Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fruit Creations Ltd is a company based in the United States known for its manufacturing fruit-based energy drinks popular with teens and busy professionals.

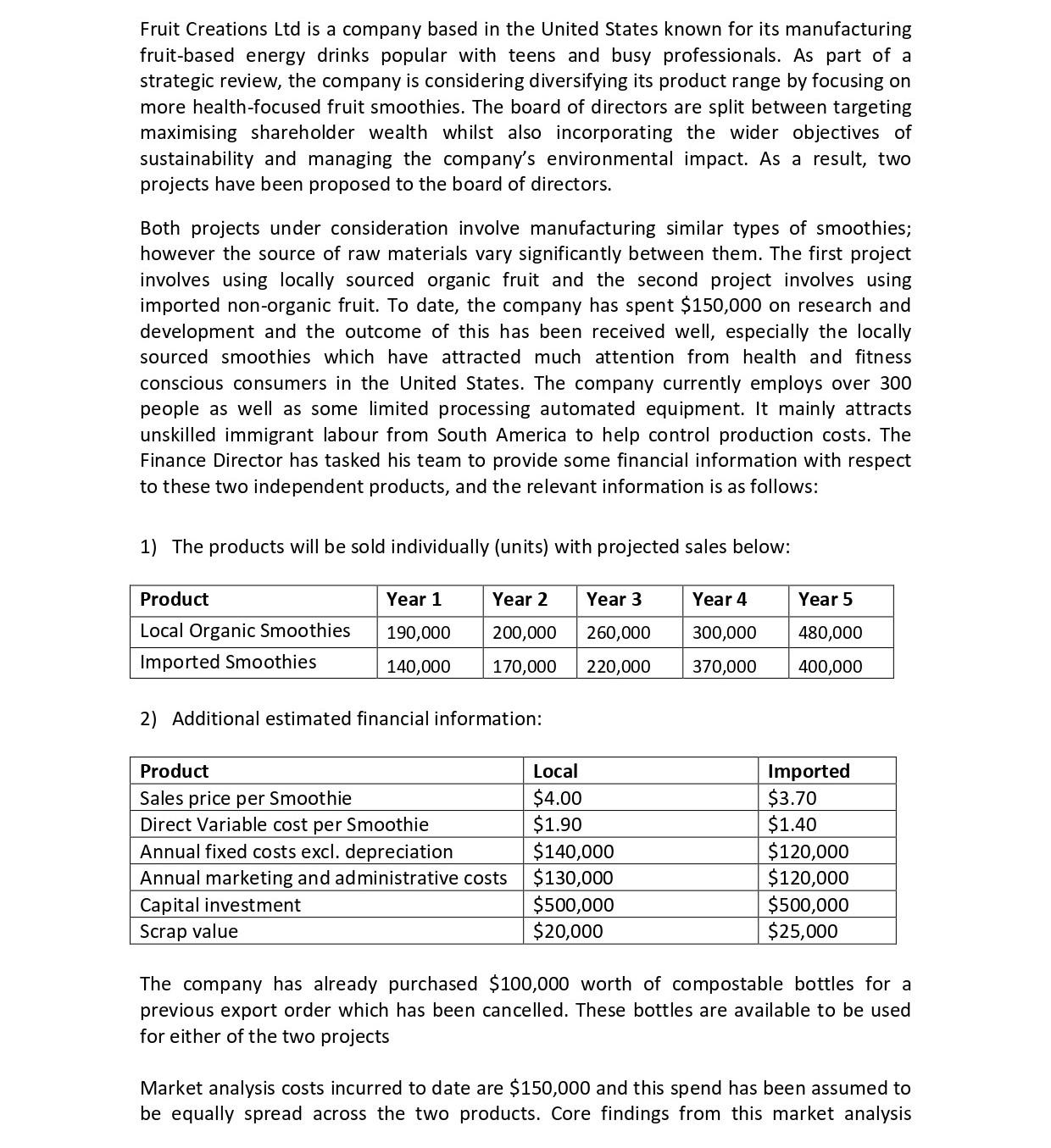

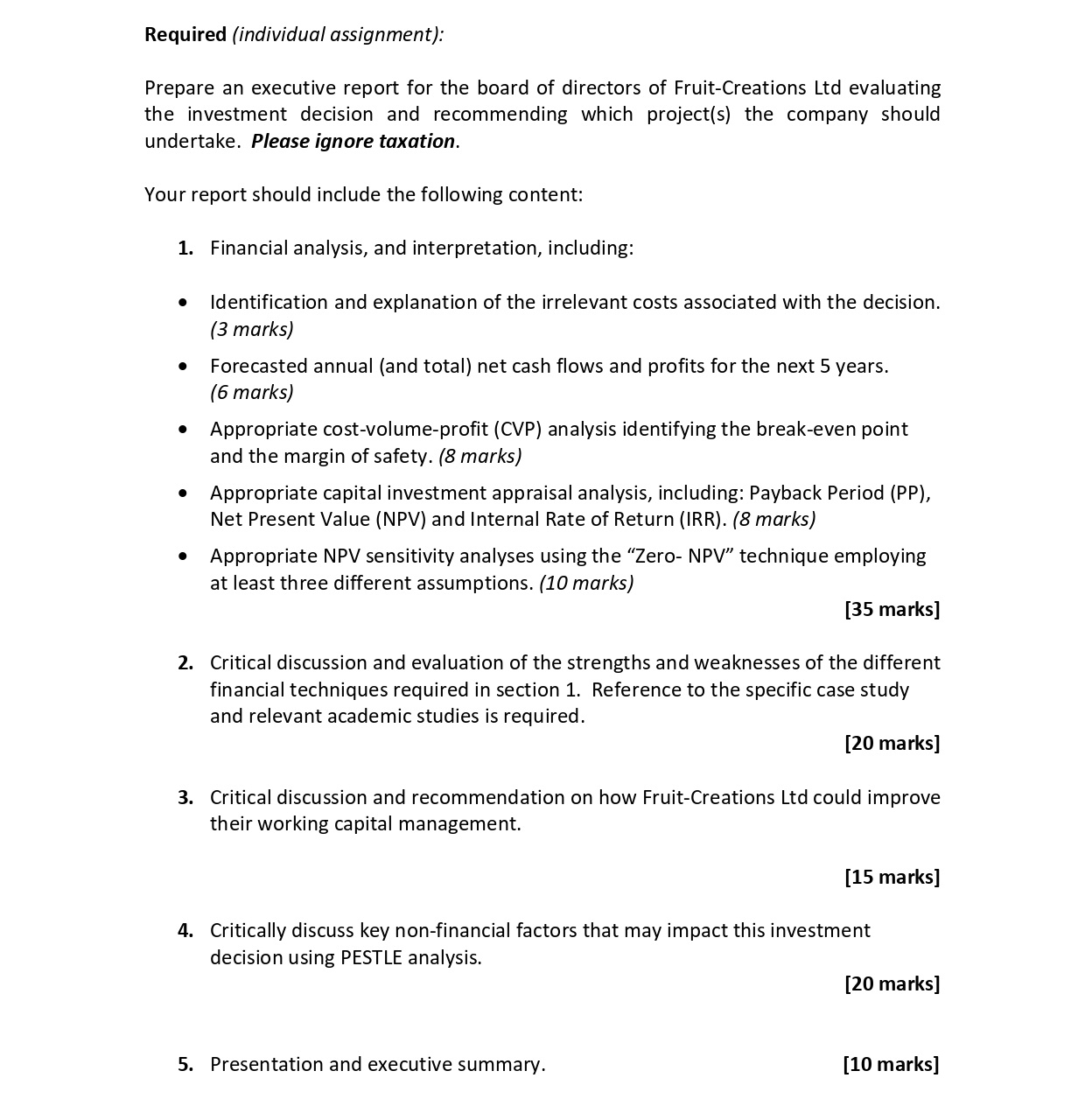

Fruit Creations Ltd is a company based in the United States known for its manufacturing fruit-based energy drinks popular with teens and busy professionals. As part of a strategic review, the company is considering diversifying its product range by focusing on more health-focused fruit smoothies. The board of directors are split between targeting maximising shareholder wealth whilst also incorporating the wider objectives of sustainability and managing the company's environmental impact. As a result, two projects have been proposed to the board of directors. Both projects under consideration involve manufacturing similar types of smoothies; however the source of raw materials vary significantly between them. The first project involves using locally sourced organic fruit and the second project involves using imported non-organic fruit. To date, the company has spent $150,000 on research and development and the outcome of this has been received well, especially the locally sourced smoothies which have attracted much attention from health and fitness. conscious consumers in the United States. The company currently employs over 300 people as well as some limited processing automated equipment. It mainly attracts unskilled immigrant labour from South America to help control production costs. The Finance Director has tasked his team to provide some financial information with respect to these two independent products, and the relevant information is as follows: 1) The products will be sold individually (units) with projected sales below: Product Year 1 Local Organic Smoothies Imported Smoothies 190,000 Year 2 Year 3 200,000 260,000 Year 4 Year 5 300,000 480,000 140,000 170,000 220,000 370,000 400,000 2) Additional estimated financial information: Product Local Imported Sales price per Smoothie $4.00 $3.70 Direct Variable cost per Smoothie $1.90 $1.40 Annual fixed costs excl. depreciation $140,000 $120,000 Annual marketing and administrative costs $130,000 $120,000 Capital investment $500,000 $500,000 Scrap value $20,000 $25,000 The company has already purchased $100,000 worth of compostable bottles for a previous export order which has been cancelled. These bottles are available to be used for either of the two projects Market analysis costs incurred to date are $150,000 and this spend has been assumed to be equally spread across the two products. Core findings from this market analysis concluded that there are some comparable products in the market however there is no established dominant supplier. Additionally, the more environmentally-conscious use of compostable bottles and lower carbon footprint ingredients are gaining popularity. Other key financial information: . Direct variable product costs grow in proportion with sales. The maximum capital expenditure budget available to spend is $500,000 and the weighted average cost of capital (WACC) is 13%. The projects are not divisible. Marketing & administrative expenses are expected to remain the same each year. The company's depreciation policy is to depreciate investment costs over the economic life of the investment (5 years) using the straight-line method. The company's threshold for the payback period is 3 years. The team have also notified the finance director of the important of managing the working capital. They have identified delays in payments from some key customers and they are aware of a backlog of inventory in various warehouse locations. Required (individual assignment): Prepare an executive report for the board of directors of Fruit-Creations Ltd evaluating the investment decision and recommending which project(s) the company should undertake. Please ignore taxation. Your report should include the following content: 1. Financial analysis, and interpretation, including: Identification and explanation of the irrelevant costs associated with the decision. (3 marks) Forecasted annual (and total) net cash flows and profits for the next 5 years. (6 marks) Appropriate cost-volume-profit (CVP) analysis identifying the break-even point and the margin of safety. (8 marks) Appropriate capital investment appraisal analysis, including: Payback Period (PP), Net Present Value (NPV) and Internal Rate of Return (IRR). (8 marks) Appropriate NPV sensitivity analyses using the "Zero- NPV" technique employing at least three different assumptions. (10 marks) [35 marks] 2. Critical discussion and evaluation of the strengths and weaknesses of the different financial techniques required in section 1. Reference to the specific case study and relevant academic studies is required. [20 marks] 3. Critical discussion and recommendation on how Fruit-Creations Ltd could improve their working capital management. [15 marks] 4. Critically discuss key non-financial factors that may impact this investment decision using PESTLE analysis. 5. Presentation and executive summary. [20 marks] [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started