Answered step by step

Verified Expert Solution

Question

1 Approved Answer

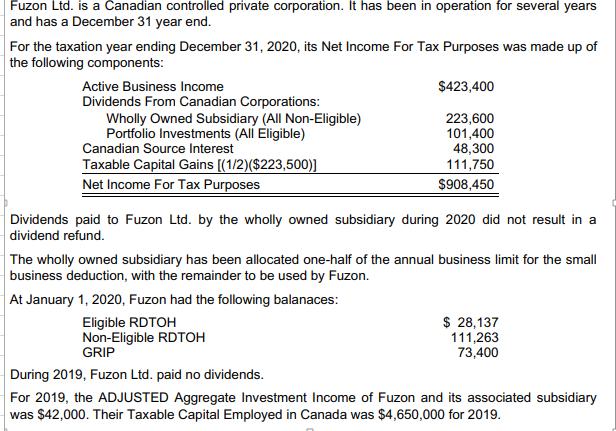

Fuzon Ltd. is a Canadian controlled private corporation. It has been in operation for several years and has a December 31 year end. For

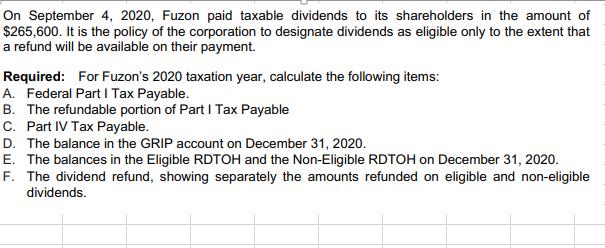

Fuzon Ltd. is a Canadian controlled private corporation. It has been in operation for several years and has a December 31 year end. For the taxation year ending December 31, 2020, its Net Income For Tax Purposes was made up of the following components: Active Business Income $423,400 Dividends From Canadian Corporations: 223,600 101,400 Wholly Owned Subsidiary (All Non-Eligible) Portfolio Investments (All Eligible) Canadian Source Interest Taxable Capital Gains [(1/2)($223,500)] 48,300 111,750 Net Income For Tax Purposes $908,450 Dividends paid to Fuzon Ltd. by the wholly owned subsidiary during 2020 did not result in a dividend refund. The wholly owned subsidiary has been allocated one-half of the annual business limit for the small business deduction, with the remainder to be used by Fuzon. At January 1, 2020, Fuzon had the following balanaces: Eligible RDTOH Non-Eligible RDTOH GRIP $ 28,137 111,263 73,400 During 2019, Fuzon Ltd. paid no dividends. For 2019, the ADJUSTED Aggregate Investment Income of Fuzon and its associated subsidiary was $42,000. Their Taxable Capital Employed in Canada was $4,650,000 for 2019. On September 4, 2020, Fuzon paid taxable dividends to its shareholders in the amount of $265,600. It is the policy of the corporation to designate dividends as eligible only to the extent that a refund will be available on their payment. Required: For Fuzon's 2020 taxation year, calculate the following items: A. Federal Part I Tax Payable. B. The refundable portion of Part I Tax Payable C. Part IV Tax Payable. D. The balance in the GRIP account on December 31, 2020. E. The balances in the Eligible RDTOH and the Non-Eligible RDTOH on December 31, 2020. F. The dividend refund, showing separately the amounts refunded on eligible and non-eligible dividends.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A Federal Part I Tax Payable 423400 B The refundable portion of Part I Tax Payable 423400 C Part IV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started