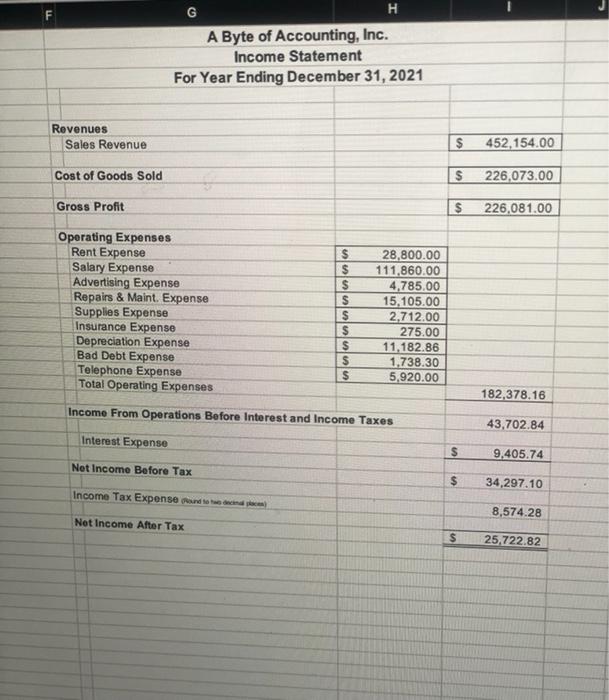

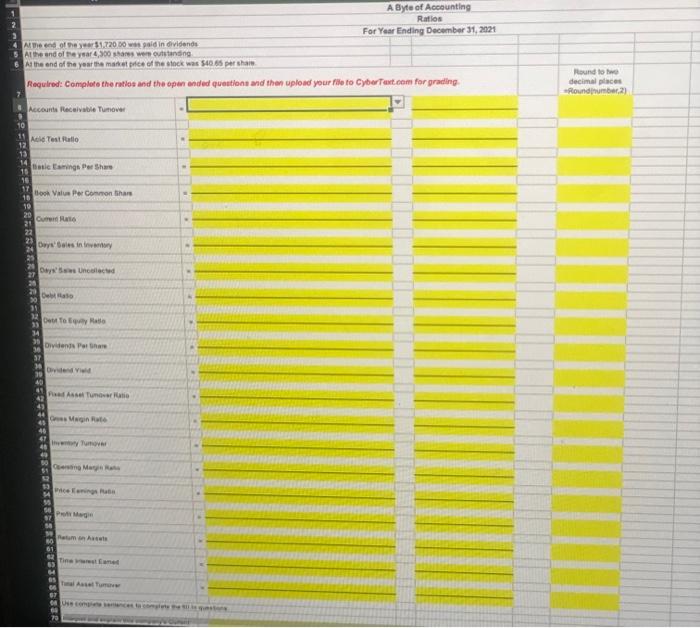

fx L N M H A Byte of Accounting Balance Sheet As of December 31, 2021 Assets $ 524,568.50 $ 34,406.00 1.720.30 Current Assets Cash Accounts Receivable Allowance for Doubtful Accounts Net Receivable Prepaid Insurance Prepaid Rent Office Supplies Inventory Total Current Assets Long-Term Assets Office Equipment Accum. Depr.-Office Equipment Net Office Equipment Computer Equipment Accum. Depr.-Computer Equipment Net Computer Equipment Total Long-Term Assets Total Assets 32,685.70 6,325.00 2.400.00 638.00 559.00 3567176 20 $ 71,900.00 12,882.88 $ 59,017.14 $ 23,500.00 9,400.00 14,100.00 73,117.14 5640/29234 Labilities Current abilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total Current-Liabilities $ 21,157.00 8,965.00 21.60 1.410.00 8,574.28 $ 40,127.88 $ 4,320.00 Long-Term Liabilities Notes Payable Bond Payable Premium on Bond Payable Net Bond Payable Total Long-Term Liabilities Total Liabilities $ 150,000.00 10,042.64 160,042.64 164 362.54 $ 204,490.52 Stockholder's Equity Capital Stock 4,300 shares $0.01 par value Paid in Capital in Excess of Par Putained Earnings Total Stockholder's Equity 5 43.00 387.757.00 48.002.82 435,802.82 7 Total abilities and Stockholder's Equity S540.293 34 19 30 F H A Byte of Accounting, Inc. Income Statement For Year Ending December 31, 2021 $ Revenues Sales Revenue $ 452,154.00 Cost of Goods Sold $ 226,073.00 Gross Profit $ 226,081.00 $ $ $ S lulu Operating Expenses Rent Expense Salary Expense Advertising Expense Repairs & Maint. Expense Supplies Expense Insurance Expense Depreciation Expense Bad Debt Expense Telephone Expense Total Operating Expenses olololololo 28,800.00 111,860.00 4,785.00 15,105.00 2,712.00 275.00 11,182.86 1,738.30 5,920.00 $ $ $ $ 182,378.16 Income From Operations Before Interest and Income Taxes 43,702.84 Interest Expense $ 9,405.74 Net Income Before Tax $ $ 34,297.10 Income Tax Expense que en 8,574.28 Net Income After Tax $ 25,722.82 Ratio Accounts Receivable Turnover Acid Test Ratio Basic Earnings Per Shore Book Value Per Common Share Current Ratio Days Sales In Inventory Days Scies Uncollected Debt Ratio Debt To Equity Ratio Duidend Yield Dividends Per Share Fred Asset Tumover Ratio Gross Margin Ratio Inventory Tumaver Operating Mergin Ratio Price Earnings Ratio Profil Marger Matamon Assets Time interest Earned Total Aut Turnover Formula = Net Sales Net Accounts Receivable Not Accounts Receivable Account Receivable Allowance for Doutiful Accounts (Cash Cash Equivalents + Short Term Investments Current Receivables) / Current Liabilities (Net Income - Preferred Dividende) Number of Common Share Outstanding Stockholder Equity Applicable To Common Share Number of Common Share Outstanding Current Assets / Current Liabilities (Ending Inventory X365) / Cost of Goods Sold (Accounts Receivable x 365) / Not Sales Total abities Total Assets Total Liabilities/Total Equity Annual Cash Dividends Per Share / Market Value Per Share Annual Cash Dividends/ Number of Common Shares Outstanding Net Income Net Fed Assets ed Foder - Cross Profit Net Sales -Coat of Goods Sold/inventory Income From Operacions Before Interest and income Taxes / Net Sales Market Price Per Share/Earnings Per Share Not Income Net Sales - Not Income / Total Assets Income Before interest Expense And Income Tax / Interest Expense Not Sales/Total Assets Round to decimal places Roundnumber,2) A Byte of Accounting Ratios For Year Ending December 31, 2021 Me end of the year 1.720 00 was paid in dividends At the end of the year 4,500 shares were outstanding At the end of the year the materice of the stock was $40.65 pershan Required: Complete the ration and the open ended questions and then upload your file to Cyber Test.com for grading, Accounts Receivable Tumover 10 1. cle Tostale 12 13 14 Basic Caming Perhe 10 16 17 10 och Value Per Common has 10 20 Quran 22 23 24 Dwyies in Days Unclected Delo De Toy Radio Dividends Portare Die Ass Tuner Mint hu en My wice em Ant tine 70