Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A company received a loan of $24,000 from a bank that was charging interest at a rate of 3.03% compounded quarterly. a. Calculate

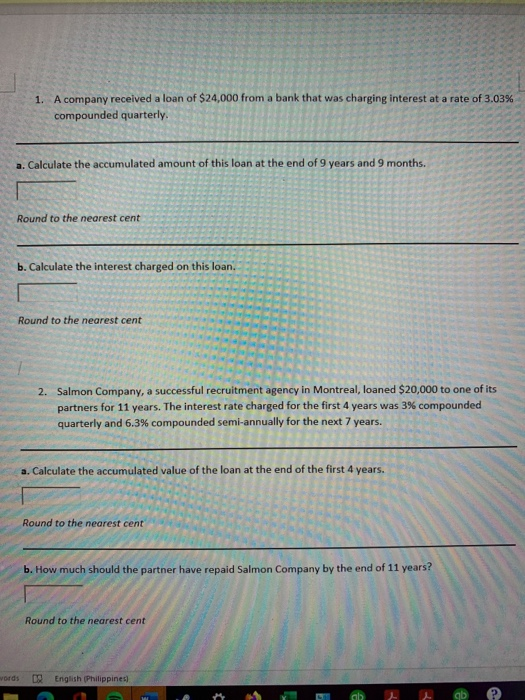

1. A company received a loan of $24,000 from a bank that was charging interest at a rate of 3.03% compounded quarterly. a. Calculate the accumulated amount of this loan at the end of 9 years and 9 months. Round to the nearest cent b. Calculate the interest charged on this loan. Round to the nearest cent 2. Salmon Company, a successful recruitment agency in Montreal, loaned $20,000 to one of its partners for 11 years. The interest rate charged for the first 4 years was 3% compounded quarterly and 6.3% compounded semi-annually for the next 7 years. a. Calculate the accumulated value of the loan at the end of the first 4 years. Round to the nearest cent b. How much should the partner have repaid Salmon Company by the end of 11 years? Round to the nearest cent DQ English (Philippines) words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Amount of loan 24000 Interest rate 303 312 07575 Per quarter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started