Answered step by step

Verified Expert Solution

Question

1 Approved Answer

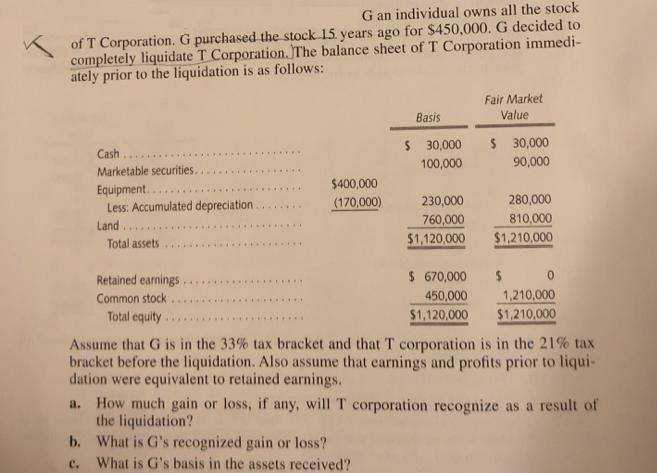

G an individual owns all the stock K of T Corporation. G purchased the stock 15. years ago for $450,000. G decided to completely

G an individual owns all the stock K of T Corporation. G purchased the stock 15. years ago for $450,000. G decided to completely liquidate T Corporation.The balance sheet of T Corporation immedi- ately prior to the liquidation is as follows: Fair Market Basis Value $ 30,000 $ 30,000 Cash 100,000 90,000 Marketable securities. $400,000 Equipment.. Less: Accumulated depreciation (170,000) 230,000 280,000 760,000 $1,120,000 810,000 $1,210,000 Land Total assets ........ $ 670,000 450,000 $1,120,000 2$ Retained earnings.. Common stock. Total equity ..... T 1,210,000 $1,210,000 ........ Assume that G is in the 33% tax bracket and that T corporation is in the 21% tax bracket before the liquidation. Also assume that earnings and profits prior to liqui- dation were equivalent to retained earnings. a. How much gain or loss, if any, will T corporation recognize as a result of the liquidation? b. What is G's recognized gain or loss? C. What is G's basis in the assets received?

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Liquidating Corp Equipment Securities Land Total Amount realized 280000 90000 810...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started