Answered step by step

Verified Expert Solution

Question

1 Approved Answer

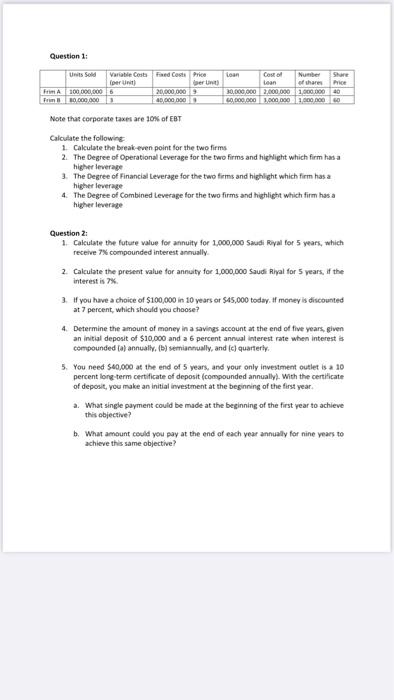

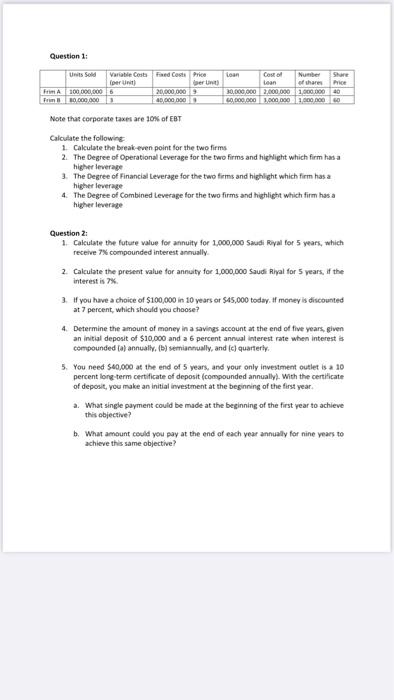

full answers please Question 1: Units Solid Variable Costa Fed Costs Price per unit) ber Fri 100.000.000 20.000.000 Fri 10.000.000 40,000000 Note that corporate taxes

full answers please

Question 1: Units Solid Variable Costa Fed Costs Price per unit) ber Fri 100.000.000 20.000.000 Fri 10.000.000 40,000000 Note that corporate taxes are 10% of EBT Loan Cost of Number Share Lean of shares Price 30,000,000 2,000,000 1.000.00040 89.000.000 3.000 DO 1000 DO 60 Calculate the following 1. Calculate the break-even point for the two firms 2. The Degree of Operational Leverage for the two firms and highlight which firm has a higher leverage 3. The Degree of Financial Leverage for the two firms and highlight which firm has a higher leverage 4. The Degree of Combined Leverage for the two firms and highlight which firm has a higher leverage Question 2: 1. Calculate the future value for annuity for 1,000,000 Saudi Riyal for 5 years, which receive 7% compounded interest annually 2. Calculate the present value for annalty for 1,000,000 Saudi Riyal for 5 years, If the interest is 7% 3. you have a choice of $100,000 in 10 years or S45,000 today. If money is discounted at 7 percent, which should you choose? 4. Determine the amount of money in a savings account at the end of five years, given an initial deposit of $10,000 and a 6 percent annual interest rate when interestis compounded (a) annually. (b) semiannually, and (c) quarterly 5. You need $40,000 at the end of 5 years, and your only investment outlet is a 10 percent long term certificate of deposit (compounded annually. With the certificate of deposit, you make an initial investment at the beginning of the first year. a. What single payment could be made at the beginning of the first year to achieve this objective? b. What amount could you pay at the end of each year annually for nine years to achieve this same objective

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started