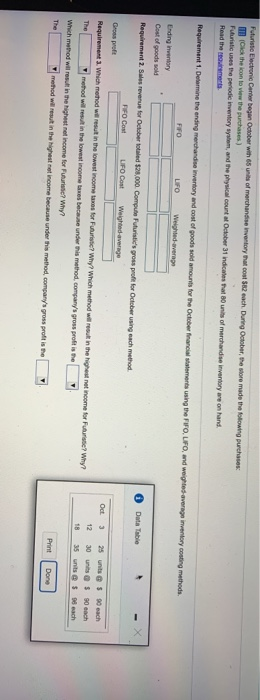

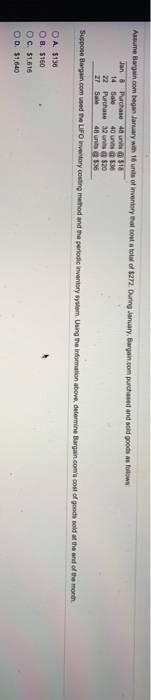

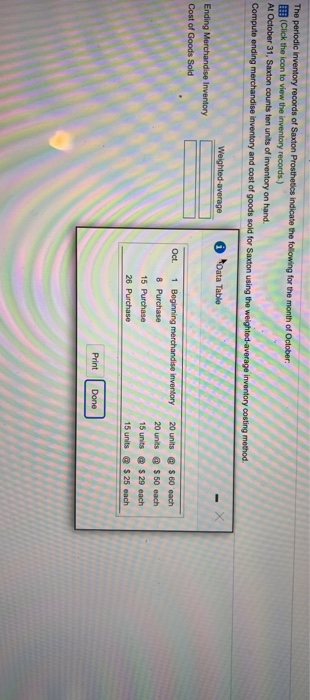

Futuristic Electronic Center began October with 65 of merchandise inventory that cost $82 each. During October, the store made the flowing purchase Co the con lo view the purchases) Futuristic uses the periodic inventory system, and the physical count at Odober 31 indicates that units of merchandise inventory are on hand Read the recents Requirement 1. Determine the ending merchandise inventory and cost of goods sold amounts for the October financ e ments in the FIFO UFO, and weideverage inventory Song s 0 Data Table Ending Inventory Cost of goods sold Requirement 2. Sales revenue for October totaled $28.000 Computer 's gross profit for October using each method FIFO Cost UFO Cost Weighted average Gross proft Requirement. Which method will result in the lowest income for Futuristic? Why? Which method will result in the highest income for Fr The method will result in the lowest income taxes because under this method company's gross profit is the Which method will result in the highest ret income for F re? Why? The method will put in the highest net income because under this method company's grootte Oct e? Why? 3 25 units @ $90 each 1230 @ $ 90 each 18 35 nits@ $ 9 each Print Done Assumeiwgain.com began January with 16 units of inventory that cost a total of $272. During January, Bargain.com purchased and sold goods as follows: Jan & Purchase 48 units 518 14 Sale 40 $36 22 Purchase 32 2 0 27 Sale 48 units Suppose llargain.com used the LIFO inventory cosing method and the periodic inventory system. Using the information above, determine Bargain.com's cost of goods sold at the end of the month O A. $138 OB. $160 OC. $1,616 OD $1.640 The periodic inventory records of Saxton Prosthetics indicate the following for the month of October III (Click the icon to view the inventory records.) At October 31, Saxton counts ten units of inventory on hand. Compute ending merchandise inventory and cost of goods sold for Saxton using the weighted average inventory costing metho Weighted average 0 Oata Table Ending Merchandise Inventory Cost of Goods Sold Oct. 1 Beginning merchandise 8 Purchase 15 Purchase 26 Purchase 20 units @ $ 60 each 20 units @ $50 each 15 units @ $ 29 each 15 units @ $ 25 each Print Done