Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FYW Co. makes model car toys. For its racer car model, the sales price is $140 each. The direct labor cost per model is

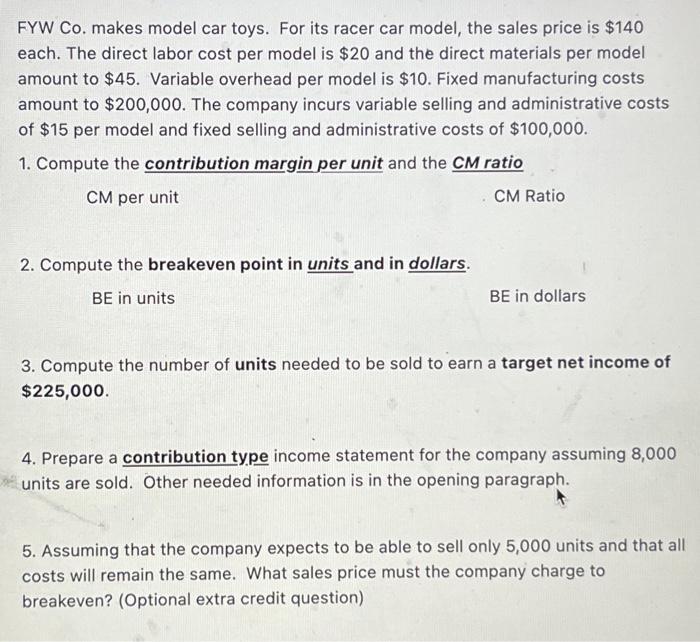

FYW Co. makes model car toys. For its racer car model, the sales price is $140 each. The direct labor cost per model is $20 and the direct materials per model amount to $45. Variable overhead per model is $10. Fixed manufacturing costs amount to $200,000. The company incurs variable selling and administrative costs of $15 per model and fixed selling and administrative costs of $100,000. 1. Compute the contribution margin per unit and the CM ratio CM per unit CM Ratio 2. Compute the breakeven point in units and in dollars. BE in units BE in dollars 3. Compute the number of units needed to be sold to earn a target net income of $225,000. 4. Prepare a contribution type income statement for the company assuming 8,000 units are sold. Other needed information is in the opening paragraph. 5. Assuming that the company expects to be able to sell only 5,000 units and that all costs will remain the same. What sales price must the company charge to breakeven? (Optional extra credit question)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Contribution Margin per Unit and CM Ratio Contribution Margin per Unit Sales Price per Unit Variable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started