Answered step by step

Verified Expert Solution

Question

1 Approved Answer

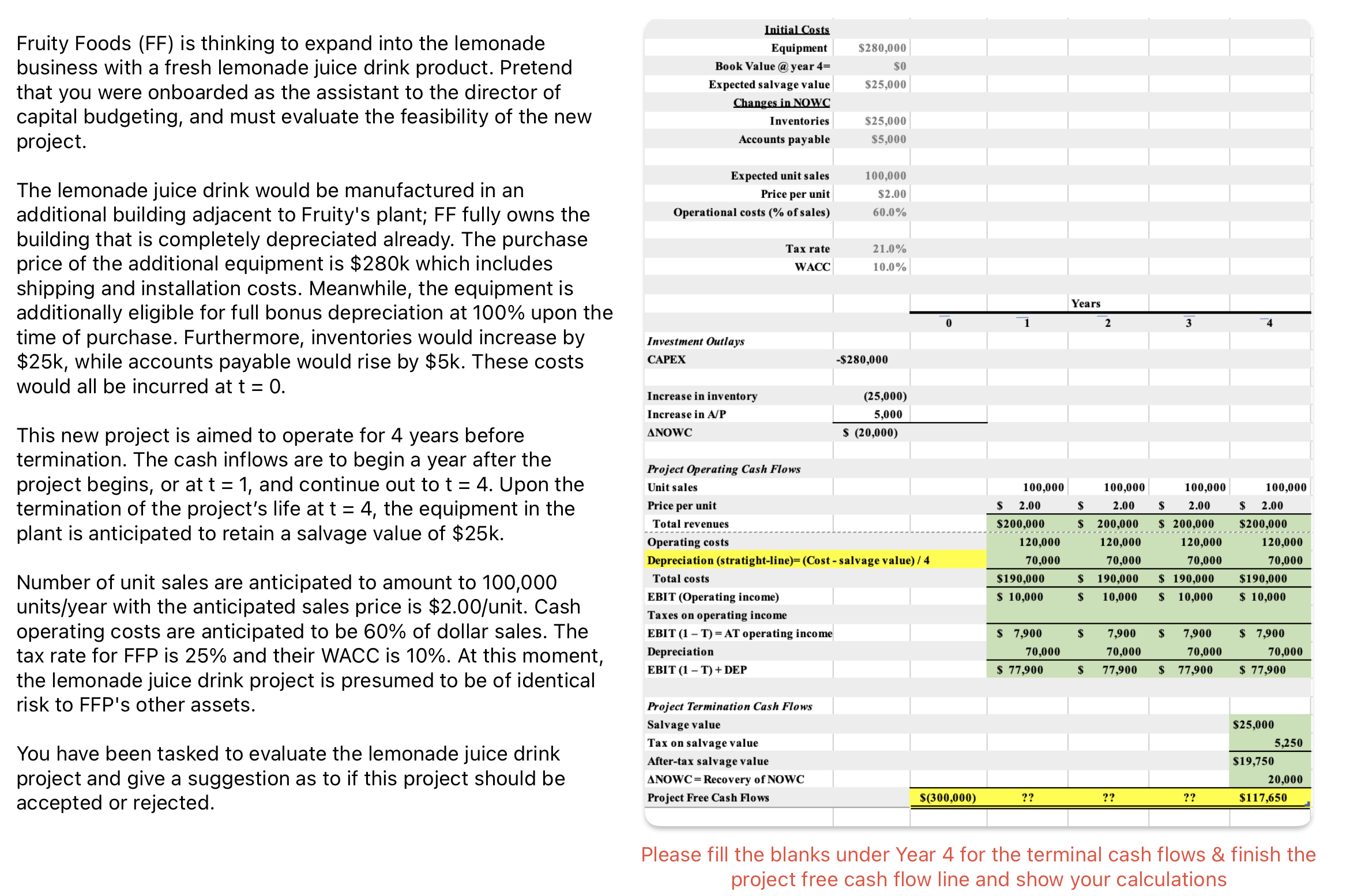

Fruity Foods ( FF ) is thinking to expand into the lemonade business with a fresh lemonade juice drink product. Pretend that you were onboarded

Fruity Foods FF is thinking to expand into the lemonade

business with a fresh lemonade juice drink product. Pretend

that you were onboarded as the assistant to the director of

capital budgeting, and must evaluate the feasibility of the new

project.

The lemonade juice drink would be manufactured in an

additional building adjacent to Fruity's plant; FF fully owns the

building that is completely depreciated already. The purchase

price of the additional equipment is $ which includes

shipping and installation costs. Meanwhile, the equipment is

additionally eligible for full bonus depreciation at upon the

time of purchase. Furthermore, inventories would increase by

$ while accounts payable would rise by $ These costs

would all be incurred at

This new project is aimed to operate for years before

termination. The cash inflows are to begin a year after the

project begins, or at and continue out to Upon the

termination of the project's life at the equipment in the

plant is anticipated to retain a salvage value of $

Number of unit sales are anticipated to amount to

unitsyear with the anticipated sales price is $ unit. Cash

operating costs are anticipated to be of dollar sales. The

tax rate for FFP is and their WACC is At this moment,

the lemonade juice drink project is presumed to be of identical

risk to FFPs other assets.

You have been tasked to evaluate the lemonade juice drink

project and give a suggestion as to if this project should be

accepted or rejected.

Please fill the blanks under Year for the terminal cash flows & finish the

project free cash flow line and show your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started