Answered step by step

Verified Expert Solution

Question

1 Approved Answer

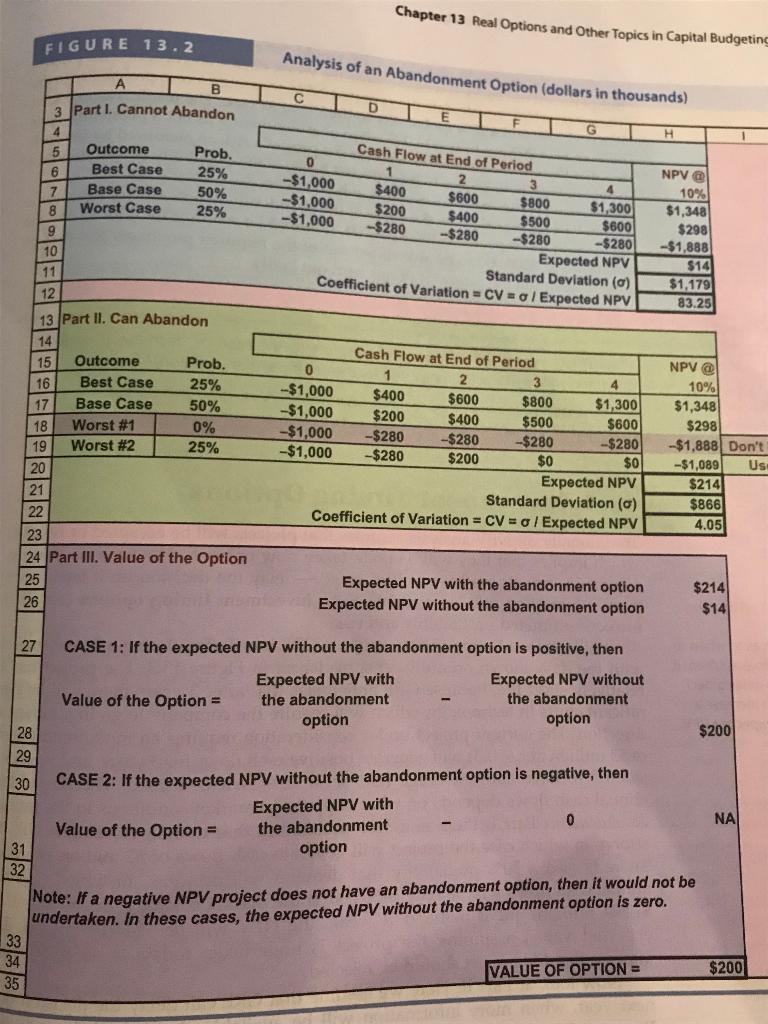

Fundamentals of Financial Management Chapter 13: Figure 13.2 Show the computations for Part I, II and III. Chapter 13 Real Options and Other Topics in

Fundamentals of Financial Management

Chapter 13:

Figure 13.2 Show the computations for Part I, II and III.

Chapter 13 Real Options and Other Topics in Capital Budgeting FIGURE 13.2 Analysis of an Abandonment Option (dollars in thousands) D G H 3 Part I. Cannot Abandon 4 5 Outcome Prob. 6 Best Case 25% 7 Base Case 50% 8 Worst Case 25% 9 Cash Flow at End of Period 0 1 2 3 4 -$1,000 $400 $600 $800 $1,300 -$1,000 $400 $500 $600 -$1,000 -$280 -$280 -$280 -$280 Expected NPV Standard Deviation (o) Coefficient of Variation - CV = 0 / Expected NPV $200 NPV @ 10% $1,348 $298 -$1,888 $14 $1,179 83.25 10 12 NPV @ 13 Part II. Can Abandon 14 15 Outcome Prob. 16 Best Case 25% 17 Base Case 50% 18 Worst #1 0% 19 Worst #2 25% 20 21 $200 Cash Flow at End of Period 0 1 2 3 4 -$1,000 $400 $600 $800 $1,300 -$1,000 $400 $500 $600 $1,000 -$280 -$280 -$280 --$280 -$1,000 -$280 $200 $0 $0 Expected NPV Standard Deviation (c) Coefficient of Variation = CV = 0 / Expected NPV 10% $1,348 $298 - $1,888 Don't -$1,089 Us $214 $866 4.05 22 23 24 Part III. Value of the Option 25 Expected NPV with the abandonment option Expected NPV without the abandonment option $214 26 $14 27 CASE 1: If the expected NPV without the abandonment option is positive, then Expected NPV with Expected NPV without Value of the Option = the abandonment the abandonment 28 option option $200 29 30 CASE 2: If the expected NPV without the abandonment option is negative, then Expected NPV with Value of the Option = the abandonment 0 31 option 32 Note: If a negative NPV project does not have an abandonment option, then it would not be undertaken. In these cases, the expected NPV without the abandonment option is zero. 33 34 35 VALUE OF OPTION = $200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started