(g) (h) (b) (c) (d) (e) (f) (a) The gross profit was correctly calculated using the profit mark-up of The following have not yet

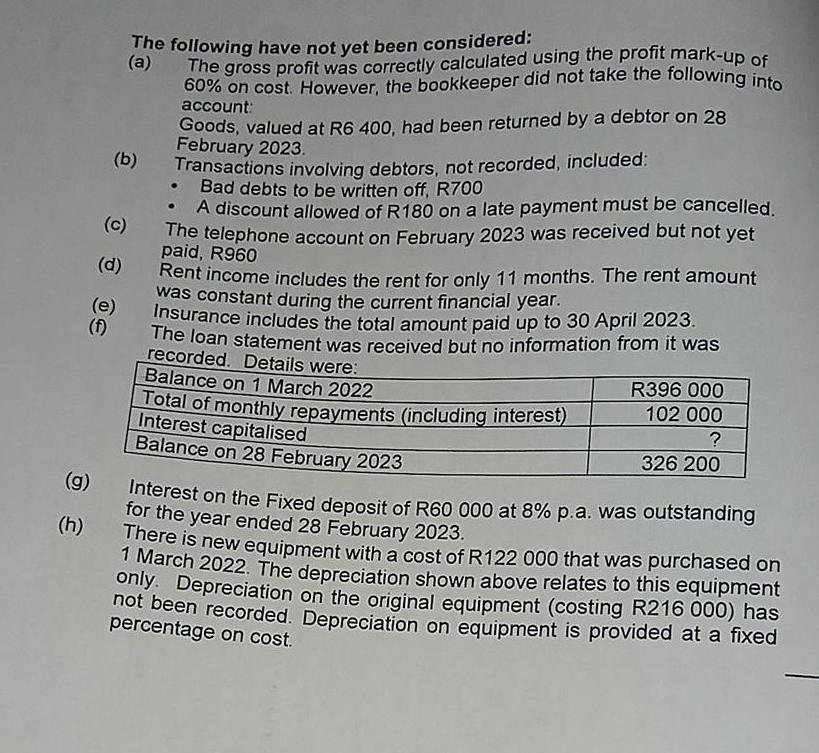

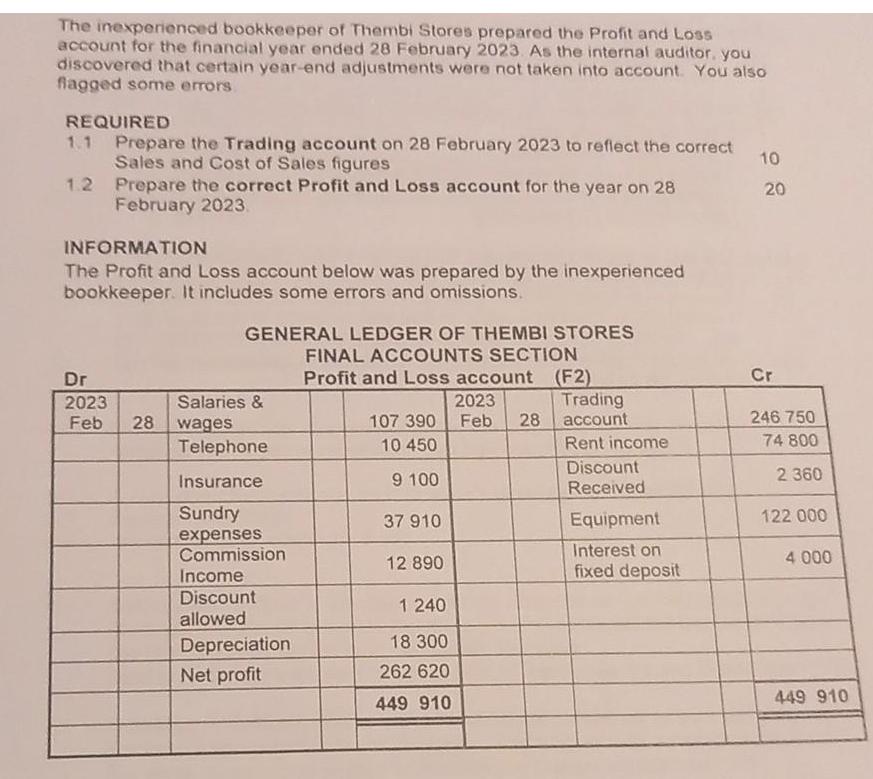

(g) (h) (b) (c) (d) (e) (f) (a) The gross profit was correctly calculated using the profit mark-up of The following have not yet been considered: 60% on cost. However, the bookkeeper did not take the following into account: Goods, valued at R6 400, had been returned by a debtor on 28 February 2023. Transactions involving debtors, not recorded, included: Bad debts to be written off, R700 . A discount allowed of R180 on a late payment must be cancelled. The telephone account on February 2023 was received but not yet R960 Rent income includes the rent for only 11 months. The rent amount was constant during the current financial year. Insurance includes the total amount paid up to 30 April 2023. The loan statement was received but no information from it was recorded. Details were: Balance on 1 March 2022 Total of monthly repayments (including interest) Interest capitalised Balance on 28 February 2023 R396 000 102 000 ? 326 200 Interest on the Fixed deposit of R60 000 at 8% p.a. was outstanding for the year ended 28 February 2023. There is new equipment with a cost of R122 000 that was purchased on 1 March 2022. The depreciation shown above relates to this equipment only. Depreciation on the original equipment (costing R216 000) has not been recorded. Depreciation on equipment is provided at a fixed percentage on cost. The inexperienced bookkeeper of Thembi Stores prepared the Profit and Loss account for the financial year ended 28 February 2023. As the internal auditor, you discovered that certain year-end adjustments were not taken into account. You also flagged some errors REQUIRED 1.1 Prepare the Trading account on 28 February 2023 to reflect the correct Sales and Cost of Sales figures 1.2 Prepare the correct Profit and Loss account for the year on 28 February 2023 INFORMATION The Profit and Loss account below was prepared by the inexperienced bookkeeper. It includes some errors and omissions. Dr 2023 Feb 28 GENERAL LEDGER OF THEMBI STORES FINAL ACCOUNTS SECTION Profit and Loss account (F2) Salaries & wages Telephone Insurance Sundry expenses Commission Income Discount allowed Depreciation Net profit 107 390 10 450 9 100 37 910 12 890 1 240 18 300 262 620 449 910 2023 Feb 28 Trading account Rent income Discount Received Equipment Interest on fixed deposit 10 20 Cr 246 750 74 800 2.360 122 000 4 000 449 910

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Let A be a 2x2 real matrix 2x2 real matrix with det ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started