Answered step by step

Verified Expert Solution

Question

1 Approved Answer

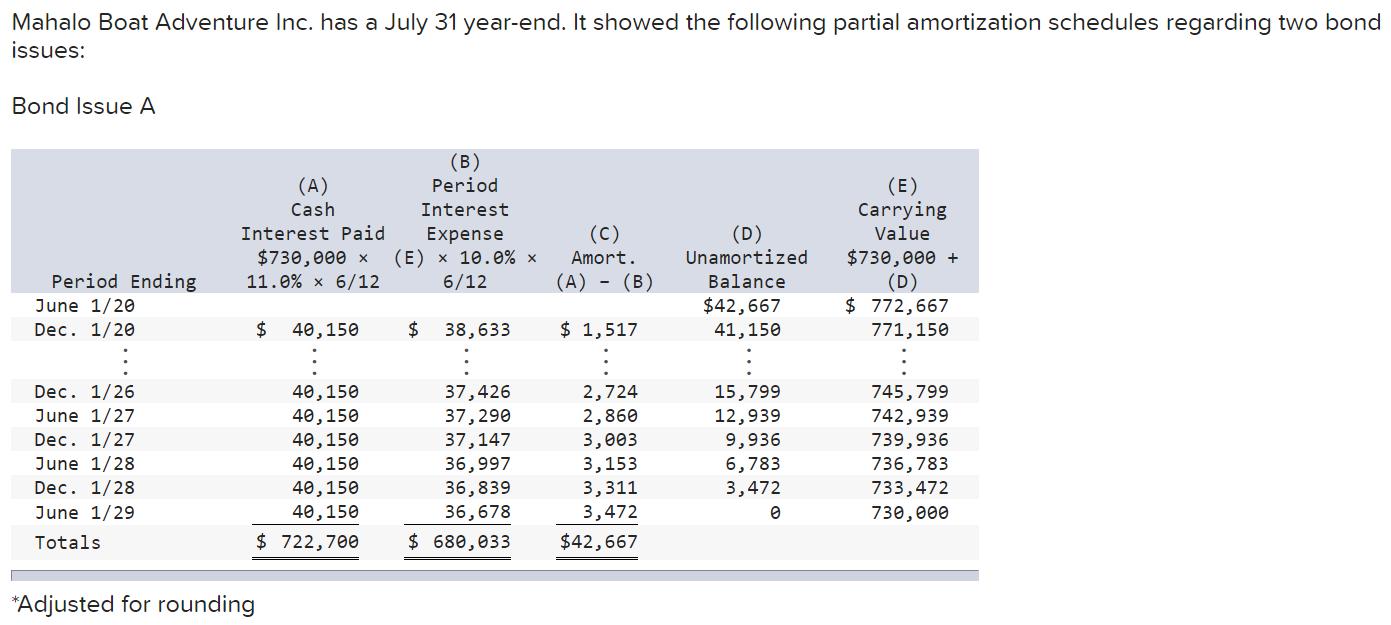

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period

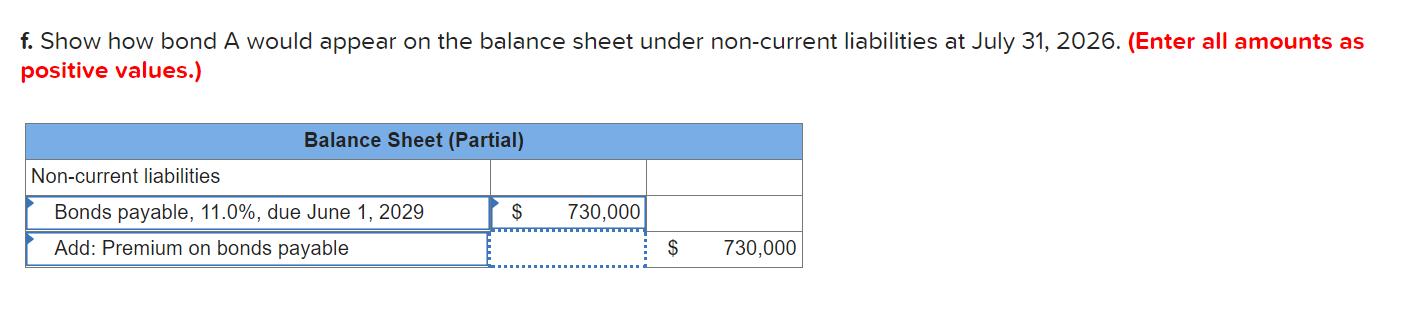

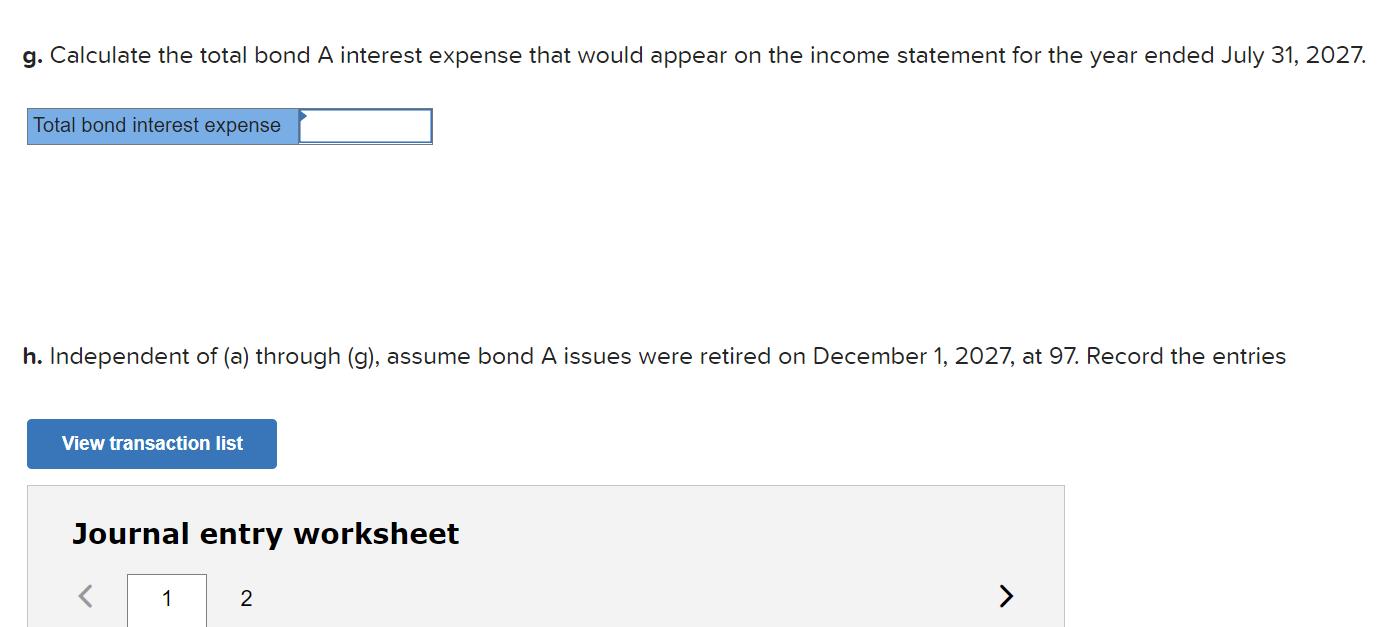

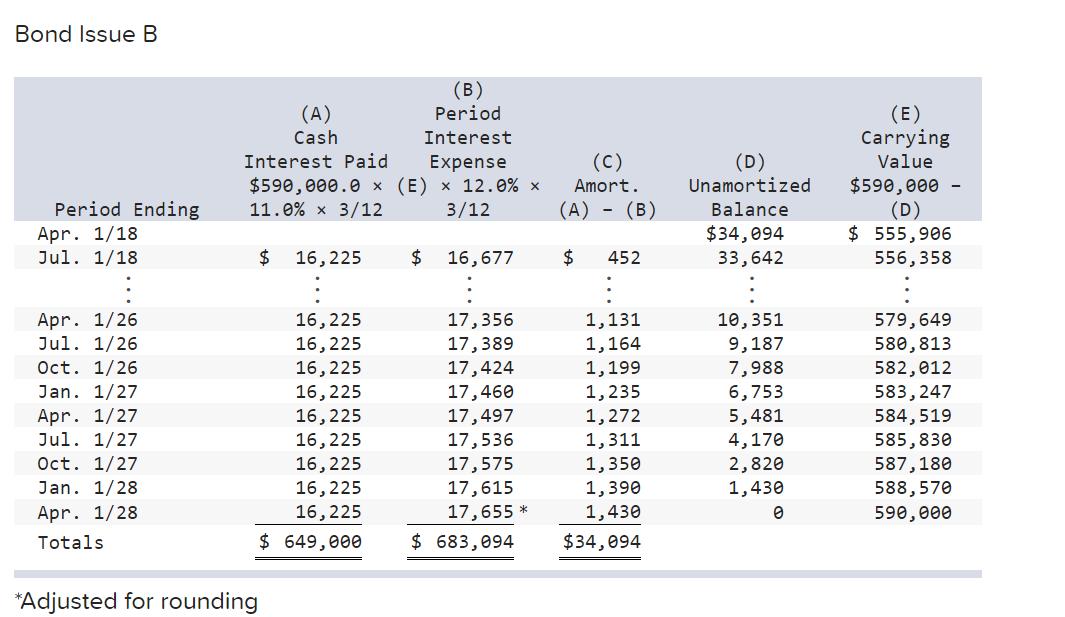

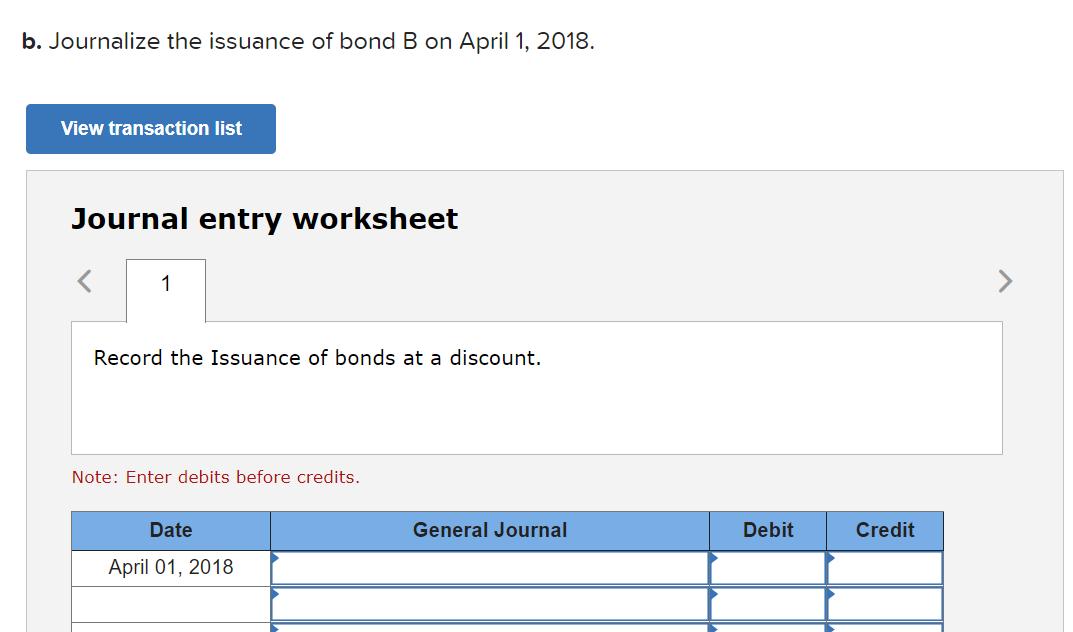

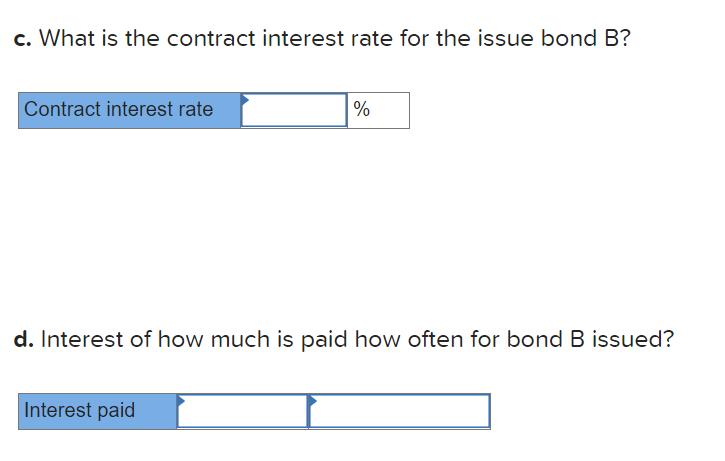

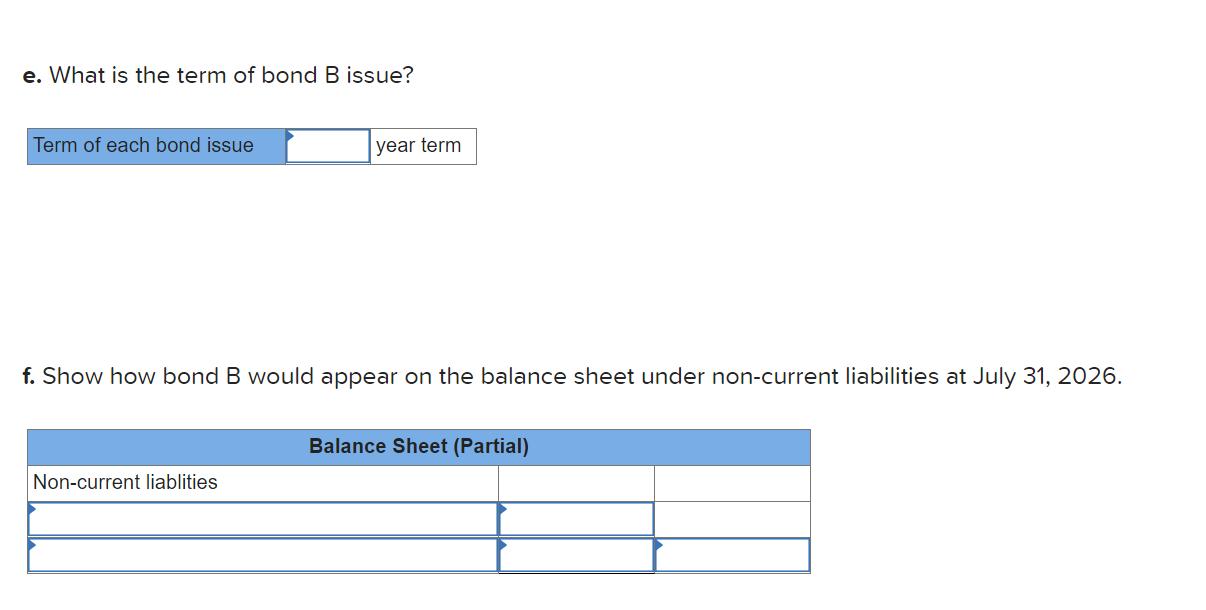

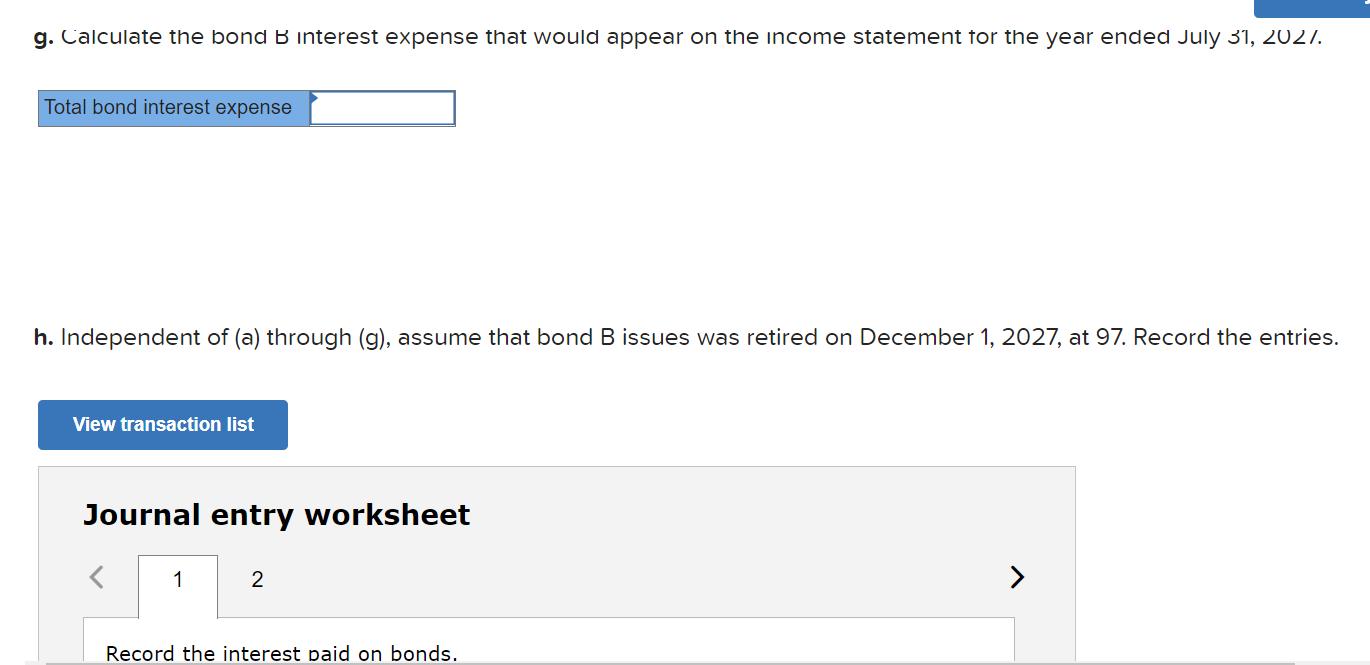

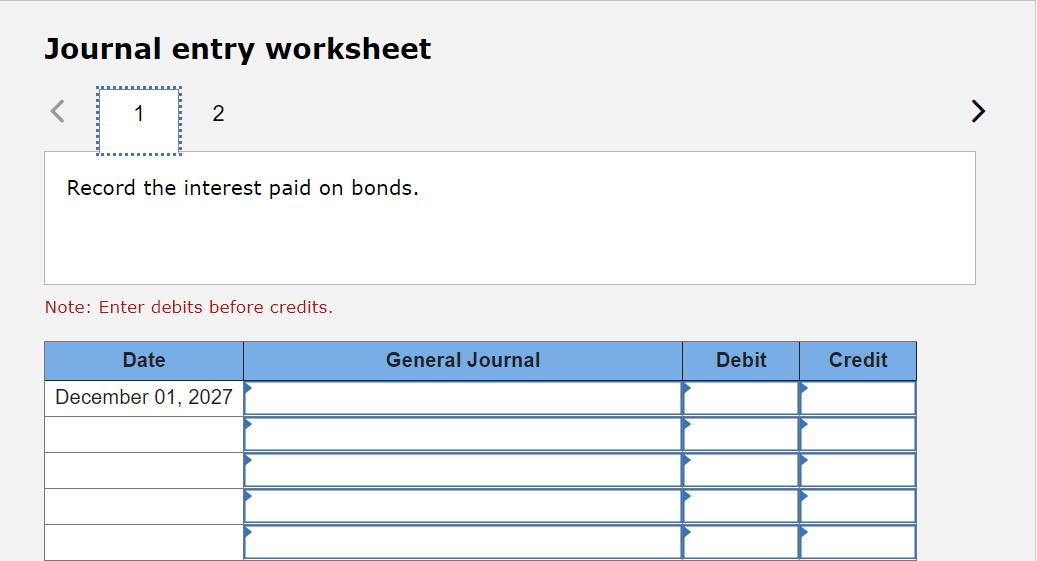

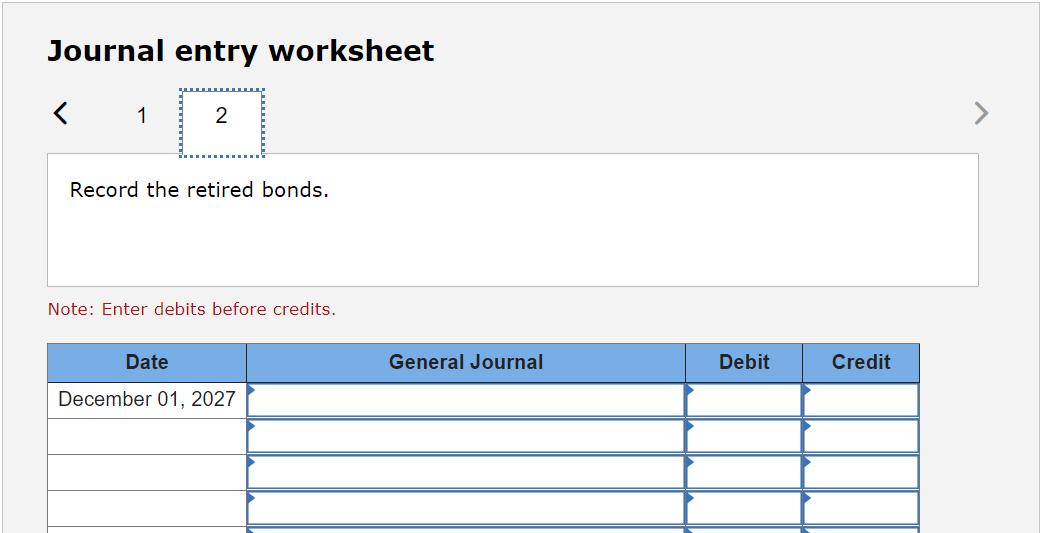

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending June 1/20 Dec. 1/20 Dec. 1/26 June 1/27 Dec. 1/27 June 1/28 Dec. 1/28 June 1/29 Totals (A) Cash Interest Paid $730,000 x 11.0 % x 6/12 *Adjusted for rounding $ 40,150 40,150 40,150 40,150 40,150 40,150 40,150 $ 722,700 (B) Period Interest Expense (E) x 10.0 % x 6/12 $ 38,633 37,426 37,290 37,147 36,997 36,839 36,678 $ 680,033 (C) Amort. (A) - (B) $ 1,517 2,724 2,860 3,003 3,153 3,311 3,472 $42,667 (D) Unamortized Balance $42,667 41,150 15,799 12,939 9,936 6,783 3,472 0 (E) Carrying Value $730,000 + (D) $772,667 771,150 745,799 742,939 739,936 736,783 733,472 730,000 f. Show how bond A would appear on the balance sheet under non-current liabilities at July 31, 2026. (Enter all amounts as positive values.) Balance Sheet (Partial) Non-current liabilities Bonds payable, 11.0%, due June 1, 2029 Add: Premium on bonds payable $ 730,000 $ 730,000 g. Calculate the total bond A interest expense that would appear on the income statement for the year ended July 31, 2027. Total bond interest expense h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2027, at 97. Record the entries View transaction list Journal entry worksheet < 1 2 V Bond Issue B Period Ending Apr. 1/18 Jul. 1/18 Apr. 1/26 Jul. 1/26 Oct. 1/26 Jan. 1/27 Apr. 1/27 Jul. 1/27 Oct. 1/27 Jan. 1/28 Apr. 1/28 Totals (A) Cash *Adjusted for rounding Interest Paid $590,000.0 x (E) x 12.0% x 11.0 % x 3/12 3/12 $ 16,225 16, 225 16,225 16,225 16,225 16,225 16,225 16,225 16,225 16,225 $ 649,000 (B) Period Interest Expense $ 16,677 17,356 17,389 17,424 17,460 17,497 17,536 17,575 17,615 17,655 * $ 683,094 (C) Amort. (A) $ 452 - (B) 1,131 1,164 1,199 1,235 1,272 1,311 1,350 1,390 1,430 $34,094 (D) Unamortized Balance $34,094 33,642 10,351 9,187 7,988 6,753 5,481 4,170 2,820 1,430 0 (E) Carrying Value $590,000 - (D) $ 555,906 556,358 579,649 580,813 582,012 583,247 584,519 585,830 587,180 588,570 590,000 b. Journalize the issuance of bond B on April 1, 2018. View transaction list Journal entry worksheet 1 Record the Issuance of bonds at a discount. Note: Enter debits before credits. Date April 01, 2018 General Journal Debit Credit c. What is the contract interest rate for the issue bond B? Contract interest rate % d. Interest of how much is paid how often for bond B issued? Interest paid e. What is the term of bond B issue? Term of each bond issue year term f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. Non-current liablities Balance Sheet (Partial) g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Total bond interest expense h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries. View transaction list Journal entry worksheet 1 2 Record the interest paid on bonds. > Journal entry worksheet < 1 2 Record the interest paid on bonds. Note: Enter debits before credits. Date December 01, 2027 General Journal Debit Credit Journal entry worksheet 1 2 Record the retired bonds. Note: Enter debits before credits. Date December 01, 2027 General Journal Debit Credit

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To answer the given questions lets go step by step a The balance sheet presentation for Bond A under noncurrent liabilities at July 31 2026 would be a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started