Answered step by step

Verified Expert Solution

Question

1 Approved Answer

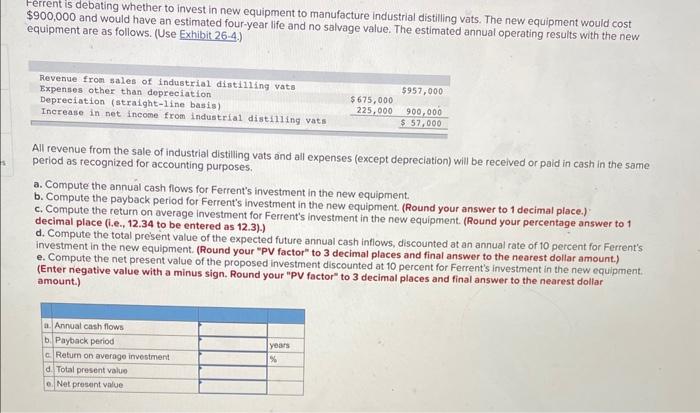

Frrent is debating whether to invest in new equipment to manufacture industrial distilling vats. The new equipment would cost $900,000 and would have an estimated

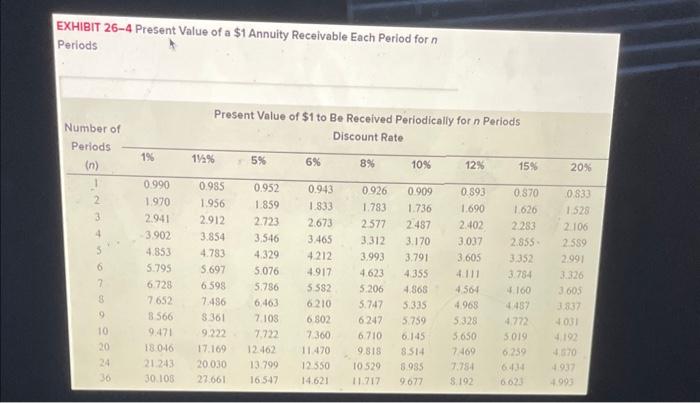

Frrent is debating whether to invest in new equipment to manufacture industrial distilling vats. The new equipment would cost $900,000 and would have an estimated four-year life and no salvage value. The estimated annual operating results with the new equipment are as follows. (Use Exhibit 26-4.) Revenue from sales of industrial distilling vats $957,000 Expenses other than depreciation $675,000 Depreciation (straight-line basis) 225,000 900,000 Increase in net income from industrial distilling vats $ 57,000 All revenue from the sale of industrial distilling vats and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. a. Compute the annual cash flows for Ferrent's investment in the new equipment. b. Compute the payback period for Ferrent's investment in the new equipment. (Round your answer to 1 decimal place.) c. Compute the return on average investment for Ferrent's investment in the new equipment. (Round your percentage answer to 1 decimal place (i.e., 12.34 to be entered as 12.3).) d. Compute the total present value of the expected future annual cash inflows, discounted at an annual rate of 10 percent for Ferrent's investment in the new equipment. (Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) e. Compute the net present value of the proposed investment discounted at 10 percent for Ferrent's investment in the new equipment. (Enter negative value with a minus sign. Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) a. Annual cash flows b. Payback period c Return on average investment d. Total present value e. Net present value years % EXHIBIT 26-4 Present Value of a $1 Annuity Receivable Each Period for n Periods Number of Periods Present Value of $1 to Be Received Periodically for n Periods Discount Rate 1% 115% 5 % 6% 8% 10% 12% (n) 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 2 1.970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 3 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 4 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855- 2.589 S 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 6 5.795 5.697 5.076 4.917 4.623 4.355 4.111 3.784 3.326 7 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3,605 8 7.652 7.486 6:463 6.210 5.747 5.335 4.968 4487 3.837 9 8.566- 8.361 7.103 6.802 6247 5.759 5.328 4.772 4.031 10 9.471 9.222 7.722 7.360 6.710 6.145 5.650 5.019 4.192 20 228 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.570 241 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 36 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993

Frrent is debating whether to invest in new equipment to manufacture industrial distilling vats. The new equipment would cost $900,000 and would have an estimated four-year life and no salvage value. The estimated annual operating results with the new equipment are as follows. (Use Exhibit 26-4.) Revenue from sales of industrial distilling vats $957,000 Expenses other than depreciation $675,000 Depreciation (straight-line basis) 225,000 900,000 Increase in net income from industrial distilling vats $ 57,000 All revenue from the sale of industrial distilling vats and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. a. Compute the annual cash flows for Ferrent's investment in the new equipment. b. Compute the payback period for Ferrent's investment in the new equipment. (Round your answer to 1 decimal place.) c. Compute the return on average investment for Ferrent's investment in the new equipment. (Round your percentage answer to 1 decimal place (i.e., 12.34 to be entered as 12.3).) d. Compute the total present value of the expected future annual cash inflows, discounted at an annual rate of 10 percent for Ferrent's investment in the new equipment. (Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) e. Compute the net present value of the proposed investment discounted at 10 percent for Ferrent's investment in the new equipment. (Enter negative value with a minus sign. Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) a. Annual cash flows b. Payback period c Return on average investment d. Total present value e. Net present value years % EXHIBIT 26-4 Present Value of a $1 Annuity Receivable Each Period for n Periods Number of Periods Present Value of $1 to Be Received Periodically for n Periods Discount Rate 1% 115% 5 % 6% 8% 10% 12% (n) 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 2 1.970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 3 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 4 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855- 2.589 S 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 6 5.795 5.697 5.076 4.917 4.623 4.355 4.111 3.784 3.326 7 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3,605 8 7.652 7.486 6:463 6.210 5.747 5.335 4.968 4487 3.837 9 8.566- 8.361 7.103 6.802 6247 5.759 5.328 4.772 4.031 10 9.471 9.222 7.722 7.360 6.710 6.145 5.650 5.019 4.192 20 228 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.570 241 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 36 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started