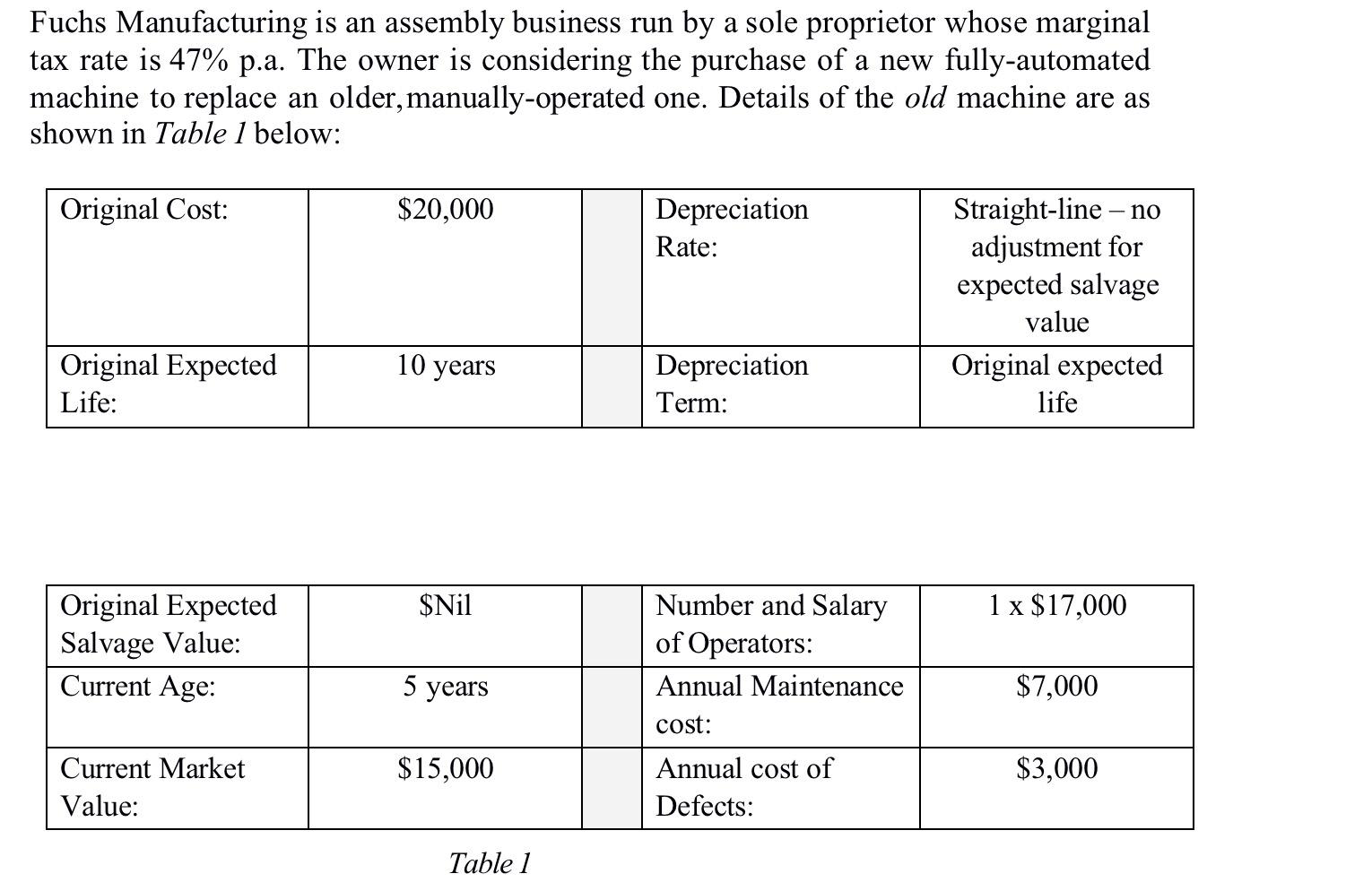

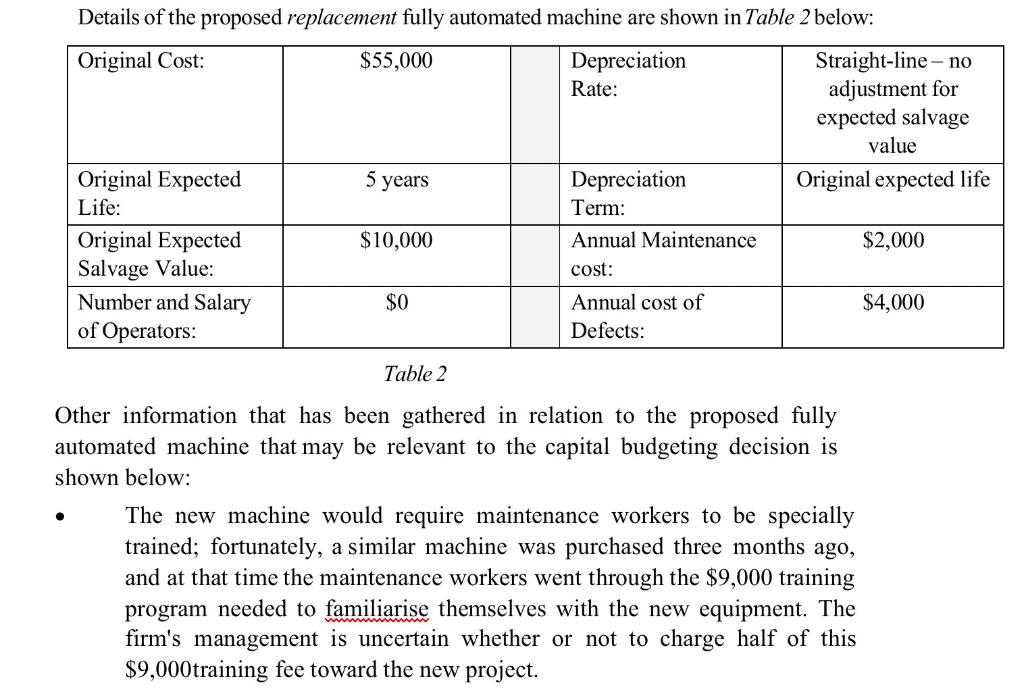

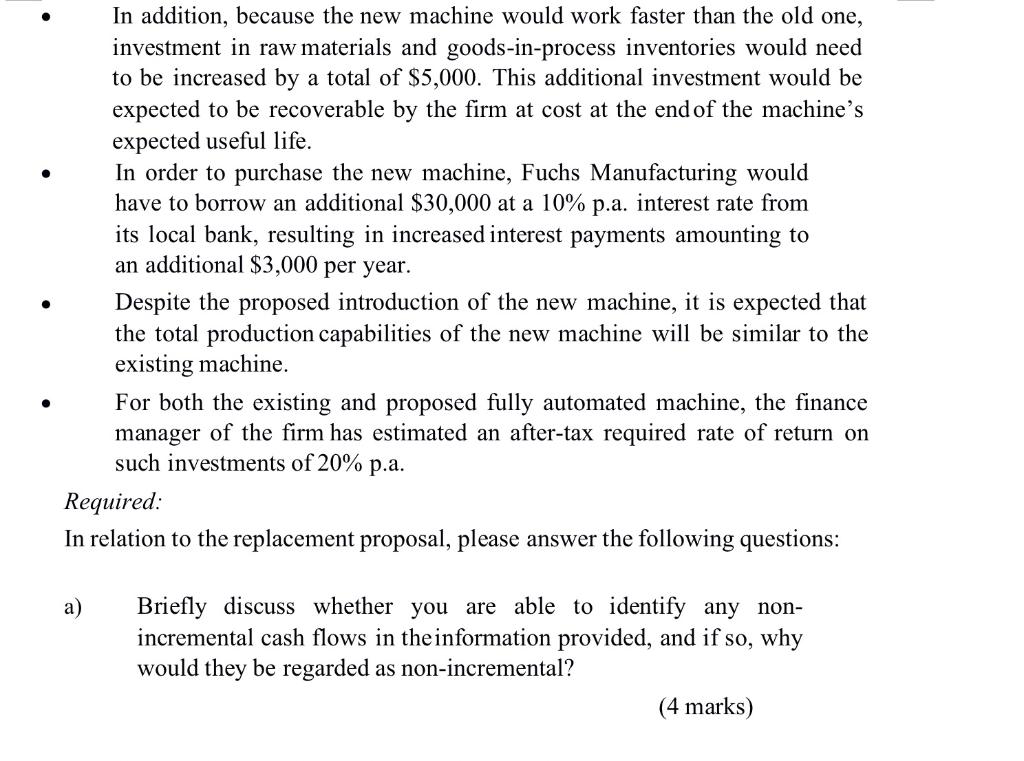

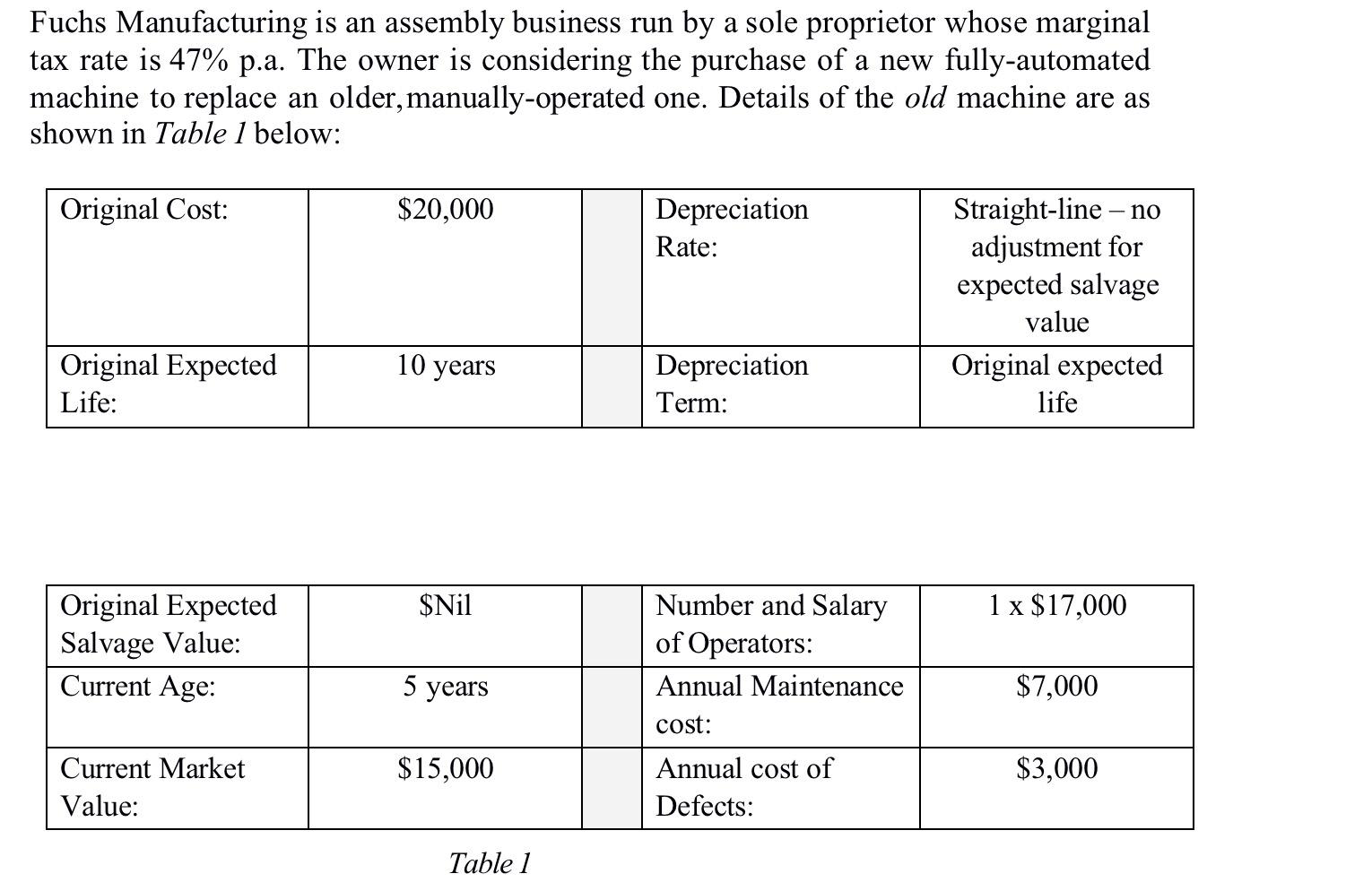

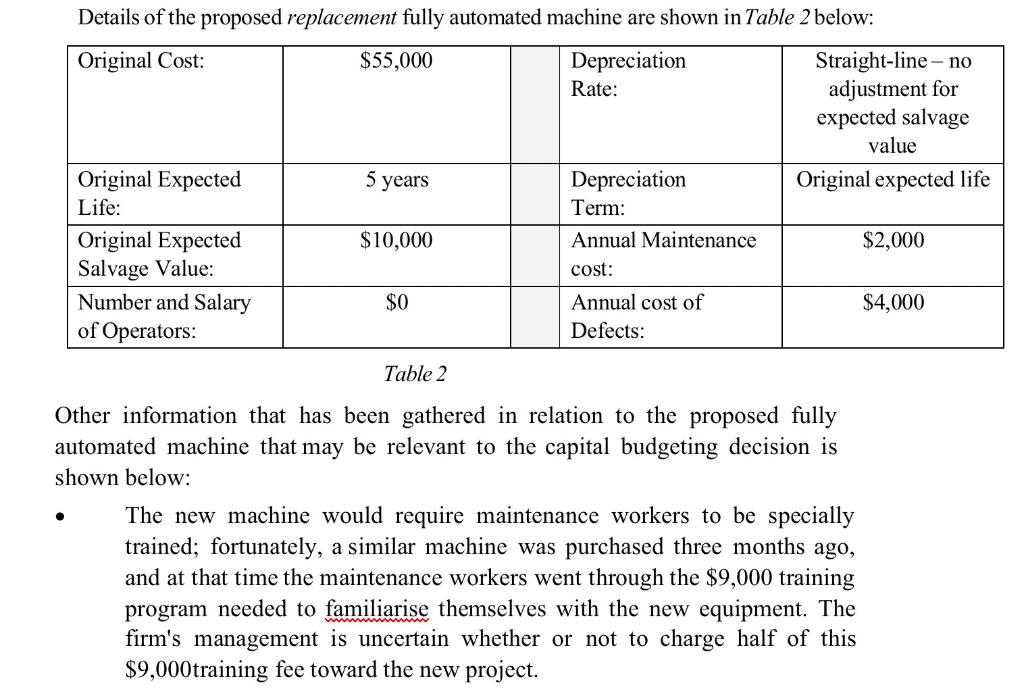

Fuchs Manufacturing is an assembly business run by a sole proprietor whose marginal tax rate is 47% p.a. The owner is considering the purchase of a new fully-automated machine to replace an older, manually-operated one. Details of the old machine are as shown in Table 1 below: Original Cost: $20,000 Straight-line - no Depreciation Rate: adjustment for expected salvage value 10 years Original Expected Life: Depreciation Term: Original expected life $Nil Number and Salary 1 x $17,000 Original Expected Salvage Value: of Operators: Current Age: 5 years Annual Maintenance $7,000 cost: Current Market $15,000 Annual cost of $3,000 Value: Defects: Table 1 Details of the proposed replacement fully automated machine are shown in Table 2 below: Original Cost: $55,000 Depreciation Rate: Original Expected 5 years Depreciation Life: Term: $10,000 Annual Maintenance Original Expected Salvage Value: cost: Number and Salary $0 Annual cost of of Operators: Defects: Table 2 Other information that has been gathered in relation to the proposed fully automated machine that may be relevant to the capital budgeting decision is shown below: The new machine would require maintenance workers to be specially trained; fortunately, a similar machine was purchased three months ago, and at that time the maintenance workers went through the $9,000 training program needed to familiarise themselves with the new equipment. The firm's management is uncertain whether or not to charge half of this $9,000training fee toward the new project. Straight-line - no adjustment for expected salvage value Original expected life $2,000 $4,000 In addition, because the new machine would work faster than the old one, investment in raw materials and goods-in-process inventories would need to be increased by a total of $5,000. This additional investment would be expected to be recoverable by the firm at cost at the end of the machine's expected useful life. In order to purchase the new machine, Fuchs Manufacturing would have to borrow an additional $30,000 at a 10% p.a. interest rate from its local bank, resulting in increased interest payments amounting to an additional $3,000 per year. Despite the proposed introduction of the new machine, it is expected that the total production capabilities of the new machine will be similar to the existing machine. For both the existing and proposed fully automated machine, the finance manager of the firm has estimated an after-tax required rate of return on such investments of 20% p.a. Required: In relation to the replacement proposal, please answer the following questions: a) Briefly discuss whether you are able to identify any non- incremental cash flows in the information provided, and if so, why would they be regarded as non-incremental? (4 marks) What would be the project's initial outlay? (5 marks) c) What are the annual differential cash flows in year's 1 to 4 of the project's life? (6 marks) d) What is the terminal cash flow in year 5 of the project, excluding the regular year 5 differential cash flow from section c) of this question? (3 marks) Draw a timeline / cash-flow diagram for this project based on the information included above. b) Calculate the project's Net Present Value (NPV). (2 marks) Calculate the Profitability Index (PI) for the project. (2 marks) h) Calculate the Internal Rate of Return (IRR) for the project. (2 marks) i) Assuming that cash-flows occur regularly over the life of the project proposal (that is, on a daily basis), if the firm requires a minimum payback period on projects of this type of less than four years, should this project be accepted based on the payback rules? Briefly justify your response. (3 marks) j) What difference would it make to your answer to section i) if the cash flows from the project proposal all occurred at the end of each year? (3 marks) k) On an overall basis, would you recommend that Fuchs Manufacturing accept the replacement proposal? Briefly justify your response. (3 marks) f)