Answered step by step

Verified Expert Solution

Question

1 Approved Answer

full answers please FIN230-Homework (5marks) L. A. Present Value. Your uncle offers you a choice of $100,000 in 10 years or $45,000 today. If money

full answers please

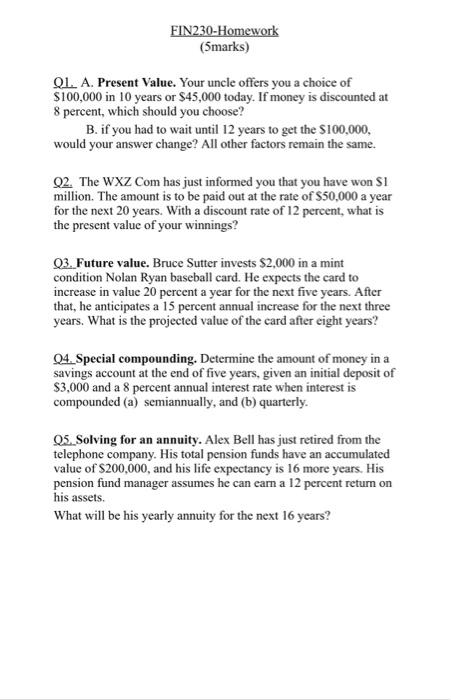

FIN230-Homework (5marks) L. A. Present Value. Your uncle offers you a choice of $100,000 in 10 years or $45,000 today. If money is discounted at 8 percent, which should you choose? B. if you had to wait until 12 years to get the $100,000, would your answer change? All other factors remain the same. Q2. The WXZ Com has just informed you that you have won SI million. The amount is to be paid out at the rate of $50,000 a year for the next 20 years. With a discount rate of 12 percent, what is the present value of your winnings? 03. Future value. Bruce Sutter invests $2,000 in a mint condition Nolan Ryan baseball card. He expects the card to increase in value 20 percent a year for the next five years. After that, he anticipates a 15 percent annual increase for the next three years. What is the projected value of the card after eight years? 04. Special compounding. Determine the amount of money in a savings account at the end of five years, given an initial deposit of $3,000 and a 8 percent annual interest rate when interest is compounded (a) semiannually, and (b) quarterly. QS. Solving for an annuity. Alex Bell has just retired from the telephone company. His total pension funds have an accumulated value of $200,000, and his life expectancy is 16 more years. His pension fund manager assumes he can earn a 12 percent return on his assets. What will be his yearly annuity for the next 16 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started