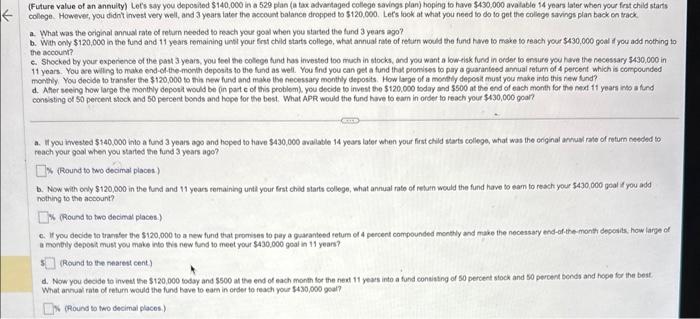

(Future value of an annuity) Lets say you deposined $140,000 in a 529 plan (a tax atvaritaged college savings plan) hoping fo havo $430.000 avatable 14 years later when your fent child starts college. However, you didnt invest very well, and 3 years later the account balance dropped to $120,000. Lers look at what you need to do lo get the collegs savings plan back on tack a. What was the original annual rate of return needed to resch your goal when you started the fund 3 years ago? b. When only $120,000 in the fund and 11 years remaining unt your frst child starts collego, what annual fate of retarn would the fund have to moke to reach your $430,000 goal I you add nothing to the accoun? c. Shocked by your expenence of the past 3 years, you fool the colege fund has invested too much in utocks, and you want a low-tisk fund in order to ensure you have the necessary 5430,000 in 11 years. You are wiling to make end-of the month deposits to the fund as well. You lind you can get a fund that ptonsies to pay a guaranteed annual return of 4 percent which is compounded monthly You decde to transter the $120,000 to thin pew fund and make the necessary monthly deposits. How large of a moeety deposit must you make into this new fund? d. Athor seeing how large the monthly depont would be (in part of this probloml you decide to invest the $120,000 today and $500 at the end of each month for the ned fif years ino a find consisting of $0 percent stock and 50 percent bends and hepe for the best. What APR would the fund have to eam in order to reach your $430,000 gool? a. If you kwested $140,000 ialo a fund 3 years ago and hoped to have $430,000 avalatle 14 years later when your fint child starts college, what was the coiginal arriak rase of return eeeded to reach your goal when you started the fund 3 years ago? (Round to two desimal places) b. Now with ony $120,000 in the fund and 11 years remaining untl your trst chid starts colloge, what annual note of relurn would the fund have to eam to resch your $430,000 goal if you add nothing to the acoount? (Round to two decimal places.) C. If you deoide to tranker the $120.000 to a new fund that promises to pay a guapanteed teturn of 4 pencent compounded monthly and make the nocessary end-of the month desolits. hew large of a monoily depost must you make into tis new tund to meet your $430.000 goal in 11 yeans? (Round to the neared cent) d. Now you decide to inveet the $120,000 today and 5500 at the end of each month for the nent 11 years into a fund contisting of 50 percent siock and so peroent bonds and hoge for the best. What annual rate of elum would the fund hove to eam in order to feach your $430,000 goal? (Round to two decimal places.)