Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(g) James purchased a 20 hectare farm in 2013 for $1 million (with no intention to sell). He sold the property to a developer

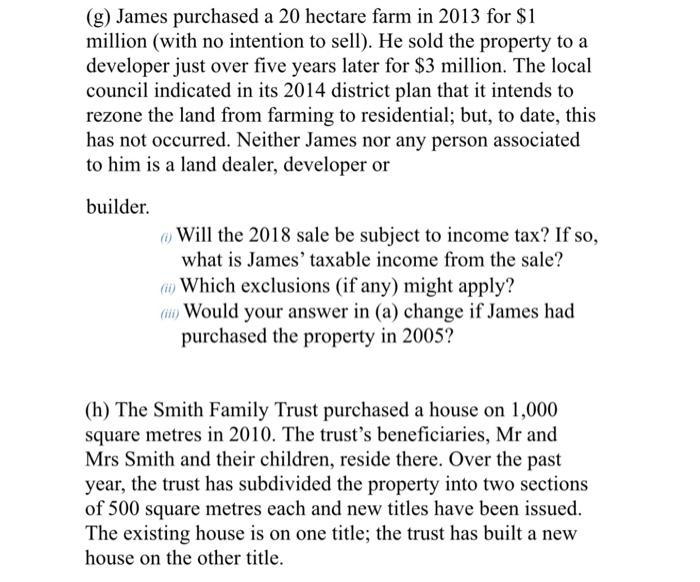

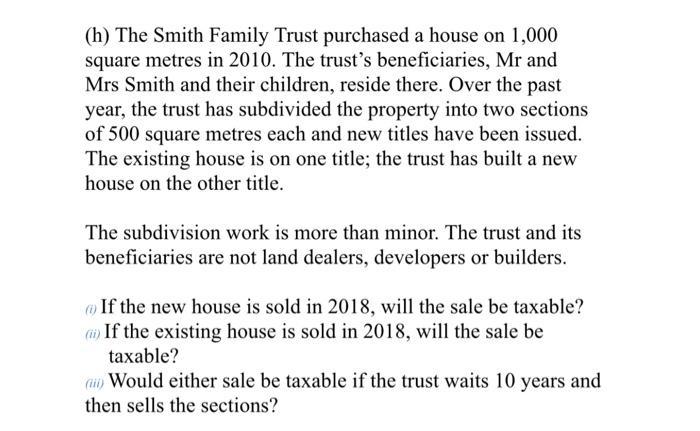

(g) James purchased a 20 hectare farm in 2013 for $1 million (with no intention to sell). He sold the property to a developer just over five years later for $3 million. The local council indicated in its 2014 district plan that it intends to rezone the land from farming to residential; but, to date, this has not occurred. Neither James nor any person associated to him is a land dealer, developer or builder. (Will the 2018 sale be subject to income tax? If so, what is James' taxable income from the sale? (it) Which exclusions (if any) might apply? (ii) Would your answer in (a) change if James had purchased the property in 2005? (h) The Smith Family Trust purchased a house on 1,000 square metres in 2010. The trust's beneficiaries, Mr and Mrs Smith and their children, reside there. Over the past year, the trust has subdivided the property into two sections of 500 square metres each and new titles have been issued. The existing house is on one title; the trust has built a new house on the other title. (h) The Smith Family Trust purchased a house on 1,000 square metres in 2010. The trust's beneficiaries, Mr and Mrs Smith and their children, reside there. Over the past year, the trust has subdivided the property into two sections of 500 square metres each and new titles have been issued. The existing house is on one title; the trust has built a new house on the other title. The subdivision work is more than minor. The trust and its beneficiaries are not land dealers, developers or builders. If the new house is sold in 2018, will the sale be taxable? (ii) If the existing house is sold in 2018, will the sale be taxable? (ii) Would either sale be taxable if the trust waits 10 years and then sells the sections?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question Qg Income tax on the sale of land Stepbystep explanation i As per IRS publication 544 a sale or disposition of assets must be reported on inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started