Question

Further Information: Let us perform a break-even analysis. For the sake of simplicity, let us say that customers buy one drink for every two sandwiches,

Further Information:

Let us perform a break-even analysis. For the sake of simplicity, let us say that customers buy one drink for every two sandwiches, and that the former will be priced at a relatively inflexible $2.99. If we aim to receive a total profit of ~$50,000 with a sandwich price of $7.45, we will need to receive around 120,000 orders per year. Sales revenues would stand at $1,073,400 (global market share of 0.0068%). Considering our low prices, extensive promotional campaign, and advantageous location, it might not be an unreachable objective, especially considering our very conservative fixed costs and the low global market share that we would need to capture. To break-even, we would need to receive just around 100,000 orders per year (revenues of $894,500 and global market share of 0.0057%).

What is the net present value, future value, sales/ revenue for the next 6 years and all the other calculation to make a very detailed and precised finance analysis and recommendations for Ms Finn Ance Major?

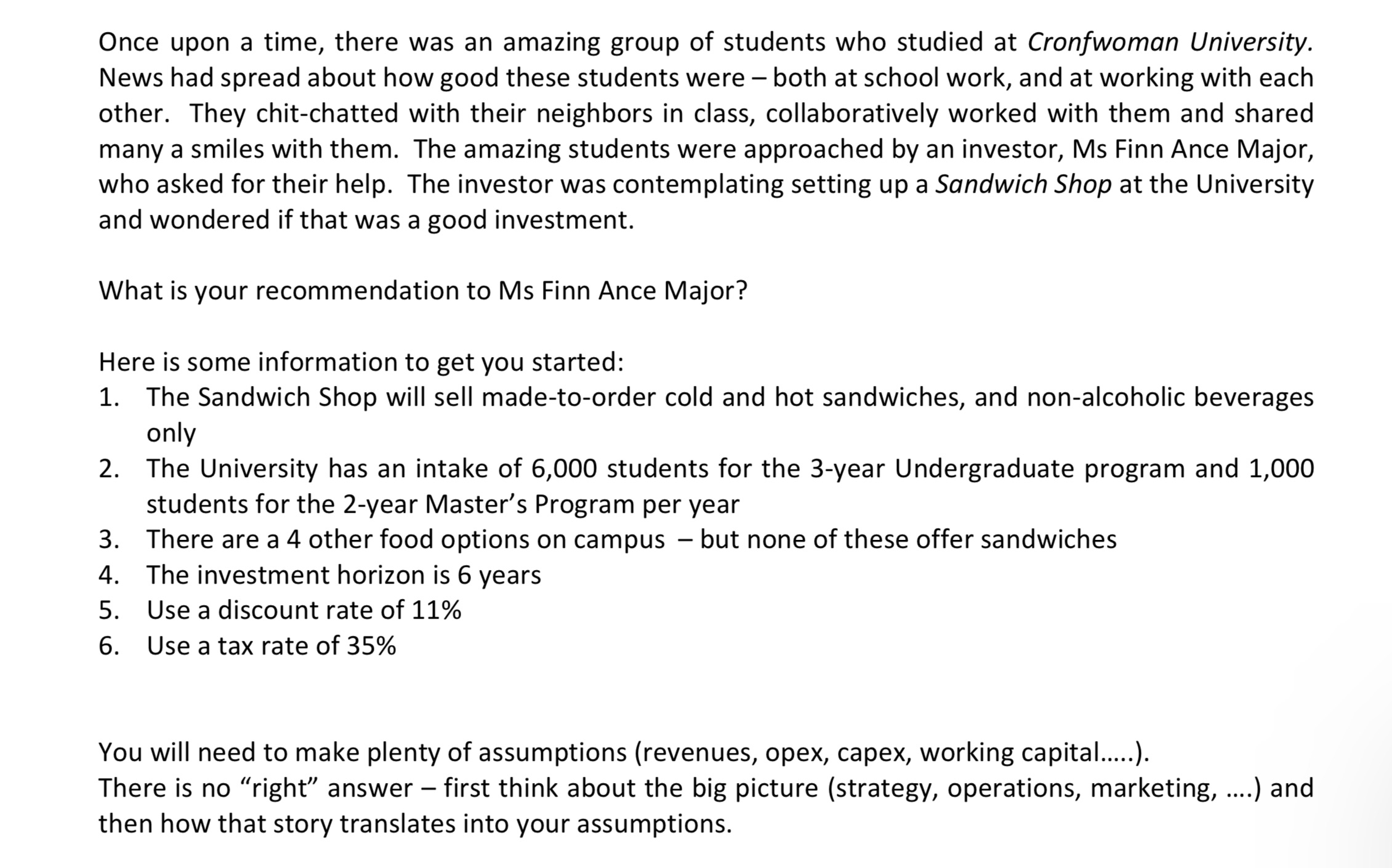

Once upon a time, there was an amazing group of students who studied at Cronfwoman University. News had spread about how good these students were - both at school work, and at working with each other. They chit-chatted with their neighbors in class, collaboratively worked with them and shared many a smiles with them. The amazing students were approached by an investor, Ms Finn Ance Major, who asked for their help. The investor was contemplating setting up a Sandwich Shop at the University and wondered if that was a good investment. What is your recommendation to Ms Finn Ance Major? Here is some information to get you started: 1. The Sandwich Shop will sell made-to-order cold and hot sandwiches, and non-alcoholic beverages only 2. The University has an intake of 6,000 students for the 3-year Undergraduate program and 1,000 students for the 2-year Master's Program per year There are a 4 other food options on campus - but none of these offer sandwiches 3. 4. The investment horizon is 6 years 5. Use a discount rate of 11% 6. Use a tax rate of 35% You will need to make plenty of assumptions (revenues, opex, capex, working capital.....). There is no right answer first think about the big picture (strategy, operations, marketing, ....) and then how that story translates into your assumptions.

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Here is my recommendation and financial analysis for Ms Finn Ance Majors proposed sandwich shop inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started