Question

G is negotiating an acquisition of K. The tentative agreed upon value is $27 per share (all cash offer) for K's stock. You work

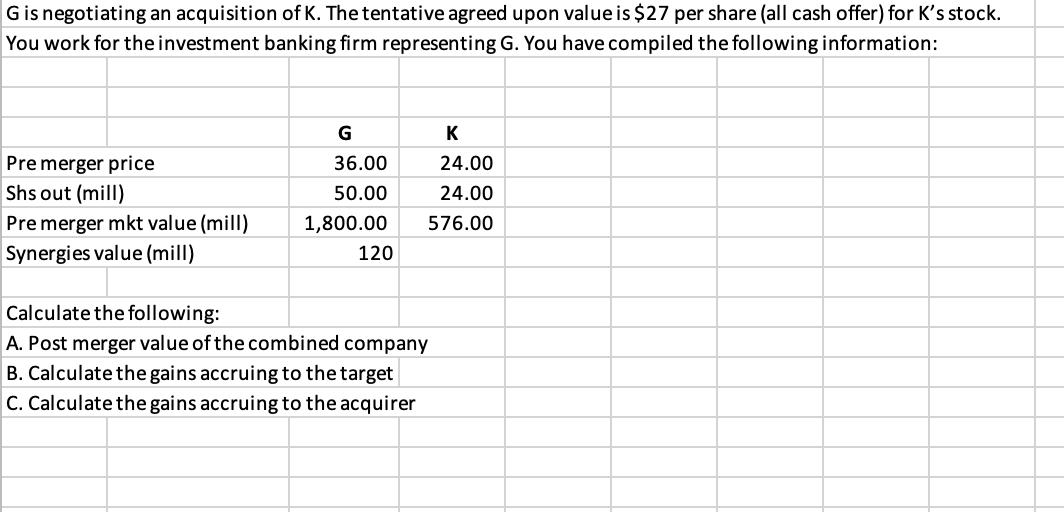

G is negotiating an acquisition of K. The tentative agreed upon value is $27 per share (all cash offer) for K's stock. You work for the investment banking firm representing G. You have compiled the following information: Pre merger price Shs out (mill) Pre merger mkt value (mill) Synergies value (mill) G 36.00 50.00 1,800.00 120 K 24.00 24.00 576.00 Calculate the following: A. Post merger value of the combined company B. Calculate the gains accruing to the target C. Calculate the gains accruing to the acquirer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Postmerger Value of the Combined Company Postmerger value of the combined company can be calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management A Strategic Emphasis

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

8th Edition

1259917029, 978-1259917028

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App