Answered step by step

Verified Expert Solution

Question

1 Approved Answer

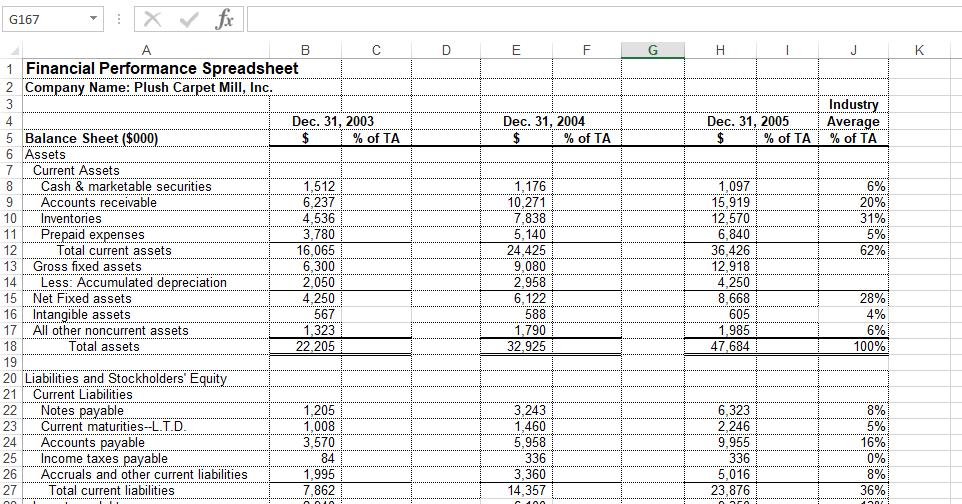

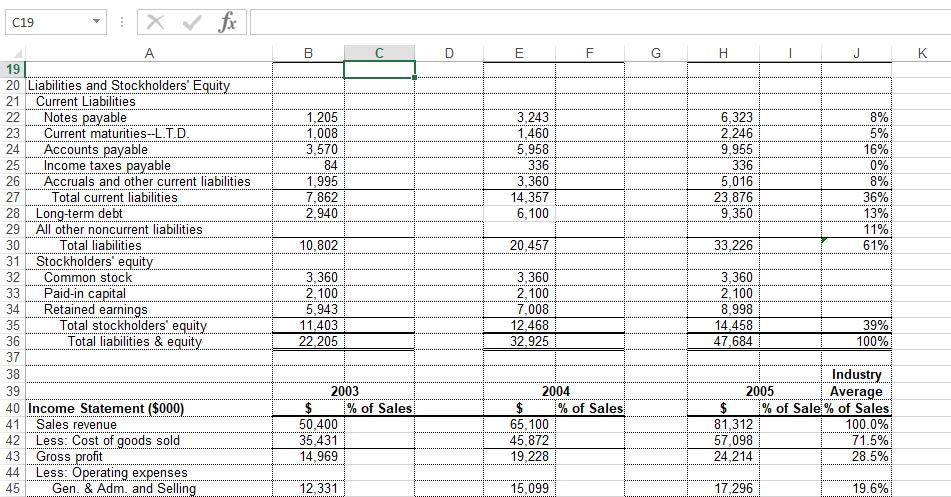

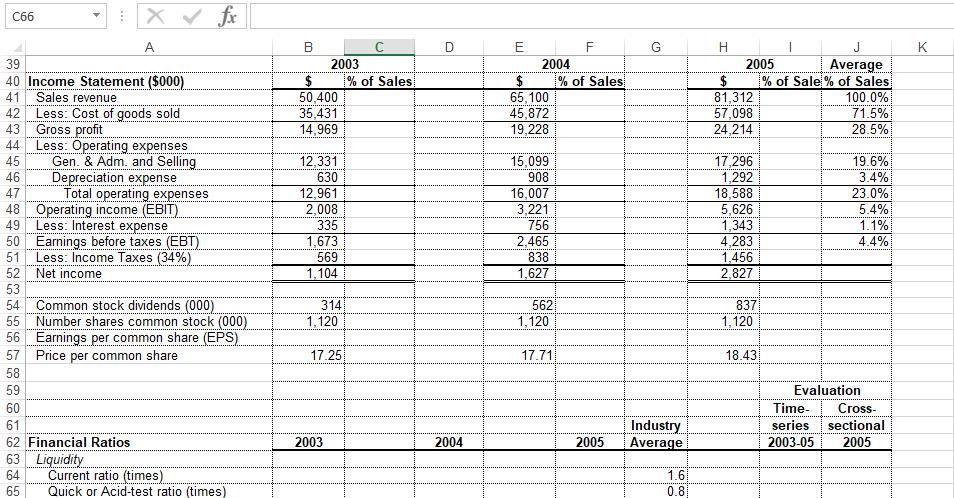

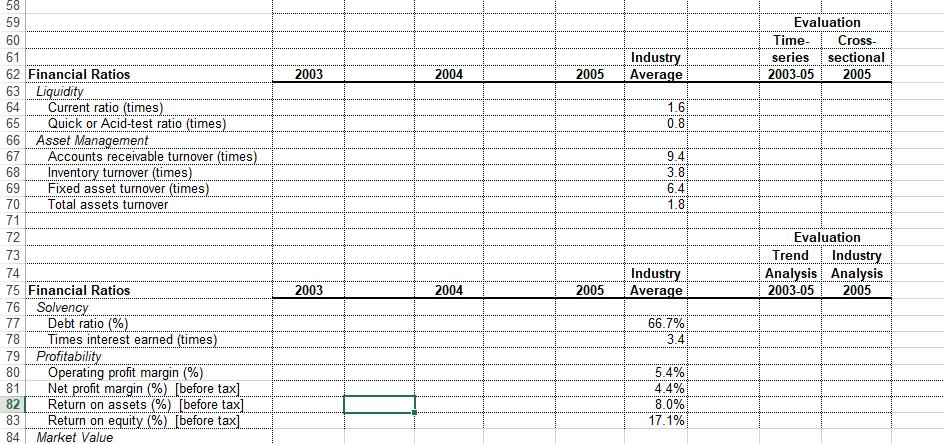

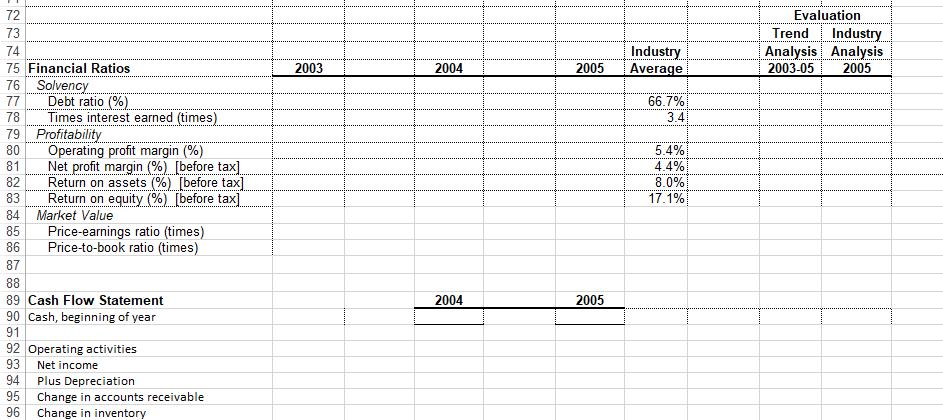

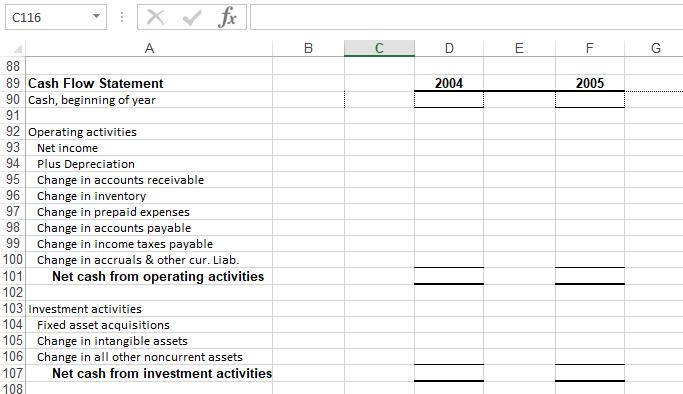

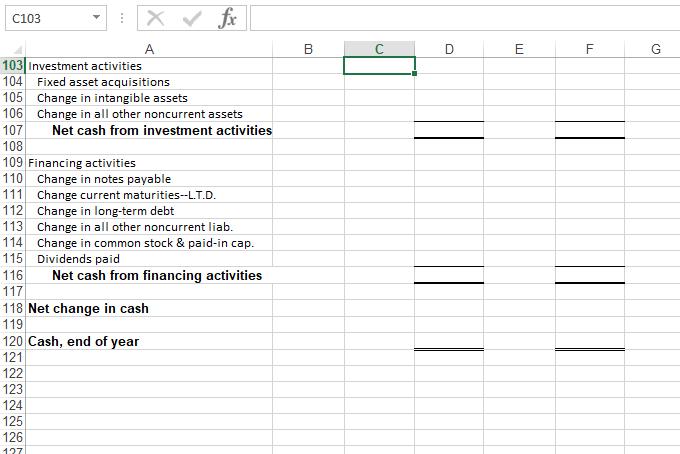

Kindly fill in the table completely and show the complete formula used to get the values. G167 B D E G H J K 1

Kindly fill in the table completely and show the complete formula used to get the values.

G167 B D E G H J K 1 Financial Performance Spreadsheet 2 Company Name: Plush Carpet Mill, Inc. Industry Average % of TA Dec. 31, 2005 Dec. 31, 2003 % of TA Dec. 31, 2004 % of TA 5 Balance Sheet ($000) 6 Assets Current Assets Cash & marketable securities $ % of TA 1,512 6,237 1,176 10,271 7.838 5.140 24,425 9 080 2 958 6 122 588 1,790 32,925 1,097 15.919 12 570 6% 20% 31% 5% Accounts receivable 10 Inventories 4,536 3,780 16,065 6.300 2 050 4,250 567 1.323 22,205 Prepaid expenses 12 13 Gross fixed assets Less: Accumulated depreciation 6,840 36,426 12 918 4. 250 11 Total current assets 62% 14 15 Net Fixed assets 8,668 28% 16 Intangible assets 17 All other noncurrent assets Total assets 605 1,985 47,684 4% 6% 18 100% 19 20 Liabilities and Stockholders' Equity 21 Current Notes :Liabilities 1,205 1,008 3,570 84 3,243 1,460 5.958 336 3,360 14,357 C 400 6,323 2,246 9.955 336 5,016 23,876 22 payable Current maturities--L.T.D Accounts payable Income taxes payable 8% 5% 16% 0% 8% 36% 23 24 25 26 Accruals and other current liabilities 1,995 7,862 27 Total current liabilities

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started