Answered step by step

Verified Expert Solution

Question

1 Approved Answer

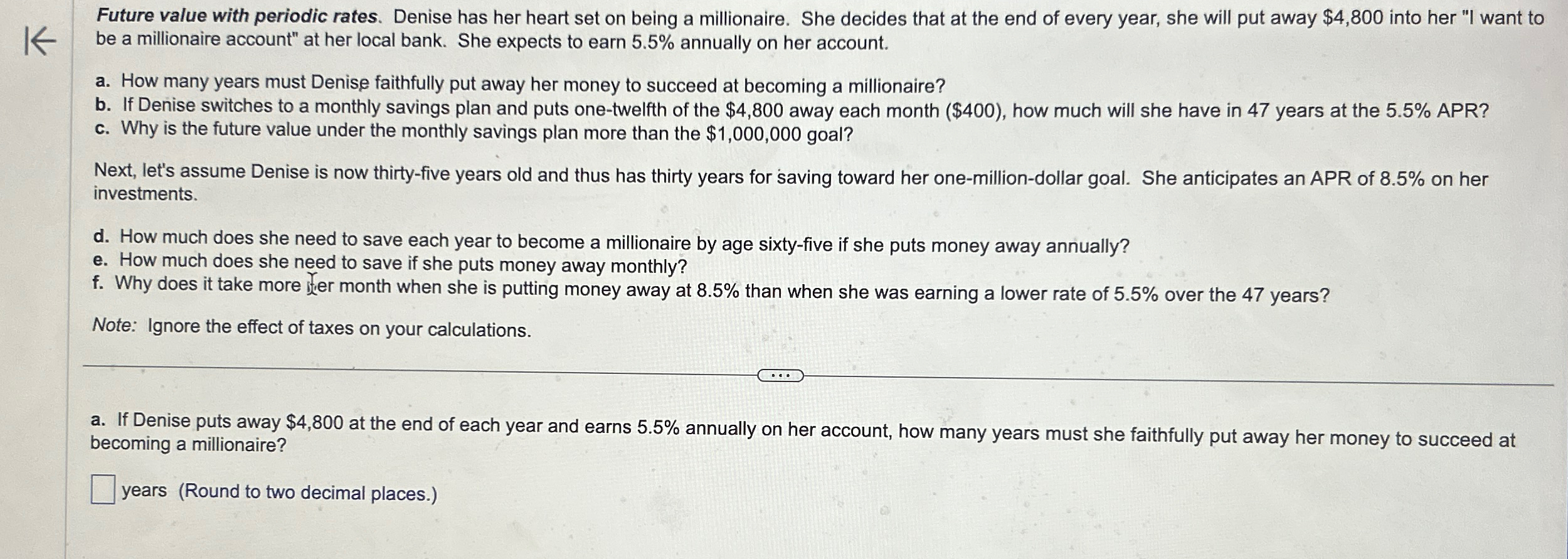

Future value with periodic rates. Denise has her heart set on being a millionaire. She decides that at the end of every year, she will

Future value with periodic rates. Denise has her heart set on being a millionaire. She decides that at the end of every year, she will put away $ into her "I want to be a millionaire account" at her local bank. She expects to earn annually on her account.

a How many years must Denise faithfully put away her money to succeed at becoming a millionaire?

b If Denise switches to a monthly savings plan and puts onetwelfth of the $ away each month $ how much will she have in years at the APR?

c Why is the future value under the monthly savings plan more than the $ goal?

Next, let's assume Denise is now thirtyfive years old and thus has thirty years for saving toward her onemilliondollar goal. She anticipates an APR of on her investments.

d How much does she need to save each year to become a millionaire by age sixtyfive if she puts money away annually?

e How much does she need to save if she puts money away monthly?

f Why does it take more fier month when she is putting money away at than when she was earning a lower rate of over the years?

Note: Ignore the effect of taxes on your calculations.

a If Denise puts away $ at the end of each year and earns annually on her account, how many years must she faithfully put away her money to succeed at becoming a millionaire?

years Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started