Question

Fullerton Waste Management purchased land and a warehouse for $750,000. In addition to the purchase price, Fullerton made the following expenditures related to the

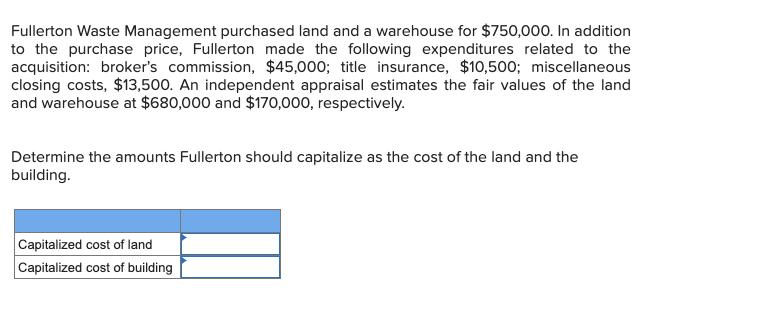

Fullerton Waste Management purchased land and a warehouse for $750,000. In addition to the purchase price, Fullerton made the following expenditures related to the acquisition: broker's commission, $45,000; title insurance, $10,500; miscellaneous closing costs, $13,500. An independent appraisal estimates the fair values of the land and warehouse at $680,000 and $170,000, respectively. Determine the amounts Fullerton should capitalize as the cost of the land and the building. Capitalized cost of land Capitalized cost of building

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the amounts that Fullerton should capitalize as the cost of the land and the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App