Answered step by step

Verified Expert Solution

Question

1 Approved Answer

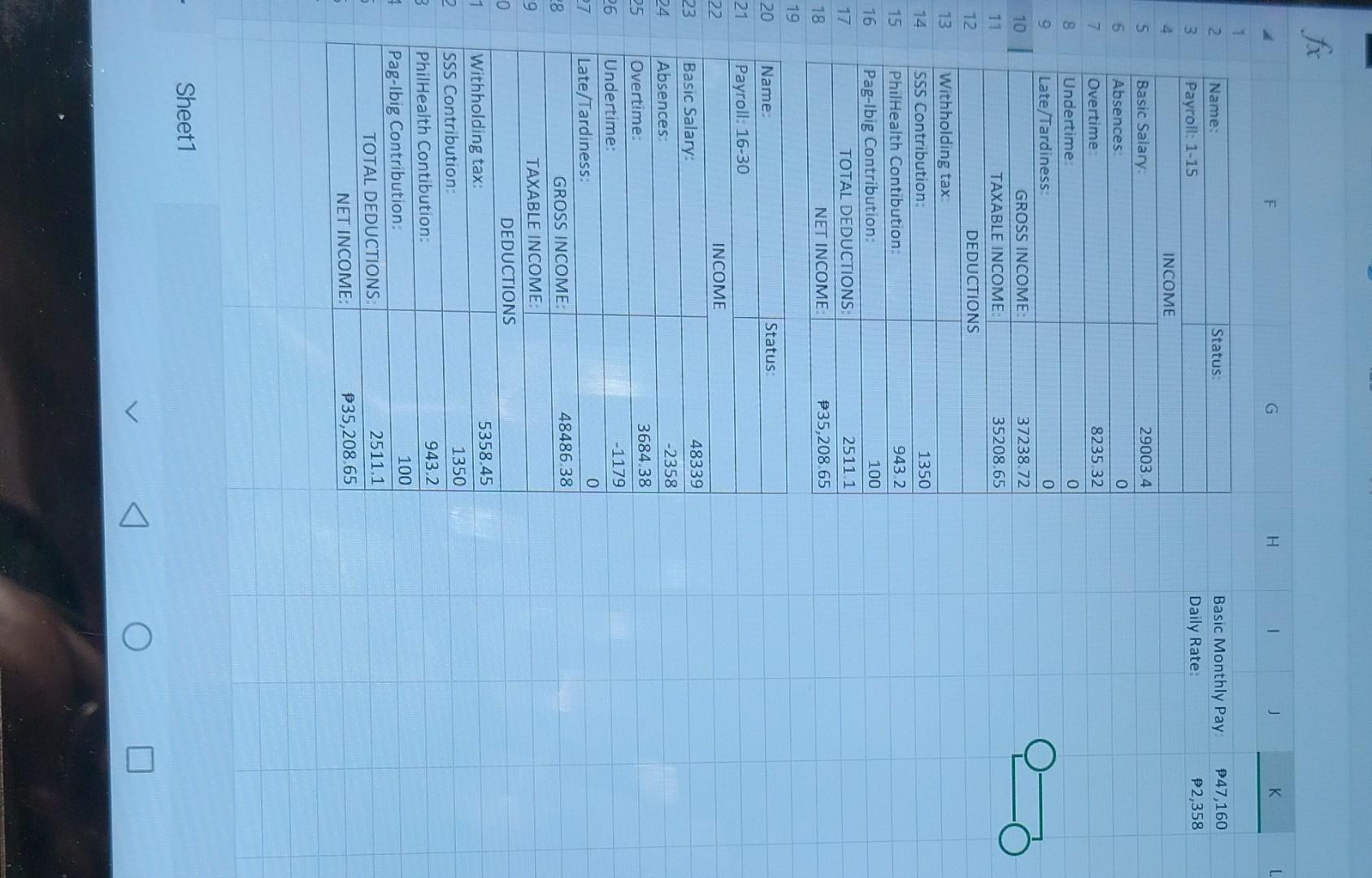

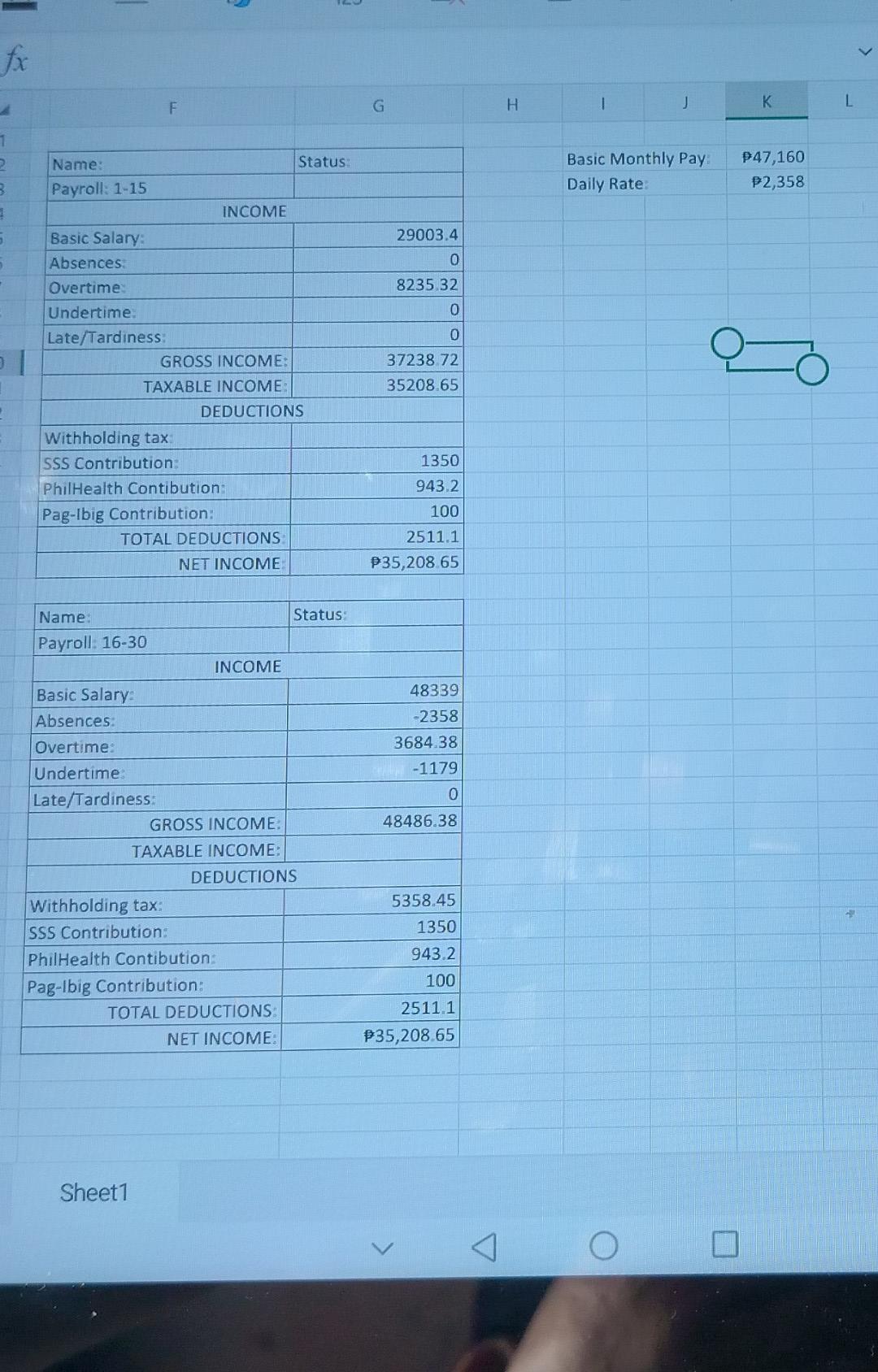

fx begin{tabular}{|c|c|} hline F & G hline Name: & Status: hline Payroll: 115 & hline multicolumn{2}{|l|}{ INCOME } hline Basic Salary:

fx \begin{tabular}{|c|c|} \hline F & G \\ \hline Name: & Status: \\ \hline Payroll: 115 & \\ \hline \multicolumn{2}{|l|}{ INCOME } \\ \hline Basic Salary: & 29003.4 \\ \hline Absences: & 0 \\ \hline Overtime: & 8235.32 \\ \hline Undertime: & 0 \\ \hline Late/Tardiness: & 0 \\ \hline GROSS INCOME: & 37238.72 \\ \hline TAXABLE INCOME: & 35208.65 \\ \hline \multicolumn{2}{|l|}{ DEDUCTIONS } \\ \hline \multicolumn{2}{|l|}{ Withholding tax } \\ \hline SSS Contribution: & 1350 \\ \hline PhilHealth Contibution: & 943.2 \\ \hline Pag-Ibig Contribution: & 100 \\ \hline TOTAL DEDUCTIONS & 2511.1 \\ \hline NET INCOME: & P35,208.65 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Name: & Status: \\ \hline Payroll: 1630 & \\ \hline \multicolumn{2}{|l|}{ INCOME } \\ \hline Basic Salary: & 48339 \\ \hline Absences: & -2358 \\ \hline Overtime: & 3684.38 \\ \hline Undertime: & -1179 \\ \hline Late/Tardiness: & 0 \\ \hline GROSS INCOME: & 48486.38 \\ \hline TAXABLE INCOME: & \\ \hline \multicolumn{2}{|l|}{ DEDUCTIONS } \\ \hline Withholding tax: & 5358.45 \\ \hline SSS Contribution: & 1350 \\ \hline PhilHealth Contibution: & 943.2 \\ \hline Pag-Ibig Contribution: & 100 \\ \hline TOTAL DEDUCTIONS: & 2511.1 \\ \hline NET INCOME: & 335,208.65 \\ \hline \end{tabular} Sheet1 fx \begin{tabular}{|c|c|} \hline F & G \\ \hline Name: & Status: \\ \hline Payroll: 115 & \\ \hline \multicolumn{2}{|l|}{ INCOME } \\ \hline Basic Salary: & 29003.4 \\ \hline Absences: & 0 \\ \hline Overtime: & 8235.32 \\ \hline Undertime: & 0 \\ \hline Late/Tardiness: & 0 \\ \hline GROSS INCOME: & 37238.72 \\ \hline TAXABLE INCOME: & 35208.65 \\ \hline \multicolumn{2}{|l|}{ DEDUCTIONS } \\ \hline \multicolumn{2}{|l|}{ Withholding tax } \\ \hline SSS Contribution: & 1350 \\ \hline PhilHealth Contibution: & 943.2 \\ \hline Pag-Ibig Contribution: & 100 \\ \hline TOTAL DEDUCTIONS & 2511.1 \\ \hline NET INCOME: & P35,208.65 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Name: & Status: \\ \hline Payroll: 1630 & \\ \hline \multicolumn{2}{|l|}{ INCOME } \\ \hline Basic Salary: & 48339 \\ \hline Absences: & -2358 \\ \hline Overtime: & 3684.38 \\ \hline Undertime: & -1179 \\ \hline Late/Tardiness: & 0 \\ \hline GROSS INCOME: & 48486.38 \\ \hline TAXABLE INCOME: & \\ \hline \multicolumn{2}{|l|}{ DEDUCTIONS } \\ \hline Withholding tax: & 5358.45 \\ \hline SSS Contribution: & 1350 \\ \hline PhilHealth Contibution: & 943.2 \\ \hline Pag-Ibig Contribution: & 100 \\ \hline TOTAL DEDUCTIONS: & 2511.1 \\ \hline NET INCOME: & 335,208.65 \\ \hline \end{tabular} Sheet1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started