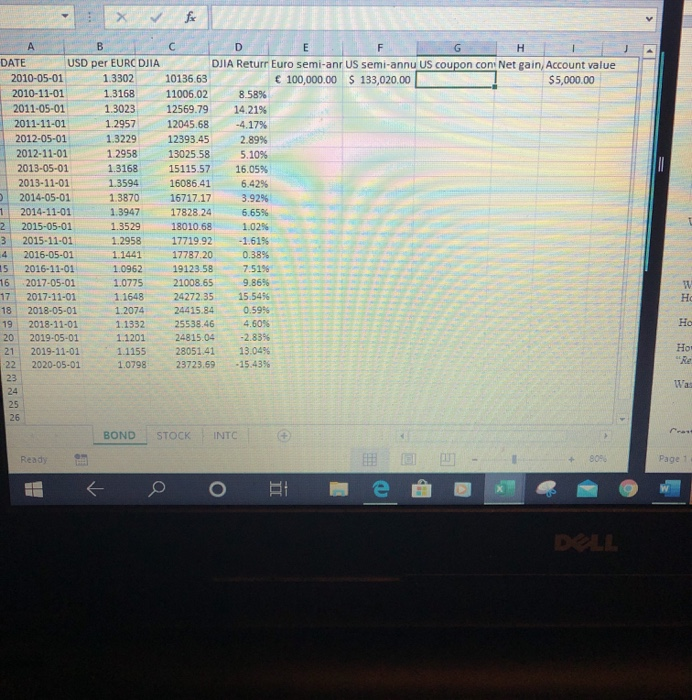

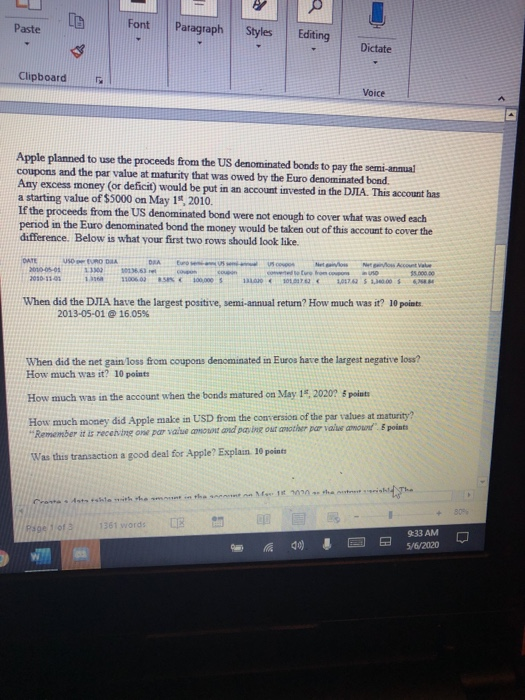

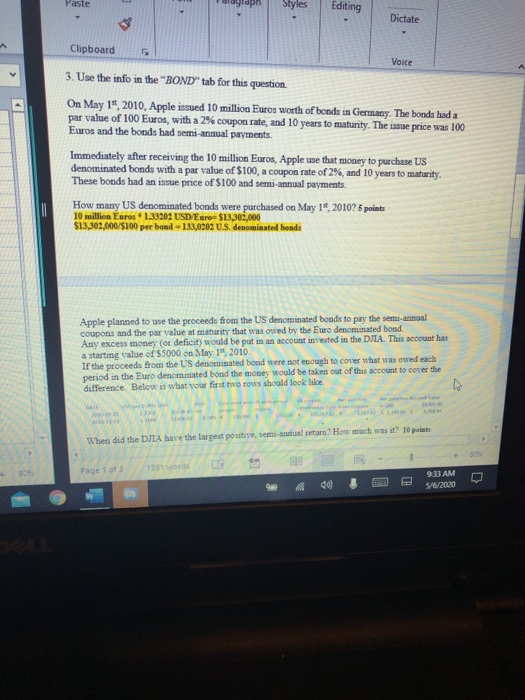

G H DATE USD per EURO DIA DJIA Returr Euro semi-anr US semi-annu US coupon cont Net gain, Account value 2010-05-01 1.3302 10136.63 100,000.00 $ 133,020,00 $5,000.00 2010-11-01 1.3168 11006.02 8.58% 2011-05-01 1.3023 12569.79 14.21% 2011-11-01 1.2957 1 2045.68 -4.17% 2012-05-01 1.3229 12393.45 2.89% 2012-11-01 12958 13025.58 5.10% 2013-05-01 1.3168 15115.57 16.05% 2013-11-01 3594 16086.41 6.42% 2014-05-01 1.3870 16717.17 3.92% 1 2014-11-01 1.3947 17828.24 6,65% 2 2015-05-01 1.3529 18010.68 1.02% 3 2015-11-01 1.2958 17719.92 -1.61% 4 2016-05-01 1.1441 17787.20 0.38% 15 2016-11-01 1.0962 1 9123.58 7.51% 16 2017-05-01 1.0775 21008.65 9.86% 17 2017-11-01 1.1648 2 4272.35 15.54% 18 2018-05-01 1.2074 24415.84 0.59% 19 2018-11-01 1.1332 25538.464 .60% 20 2019-05-01 1.1201 24815.04 -2.83% 21 2019-11-01 1.1155 28051.41 13.04% 22 2020-05-01 1.0798 23723.69 -15.43% W HO Hot "Re Wa OEM BOND STOCK INTC Ready Page 1 DL Paste Font Paragraph Styles Editing Dictate Clipboard Voice Apple planned to use the proceeds from the US denominated boods to pay the semi-annual coupons and the par value at maturity that was owed by the Euro denominated bond Any excess money (or deficit) would be put in an account invested in the DJA. This account has a starting value of $5000 on May 19, 2010. If the proceeds from the US denominated bond were not enough to cover what was owed each period in the Euro denominated bond the money would be taken out of this account to cover the difference. Below is what your first two rows should look like. Euro DATE USO 2010-05-01 2010-11-01 1 EURO DIA DA 13300 11366) O 1 10000 c Muut ture on 101 Account 5.000.00 USD 1070 10.00 100.000 When did the DJIA have the largest positive, semi-annual return? How much was it? 10 points 2013-05-01 @ 16.05% When did the net gain loss from coupons denominated in Euros have the largest negative loss? How much was it? 10 points How much was in the account when the bonds matured on May 19, 2020? 5 points How much money did Apple make in USD from the conversion of the par values at maturity? Remember it is receiving on para m anding out another par valw amour!" points Was this transaction a good deal for Apple? Explain. 10 points he t - the The Crona Astasho 1361 words OE E - 304 D 40 9:33 AM DE E 5/6/2020 Paste layiap Styles Editing Dictate Clipboard Voice 3. Use the info in the "BOND" tab for this question On May 1 2010, Apple issued 10 million Euros worth of bonds in Germany. The boods bada par value of 100 Euros, with a 2% coupon rate, and 10 years to maturity. The issue price was 100 Euros and the bonds bad semi-annual payments. Immediately after receiving the 10 million Euros, Apple use that money to purchase US denominated bonds with a par value of $100, a coupon rate of 2%, and 10 years to maturity. These bonds had an issue price of $100 and semi-annual payments. How many US denominated bonds were purchased on May 1, 2010? points 10 million Euros * 1.33202 USD/Euro= $13,302,000 $13,302,000/$100 per bond - 133,0202 U.S. denominated bonds Apple planned to use the proceeds from the US denominated bonds to pay the semi-annual coupons and the par value at maturity that was owed by the Euro denominated bond. Any excess money (or deficit) would be put in an account invested in the DUIA. This account has a starting value of $5000 on May 1" 2010. If the proceeds from the US denominated bond were not enough to cover what was owed each period in the Euro denominated bond the money would be taken out of this account to cover the difference. Below is what your first two rows should look like. wher When did the DJIA have the largest positive, semi-annual return? How much was it? 10 points Page 1 of B 1361 Words E 9:33 AM 0 G H DATE USD per EURO DIA DJIA Returr Euro semi-anr US semi-annu US coupon cont Net gain, Account value 2010-05-01 1.3302 10136.63 100,000.00 $ 133,020,00 $5,000.00 2010-11-01 1.3168 11006.02 8.58% 2011-05-01 1.3023 12569.79 14.21% 2011-11-01 1.2957 1 2045.68 -4.17% 2012-05-01 1.3229 12393.45 2.89% 2012-11-01 12958 13025.58 5.10% 2013-05-01 1.3168 15115.57 16.05% 2013-11-01 3594 16086.41 6.42% 2014-05-01 1.3870 16717.17 3.92% 1 2014-11-01 1.3947 17828.24 6,65% 2 2015-05-01 1.3529 18010.68 1.02% 3 2015-11-01 1.2958 17719.92 -1.61% 4 2016-05-01 1.1441 17787.20 0.38% 15 2016-11-01 1.0962 1 9123.58 7.51% 16 2017-05-01 1.0775 21008.65 9.86% 17 2017-11-01 1.1648 2 4272.35 15.54% 18 2018-05-01 1.2074 24415.84 0.59% 19 2018-11-01 1.1332 25538.464 .60% 20 2019-05-01 1.1201 24815.04 -2.83% 21 2019-11-01 1.1155 28051.41 13.04% 22 2020-05-01 1.0798 23723.69 -15.43% W HO Hot "Re Wa OEM BOND STOCK INTC Ready Page 1 DL Paste Font Paragraph Styles Editing Dictate Clipboard Voice Apple planned to use the proceeds from the US denominated boods to pay the semi-annual coupons and the par value at maturity that was owed by the Euro denominated bond Any excess money (or deficit) would be put in an account invested in the DJA. This account has a starting value of $5000 on May 19, 2010. If the proceeds from the US denominated bond were not enough to cover what was owed each period in the Euro denominated bond the money would be taken out of this account to cover the difference. Below is what your first two rows should look like. Euro DATE USO 2010-05-01 2010-11-01 1 EURO DIA DA 13300 11366) O 1 10000 c Muut ture on 101 Account 5.000.00 USD 1070 10.00 100.000 When did the DJIA have the largest positive, semi-annual return? How much was it? 10 points 2013-05-01 @ 16.05% When did the net gain loss from coupons denominated in Euros have the largest negative loss? How much was it? 10 points How much was in the account when the bonds matured on May 19, 2020? 5 points How much money did Apple make in USD from the conversion of the par values at maturity? Remember it is receiving on para m anding out another par valw amour!" points Was this transaction a good deal for Apple? Explain. 10 points he t - the The Crona Astasho 1361 words OE E - 304 D 40 9:33 AM DE E 5/6/2020 Paste layiap Styles Editing Dictate Clipboard Voice 3. Use the info in the "BOND" tab for this question On May 1 2010, Apple issued 10 million Euros worth of bonds in Germany. The boods bada par value of 100 Euros, with a 2% coupon rate, and 10 years to maturity. The issue price was 100 Euros and the bonds bad semi-annual payments. Immediately after receiving the 10 million Euros, Apple use that money to purchase US denominated bonds with a par value of $100, a coupon rate of 2%, and 10 years to maturity. These bonds had an issue price of $100 and semi-annual payments. How many US denominated bonds were purchased on May 1, 2010? points 10 million Euros * 1.33202 USD/Euro= $13,302,000 $13,302,000/$100 per bond - 133,0202 U.S. denominated bonds Apple planned to use the proceeds from the US denominated bonds to pay the semi-annual coupons and the par value at maturity that was owed by the Euro denominated bond. Any excess money (or deficit) would be put in an account invested in the DUIA. This account has a starting value of $5000 on May 1" 2010. If the proceeds from the US denominated bond were not enough to cover what was owed each period in the Euro denominated bond the money would be taken out of this account to cover the difference. Below is what your first two rows should look like. wher When did the DJIA have the largest positive, semi-annual return? How much was it? 10 points Page 1 of B 1361 Words E 9:33 AM 0