Answered step by step

Verified Expert Solution

Question

1 Approved Answer

g. Estimate the stock return for your chosen stock. Apply the Monte Carlo Simulation with 1,000 simulations to estimate the average, median, min, max,

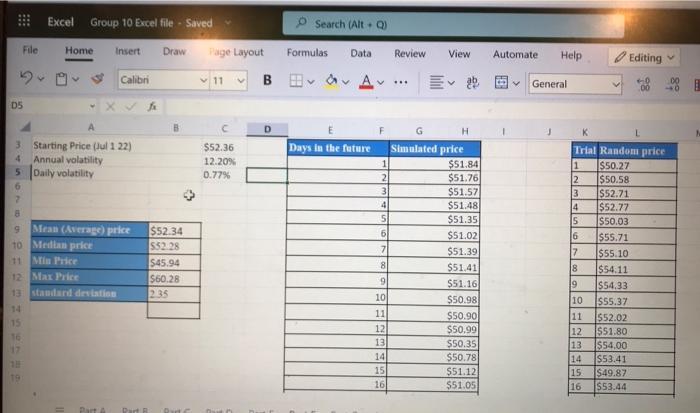

g. Estimate the stock return for your chosen stock. Apply the Monte Carlo Simulation with 1,000 simulations to estimate the average, median, min, max, standard deviation and the chance of loss of the return for your chosen stock in the next 30 trading days. (First you estimate the stock return. Then, you estimate the daily volatility of the stock return by applying STDEV.P function in excel. Next, you simulate the return in the next 30 trading days. After this, you apply the 1,000 simulations and calculate the average return, median return, minimum and maximum return, and the chance of loss of the return) 5 D5 File 5 6 7 8 3 Starting Price (Jul 1 22) 4 Annual volatility Daily volatility Excel Group 10 Excel file - Saved Search (Alt+Q) Home Insert Draw Page Layout Formulas Data Review Calibri BEA 14 15 16 17 9 10 Median price 11 19 Min Price 12 Max Price 13 standard deviation Mean (Average) price $52.34 $52.28 fr $45.94 $60.28 2.35 Part A Part B Run C 11 $52.36 12.20 % 0.77% D Days in the future V 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 *** View V G Simulated price H $51.84 $51.76 $51.57 $51.48 $51.35 $51.02 $51.39 $51.41 $51.16 $50.98 $50.90 $50,99 $50.35 $50.78 $51.12 $51.05 Automate Help Y General 1 2 3 Trial Random price $50.27 $50.58 $52.71 4 $52.77 5 $50.03 6 $55.71 7 $55.10 8 $54.11 9 $54.33 10 $55.37 11 12 13 $52.02 $51.80 Editing $54.00 14 $53.41 15 $49.87 16 $53.44 +0 00 .00 40 L V

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Monte Carlo simulation is a mathematical technique used in finance to model potential investment out...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started