Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Futhi Supplies is a company involved in the transport of produce from WaZulu-Natal to the Johannesburg metropolitan area. The company operates six refrigerated trucks.

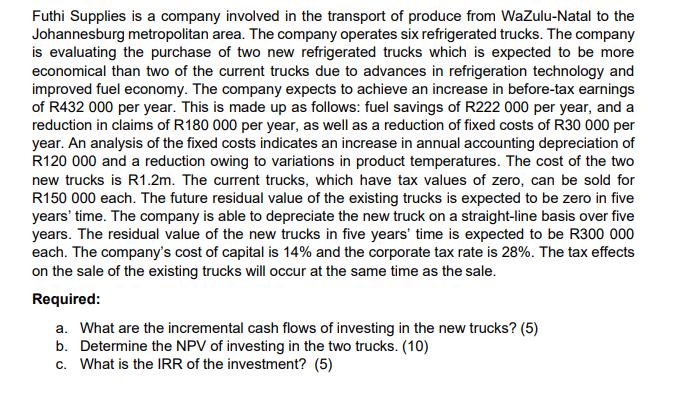

Futhi Supplies is a company involved in the transport of produce from WaZulu-Natal to the Johannesburg metropolitan area. The company operates six refrigerated trucks. The company is evaluating the purchase of two new refrigerated trucks which is expected to be more economical than two of the current trucks due to advances in refrigeration technology and improved fuel economy. The company expects to achieve an increase in before-tax earnings of R432 000 per year. This is made up as follows: fuel savings of R222 000 per year, and a reduction in claims of R180 000 per year, as well as a reduction of fixed costs of R30 000 per year. An analysis of the fixed costs indicates an increase in annual accounting depreciation of R120 000 and a reduction owing to variations in product temperatures. The cost of the two new trucks is R1.2m. The current trucks, which have tax values of zero, can be sold for R150 000 each. The future residual value of the existing trucks is expected to be zero in five years' time. The company is able to depreciate the new truck on a straight-line basis over five years. The residual value of the new trucks in five years' time is expected to be R300 000 each. The company's cost of capital is 14% and the corporate tax rate is 28%. The tax effects on the sale of the existing trucks will occur at the same time as the sale. Required: a. What are the incremental cash flows of investing in the new trucks? (5) b. Determine the NPV of investing in the two trucks. (10) c. What is the IRR of the investment? (5)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Incremental cash flows of investing in new trucks Year 0 Cash outflow on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started