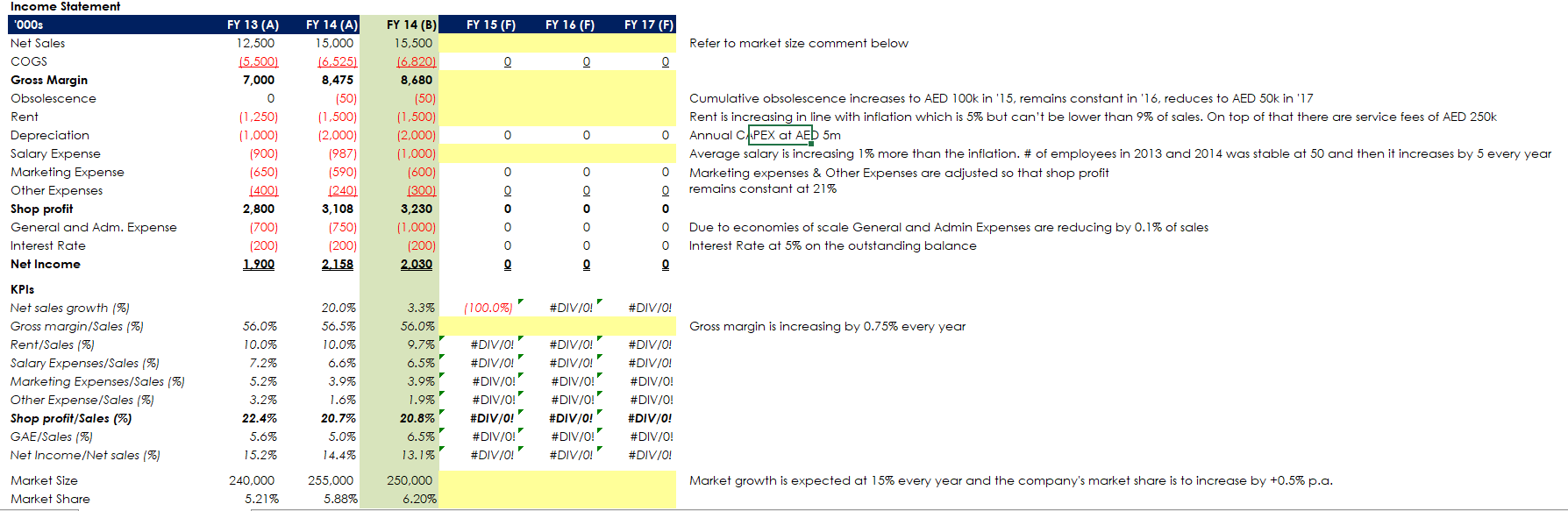

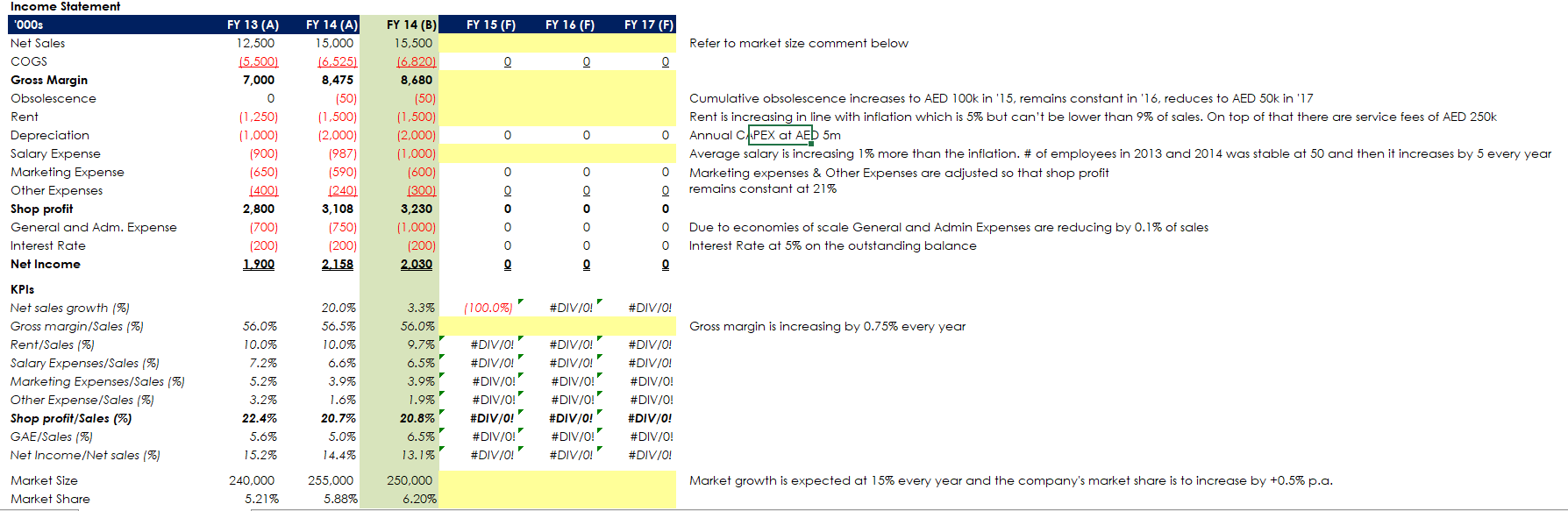

FY 15 (F) FY 16 (F) FY 17 (F) Refer to market size comment below FY 13(A) 12,500 (5,500) 7,000 0 0 0 Income Statement '000s Net Sales COGS Gross Margin Obsolescence Rent Depreciation Salary Expense Marketing Expense Other Expenses Shop profit General and Adm. Expense Interest Rate Net Income 0 0 0 FY 14 (A) 15,000 16,525) 8,475 (50) (1,500) (2.000) 1987) (590) (240) 3,108 (750) (200) 2.158 (1,250) (1,000) (900) (650) (400) 2,800 (700) (200) 1.900 FY 14 (1) 15,500 16,820) 8,680 (50) (1,500) (2.000) (1,000) (600) (300) 3,230 (1,000) (200) 2.030 Cumulative obsolescence increases to AED 100k in '15, remains constant in '16, reduces to AED 50k in '17 Rent is increasing in line with inflation which is 5% but can't be lower than 9% of sales. On top of that there are service fees of AED 250k Annual CAPEX at AED 5m Average salary is increasing 1% more than the inflation. # of employees in 2013 and 2014 was stable at 50 and then it increases by 5 every year Marketing expenses & Other Expenses are adjusted so that shop profit remains constant at 21% O O O O OOO O O Oll O 0 O Due to economies of scale General and Admin Expenses are reducing by 0.1% of sales Interest Rate at 5% on the outstanding balance O Oll 1100.0%)' #DIV/0!' #DIV/0! 3.3% 56.0% Gross margin is increasing by 0.75% every year 0.7% #DIV/0! #DIV/0! KPIs Net sales growth (%) Gross margin/Sales (%) Rent/Sales (%) Salary Expenses/Sales (%) Marketing Expenses/Sales %) Other Expense/Sales (%) Shop profit/Sales (%) GAE/Sales (%) Net Income/Net sales (%) Market Size Market Share 56.0% 10.0% 7.2% 5.2% 3.2% 22.4% 5.6% 15.2% 20.0% 56.5% 10.0% 6.6% 3.9% 1.6% 20.7% 5.0% 14.4% #DIV/0!' #DIV/0! #DIV/0!' #DIV/0!' #DIV/0! #DIV/0! #DIV/0!' #DIV/0!' #DIV/0!' 6.5% 3.9% 1.9% 20.8% 6.5% 13.1% 250,000 6.20% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!' #DIV/0!' #DIV/0!' Market growth is expected at 15% every year and the company's market share is to increase by +0.5% p.a. 240,000 5.21% 255,000 5.88% FY 15 (F) FY 16 (F) FY 17 (F) Refer to market size comment below FY 13(A) 12,500 (5,500) 7,000 0 0 0 Income Statement '000s Net Sales COGS Gross Margin Obsolescence Rent Depreciation Salary Expense Marketing Expense Other Expenses Shop profit General and Adm. Expense Interest Rate Net Income 0 0 0 FY 14 (A) 15,000 16,525) 8,475 (50) (1,500) (2.000) 1987) (590) (240) 3,108 (750) (200) 2.158 (1,250) (1,000) (900) (650) (400) 2,800 (700) (200) 1.900 FY 14 (1) 15,500 16,820) 8,680 (50) (1,500) (2.000) (1,000) (600) (300) 3,230 (1,000) (200) 2.030 Cumulative obsolescence increases to AED 100k in '15, remains constant in '16, reduces to AED 50k in '17 Rent is increasing in line with inflation which is 5% but can't be lower than 9% of sales. On top of that there are service fees of AED 250k Annual CAPEX at AED 5m Average salary is increasing 1% more than the inflation. # of employees in 2013 and 2014 was stable at 50 and then it increases by 5 every year Marketing expenses & Other Expenses are adjusted so that shop profit remains constant at 21% O O O O OOO O O Oll O 0 O Due to economies of scale General and Admin Expenses are reducing by 0.1% of sales Interest Rate at 5% on the outstanding balance O Oll 1100.0%)' #DIV/0!' #DIV/0! 3.3% 56.0% Gross margin is increasing by 0.75% every year 0.7% #DIV/0! #DIV/0! KPIs Net sales growth (%) Gross margin/Sales (%) Rent/Sales (%) Salary Expenses/Sales (%) Marketing Expenses/Sales %) Other Expense/Sales (%) Shop profit/Sales (%) GAE/Sales (%) Net Income/Net sales (%) Market Size Market Share 56.0% 10.0% 7.2% 5.2% 3.2% 22.4% 5.6% 15.2% 20.0% 56.5% 10.0% 6.6% 3.9% 1.6% 20.7% 5.0% 14.4% #DIV/0!' #DIV/0! #DIV/0!' #DIV/0!' #DIV/0! #DIV/0! #DIV/0!' #DIV/0!' #DIV/0!' 6.5% 3.9% 1.9% 20.8% 6.5% 13.1% 250,000 6.20% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!' #DIV/0!' #DIV/0!' Market growth is expected at 15% every year and the company's market share is to increase by +0.5% p.a. 240,000 5.21% 255,000 5.88%