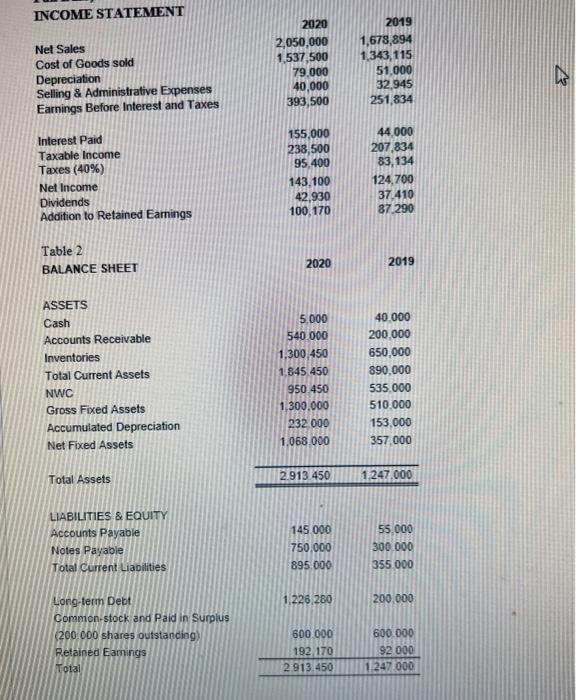

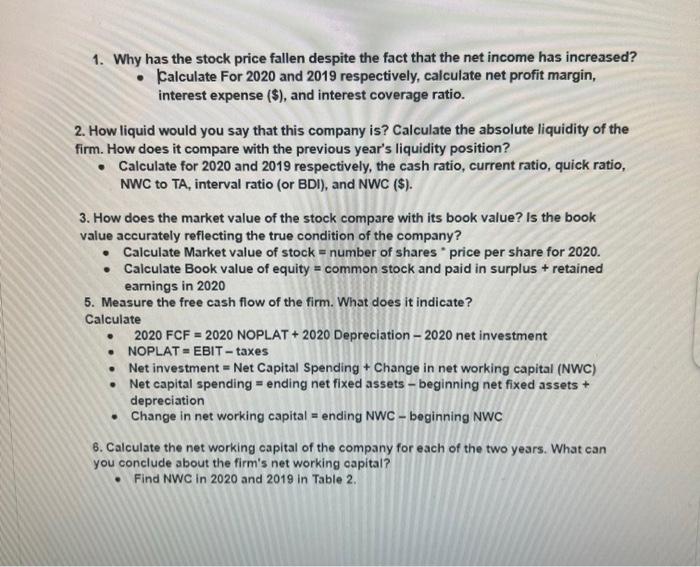

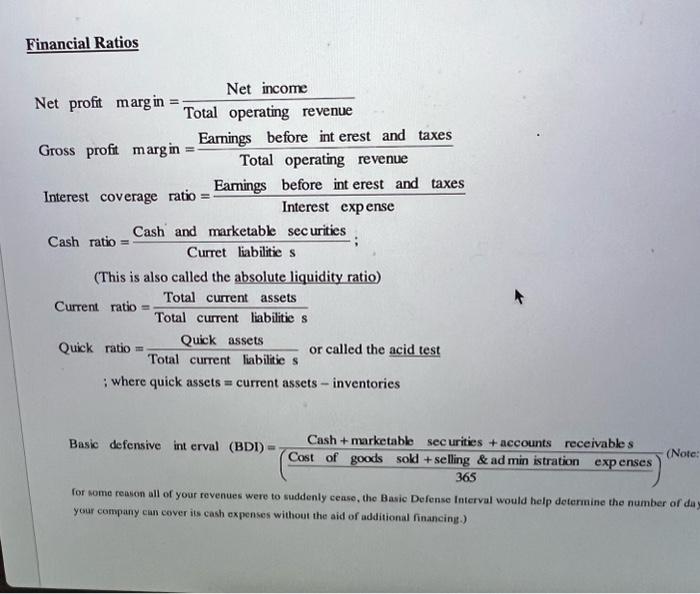

Fun Bulb, Co. has been expanding quite rapidly and ventured into a newly developed materials for their products at the end of 2018. At that time, the future outlook seemed very promising and the economy was stable. Stock price per share was $7. The overall competitive pressure was not too severe. Due to this expectation, the firm built two new manufacturing plants and significantly increased its inventory. Now it is the end of 2020. Fun Bulb had a quite a jump in profits over the past few years. However, when Mary Stuart, the Assistant to the CFO at Fun Bulb, looked at the accounting statements for 2020 , she was not happy to see the lower profitability shown in the statements. There was also a big concern on the significant drop in the cash balance of the firm. Mary knew that the stockholders would be very concerned when these statements are released. She also knew that her boss, the CFO, would need to come up with some reasonable answers for the cash issue. The cash balance issue is of particular importance because the firm is planning on raising some short-term capital in the recent future. The current stock price per share at the end of 2020 is \$5.50. Given Table 1 and 2 below (Income Statement and Balance Sheet for the recent two years), Mary needs to do some basic cash flow and financial ratio analysis and provide suggestions to her boss. Please help her by answering the following 6 questions. INCOME STATEMIENT Net Sales Cost of Goods sold Depreciation Selling \& Administrative Expenses Earnings Before Interest and Taxes Interest Paid Taxable Income Taxes (40\%) Net Income Dividends Addition to Retained Earnings Table 2 BALANCE SHEET ASSETS Cash Accounts Receivable Inventories Total Current Assets NWC Gross Fixed Assets Accumulated Depreciation Net Fided Assets Total Assets LLABLITIES \& EQUITY Accounts Payable Notes Payable Total Current Liabilities Long-term Debt Common-stock and Paid in Surplus (200.000 shares outstandiog) Retained Eamings tota1 2020 2019 2,050,000 1,678,894 1,537,500 1,343,115 79.000 51,000 40,000 32,945 393,500 251,834 155,000 44,000 238,500 207,834 83,134 143,100 124,700 37.410 100,170 37.290 2020 2019 5,000 40.000 540.000 200,000 1,300,450 650,000 1.845450 890,000 950.450 535,000 1.300,000 510.000 232.000 153,000 1.068 .000 357,000 \begin{tabular}{|} \hline 2.913 .450 & 1.247,000 \\ \hline \end{tabular} \begin{tabular}{|l} 145.000 \\ 750,000 \\ 895.000 \end{tabular}55,000300000355.000 1.226 .280 200,000 \begin{tabular}{|r|r|} \hline 600.000 & 600.000 \\ 192.170 & 92000 \\ \hline 2913.450 & 1247.000 \\ \hline \end{tabular} 1. Why has the stock price fallen despite the fact that the net income has increased? - Calculate For 2020 and 2019 respectively, calculate net profit margin, interest expense (\$), and interest coverage ratio. 2. How liquid would you say that this company is? Calculate the absolute liquidity of the firm. How does it compare with the previous year's liquidity position? - Calculate for 2020 and 2019 respectively, the cash ratio, current ratio, quick ratio, NWC to TA, interval ratio (or BDI ), and NWC (\$). 3. How does the market value of the stock compare with its book value? Is the book value accurately reflecting the true condition of the company? - Calculate Market value of stock = number of shares * price per share for 2020. - Calculate Book value of equity = common stock and paid in surplus + retained earnings in 2020 5. Measure the free cash flow of the firm. What does it indicate? Calculate - 2020FCF=2020 NOPLAT +2020 Depreciation -2020 net investment - NOPLAT =EBIT taxes - Net investment = Net Capital Spending + Change in net working capital (NWC) - Net capital spending = ending net fixed assets - beginning net fixed assets + depreciation - Change in net working capital = ending NWC - beginning NWC 6. Calculate the net working capital of the company for each of the two years. What can you conclude about the firm's net working capital? - Find NWC in 2020 and 2019 in Table 2. Financial Ratios Net profit marg in =TotaloperatingrevenueNetincome Gross profit marg in =TotaloperatingrevenueEarningsbeforeinterestandtaxes Interest coverage ratio =InterestexpenseEarningsbeforeinterestandtaxes Cashratio=CurretliabilitiesCashandmarketablesecurities (This is also called the absolute liquidity ratio) Currentratio=TotalcurrentliabilitiesTotalcurrentassetsQuickratio=TotalcurrentliabilitiesQuickassetsorcalledtheacidtest;wherequickassets=currentassets-inventories Basicdefensiveinterval(BDI)=(365Costofgoodssold+selling&administrationexpenses)Cash+marketablesecurities+accountsreceivables(Note: for some reason all of your revenues were to suddenly cease, the Basic Defense Interval would help deternine the number of da your compairy can cover is cash expenses without the aid of additional financing.)