Answered step by step

Verified Expert Solution

Question

1 Approved Answer

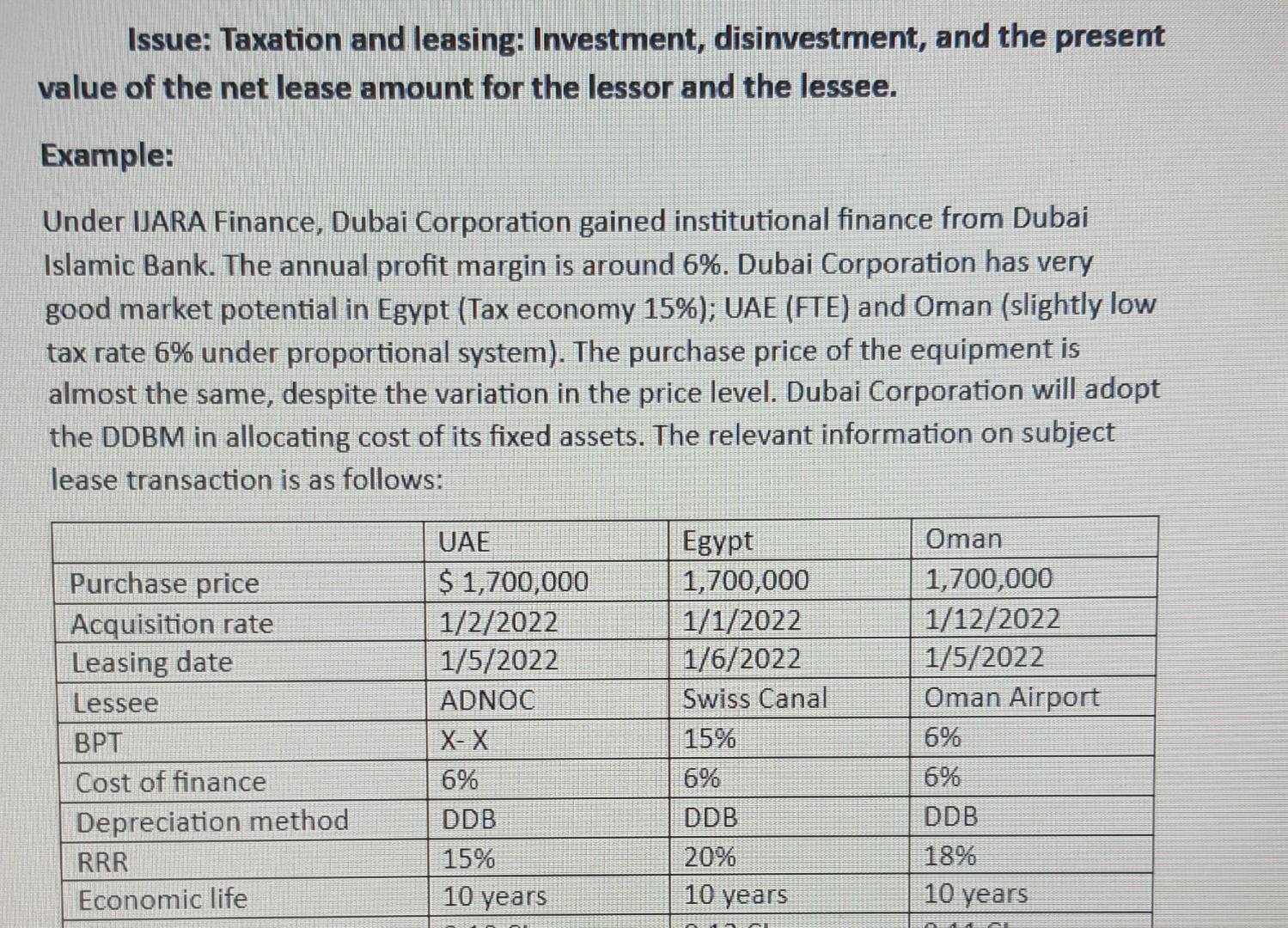

full solution please Issue: Taxation and leasing: Investment, disinvestment, and the present value of the net lease amount for the lessor and the lessee. Example:

full solution please

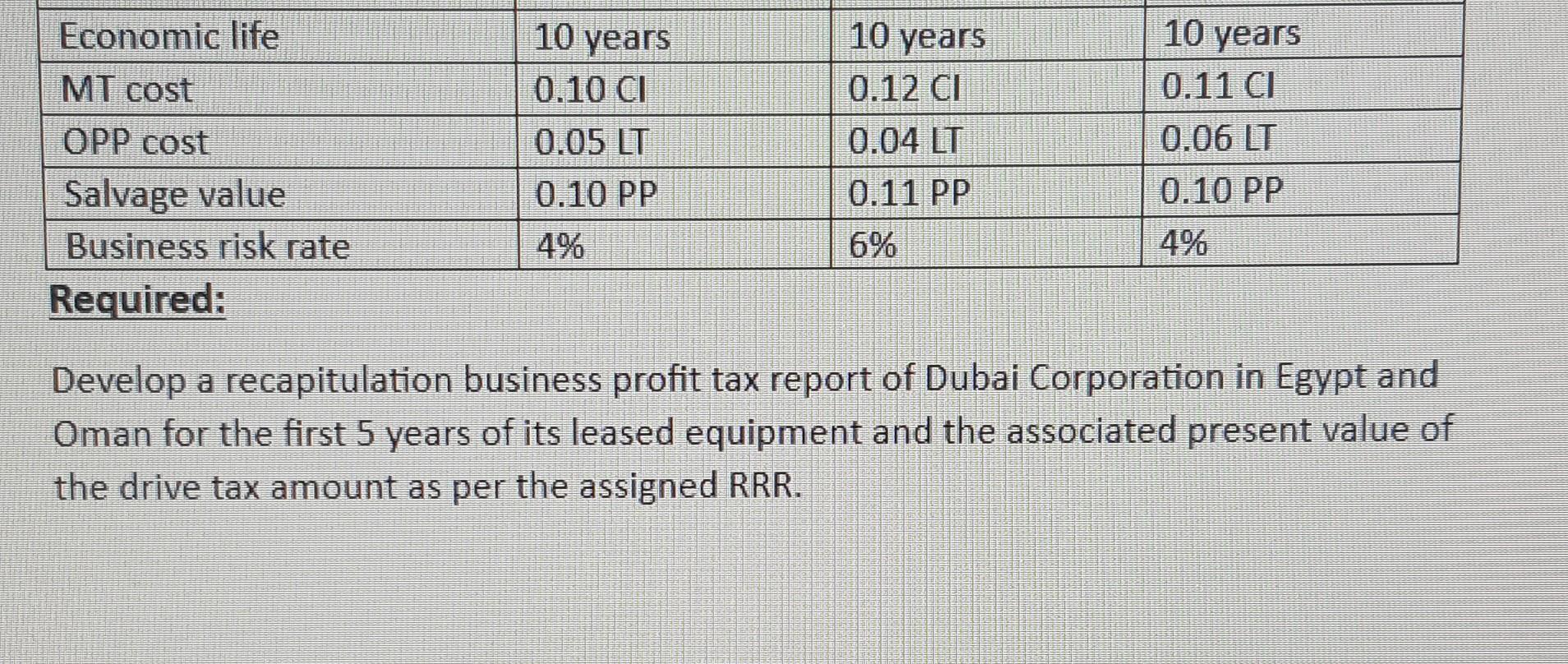

Issue: Taxation and leasing: Investment, disinvestment, and the present value of the net lease amount for the lessor and the lessee. Example: Under IJARA Finance, Dubai Corporation gained institutional finance from Dubai Islamic Bank. The annual profit margin is around 6\%. Dubai Corporation has very good market potential in Egypt (Tax economy 15\%); UAE (FTE) and Oman (slightly low tax rate 6% under proportional system). The purchase price of the equipment is almost the same, despite the variation in the price level. Dubai Corporation will adopt the DDBM in allocating cost of its fixed assets. The relevant information on subject lease transaction is as follows: Develop a recapitulation business profit tax report of Dubai Corporation in Egypt and Oman for the first 5 years of its leased equipment and the associated present value of the drive tax amount as per the assigned RRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started