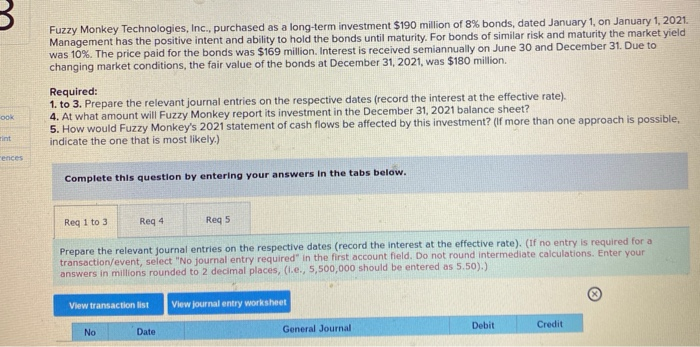

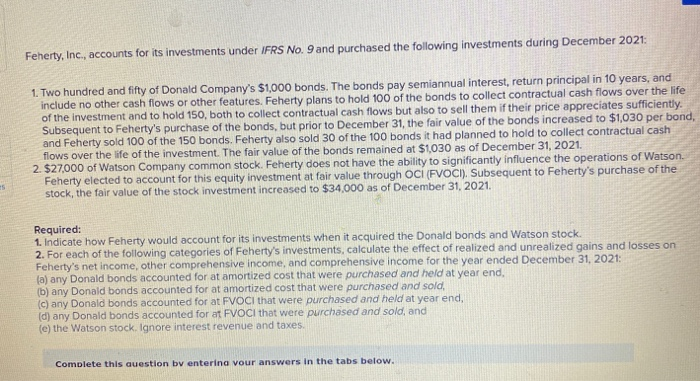

Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $190 million of 8% bonds, dated January 1, on January 1, 2021 Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $169 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2021, was $180 million. Required: 1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). 4. At what amount will Fuzzy Monkey report its investment in the December 31, 2021 balance sheet? 5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment? (if more than one approach is possible, indicate the one that is most likely.) OOK int -ences Complete this question by entering your answers in the tabs below. Reg 1 to 3 Reg 4 Reg 5 Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places, (1.e., 5,500,000 should be entered as 5.50).) View transaction list View journal entry worksheet Debit No Credit General Journal Date Feherty, Inc., accounts for its investments under IFRS No. 9 and purchased the following investments during December 2021: 1. Two hundred and fifty of Donald Company's $1,000 bonds. The bonds pay semiannual interest, return principal in 10 years, and include no other cash flows or other features. Feherty plans to hold 100 of the bonds to collect contractual cash flows over the life of the investment and to hold 150, both to collect contractual cash flows but also to sell them if their price appreciates sufficiently. Subsequent to Feherty's purchase of the bonds, but prior to December 31, the fair value of the bonds increased to $1,030 per bond, and Feherty sold 100 of the 150 bonds. Feherty also sold 30 of the 100 bonds it had planned to hold to collect contractual cash flows over the life of the investment. The fair value of the bonds remained at $1030 as of December 31, 2021. 2. $27,000 of Watson Company common stock. Feherty does not have the ability to significantly influence the operations of Watson Feherty elected to account for this equity investment at fair value through OC (FVOCI). Subsequent to Feherty's purchase of the stock, the fair value of the stock investment increased to $34,000 as of December 31, 2021. Required: 1. Indicate how Feherty would account for its investments when it acquired the Donald bonds and Watson stock. 2. For each of the following categories of Feherty's investments, calculate the effect of realized and unrealized gains and losses on Feherty's net income, other comprehensive income, and comprehensive income for the year ended December 31, 2021: (a) any Donald bonds accounted for at amortized cost that were purchased and held at year end. (b) any Donald bonds accounted for at amortized cost that were purchased and sold, (c) any Donald bonds accounted for at FVOCI that were purchased and held at year end, (d) any Donald bonds accounted for at FVOCI that were purchased and sold, and (e) the Watson stock. Ignore interest revenue and taxes. Complete this question by entering vour answers in the tabs below