cost of Goods Sold. Prepare the appropriate journal entry: 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below