Answered step by step

Verified Expert Solution

Question

1 Approved Answer

full work 1. A monopoly firm sells a product to two types of consumers, low valuation con- sumers whose valuations are 2q and high valuation

full work

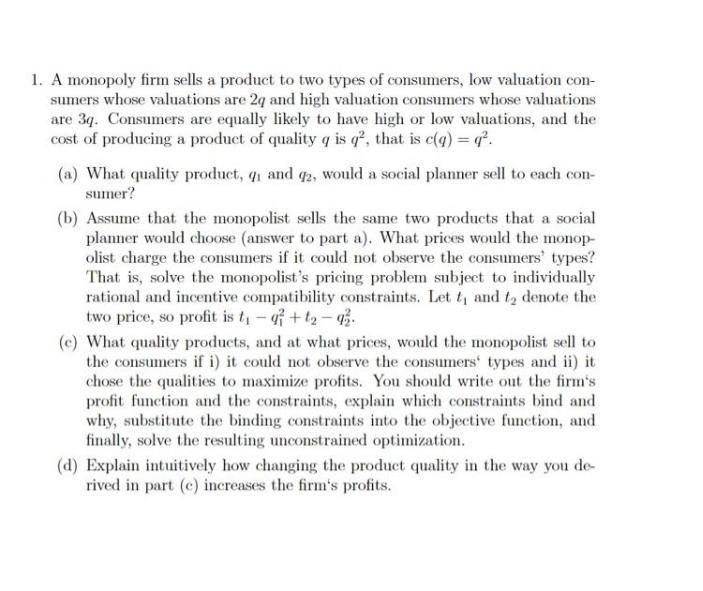

1. A monopoly firm sells a product to two types of consumers, low valuation con- sumers whose valuations are 2q and high valuation consumers whose valuations are 39. Consumers are equally likely to have high or low valuations, and the cost of producing a product of quality q is q?, that is c(q) = 0%. (a) What quality product, 41 and 42, would a social planner sell to each con- sumer? (b) Assume that the monopolist sells the same two products that a social planner would choose answer to part a). What prices would the monop- olist charge the consumers if it could not observe the consumers' types? That is, solve the monopolist's pricing problem subject to individually rational and incentive compatibility constraints. Let t, and t, denote the two price, so profit is t, - q + t2 - 4. (C) What quality products, and at what prices, would the monopolist sell to the consumers if i) it could not observe the consumers' types and ii) it chose the qualities to maximize profits. You should write out the firm's profit function and the constraints, explain which constraints bind and why, substitute the binding constraints into the objective function, and finally, solve the resulting unconstrained optimization. (d) Explain intuitively how changing the product quality in the way you de rived in part (c) increases the firm's profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started