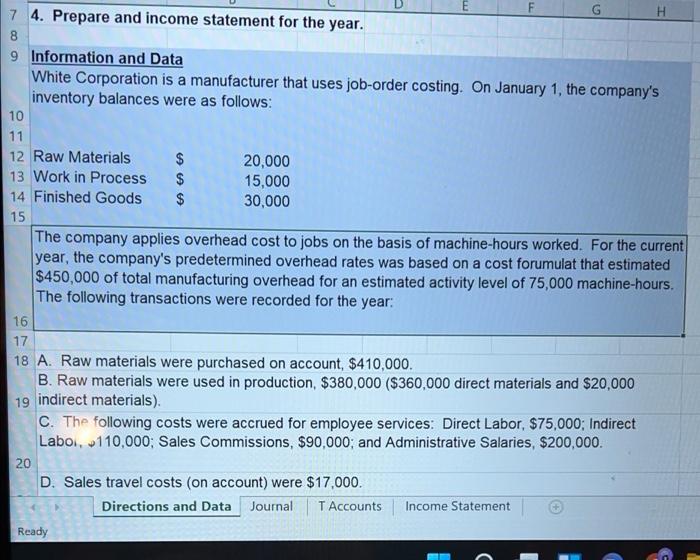

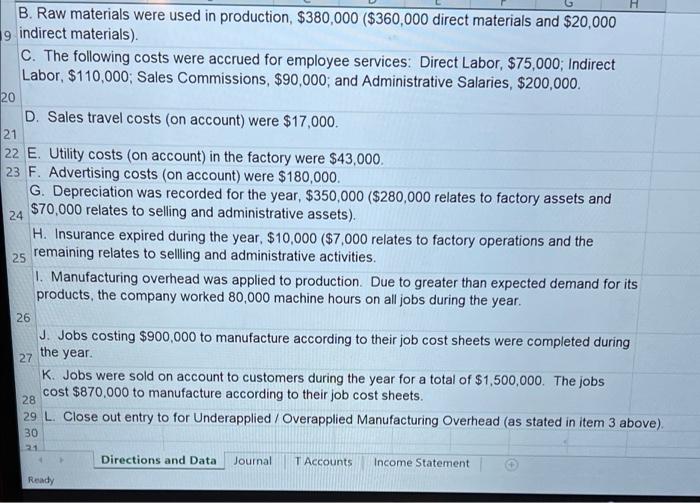

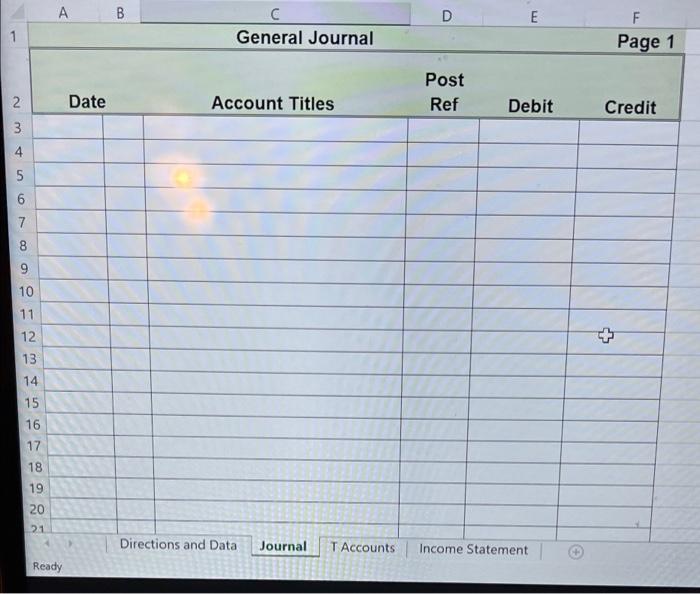

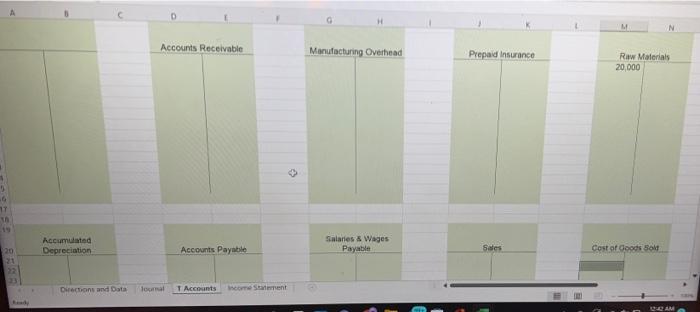

G A A A 7 4. Prepare and income statement for the year. 8 9 Information and Data White Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: 10 11 12 Raw Materials $ 20,000 13 Work in Process $ 15,000 14 Finished Goods $ 30,000 15 The company applies overhead cost to jobs on the basis of machine-hours worked. For the current year, the company's predetermined overhead rates was based on a cost forumulat that estimated $450,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. The following transactions were recorded for the year: 16 17 18 A. Raw materials were purchased on account, $410,000. B. Raw materials were used in production, $380,000 ($360,000 direct materials and $20,000 19 indirect materials). C. The following costs were accrued for employee services: Direct Labor, $75,000; Indirect Laboi, w110,000; Sales Commissions, $90,000; and Administrative Salaries, $200,000. 20 D. Sales travel costs on account) were $17,000. Directions and Data Journal T Accounts Income Statement Ready 24 B. Raw materials were used in production, $380,000 ($360,000 direct materials and $20,000 9 indirect materials). C. The following costs were accrued for employee services: Direct Labor, $75,000; Indirect Labor, $110,000: Sales Commissions, $90,000; and Administrative Salaries, $200,000. 20 D. Sales travel costs (on account) were $17,000. 21 22 E. Utility costs (on account) in the factory were $43,000. 23 F. Advertising costs on account) were $180,000 G. Depreciation was recorded for the year, $350,000 ($280,000 relates to factory assets and $70,000 relates to selling and administrative assets). H. Insurance expired during the year, $10,000 ($7,000 relates to factory operations and the 25 remaining relates to sellling and administrative activities. 1. Manufacturing overhead was applied to production. Due to greater than expected demand for its products, the company worked 80,000 machine hours on all jobs during the year. 26 J. Jobs costing $900,000 to manufacture according to their job cost sheets were completed during 27 K. Jobs were sold on account to customers during the year for a total of $1,500,000. The jobs cost $870,000 to manufacture according to their job cost sheets. 28 29 L Close out entry to for Underapplied / Overapplied Manufacturing Overhead (as stated in item 3 above). 30 the year. 21 Directions and Data Journal T Accounts Income Statement Ready A B D E E General Journal F Page 1 Post Ref 2 Date Account Titles Debit Credit 3 3 4 5 LO 6 7 7 8 9 10 11 + 12 13 14 15 16 17 18 19 20 21 Directions and Data Journal T Accounts Income Statement Ready D H M N Accounts Receivable Manufacturing Overhead Prepaid Insurance Raw Materials 20,000 5 6 17 hccumulated Depreciation Salaries & Wages Payable 20 Accounts Payable Sales Cost of Goods solt Directions and Data TAccounts Incoment AM J K L M N Sales Travel Exp Advertising Exp OTECTED VIEW Be careful_files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing x fx A D G H B Smith Corporation Income Statement For the Year Ended December 31 Note: You will use all lines on the formatted statement