Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare journal entries . G lollowing transact Bb 3011269 96x625) x ecures - FIMAND Ten Sports Live x Ho et02-xythos.content.blackboardcdn.com/5f28a91920991/3011269?X-Blackboard-Expiration=16360596000008X-Blaa O. 2.1 Following transactions took

prepare journal entries .

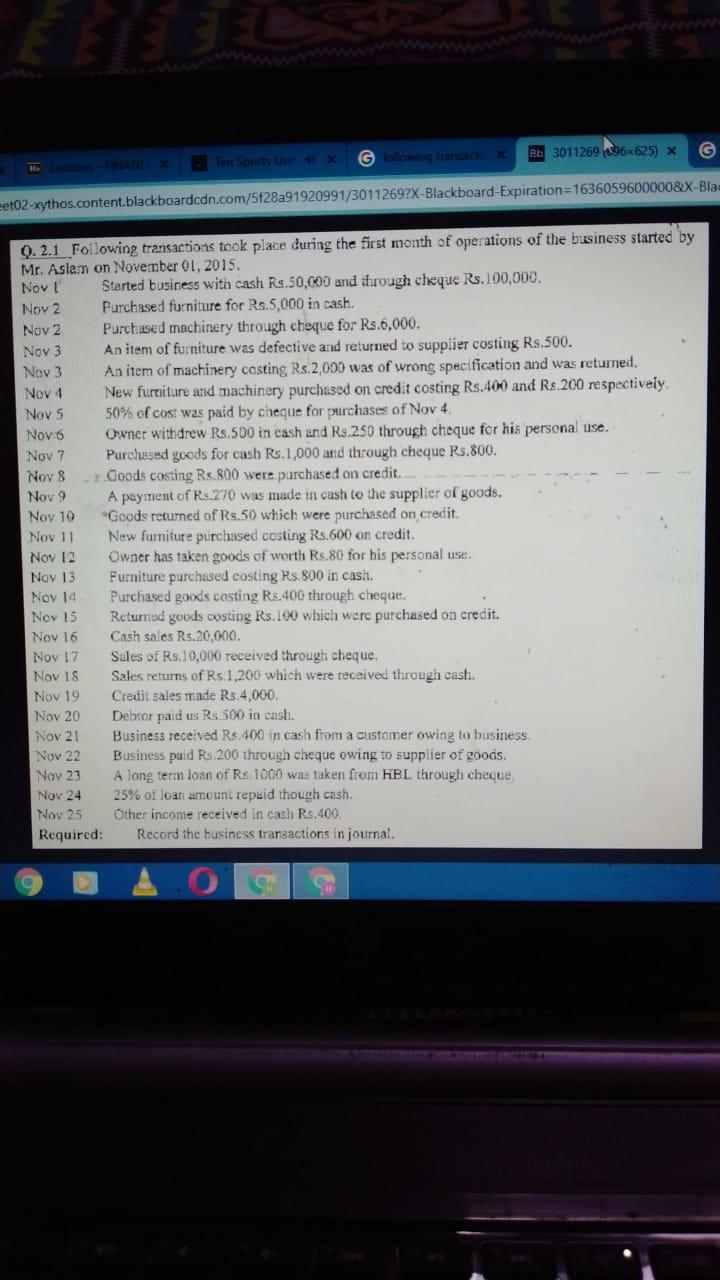

G lollowing transact Bb 3011269 96x625) x ecures - FIMAND Ten Sports Live x Ho et02-xythos.content.blackboardcdn.com/5f28a91920991/3011269?X-Blackboard-Expiration=16360596000008X-Blaa O. 2.1 Following transactions took place during the first month of operations of the business started by Mr. Aslam on November O1, 2015. Started business with cash Rs.50,000 and ifrough cheque Rs.100,000. Purchased furniture for Rs.5,000 in cash. Nov t Nov 2 Purchased machinery through cheque for Rs.6,000. An item of furniture was defective and returned to supplier costing Rs.500. An item of machinery costing Rs.2,000 was of wrong specification and was returned. New furniture and machinery purchased on credit costing Rs.400 and Rs.200 respectively. 50% of cost was paid by cheque for purchases of Nov 4. Owner withdrew Rs.500 in cash und Rs.250 through cheque for his personal use. Purchased goods for cash Rs.1,000 and through cheque Rs.800. Goods costing Rs.800 were purchased on credit. A payment of Rs.270 was made in cush to the supplier of goods. "Goods returned of Rs.50 which were purchased on credit. New furniture purchased costing Rs.600 on credit. Owner has taken goods of worth Rs.80 for his personal use. Furniture purchased costing Rs. 800 in cash. Purchased goods costing Rs.400 through cheque. Returned goods costing Rs.100 which were purchased on credit. Cash sales Rs,20,000. Sales of Rs.10,000 received through cheque. Sales returns of Rs.1,200 which were received through cash. Nov 2 Nov 3 Nov 3 Nov 4 Nov 5 N 6 7 Nov 8 Nov 9 ov 10 Nov 11 Nov 12 Nov 13 Nov 14 Nov 15 o 16 Nov 17 Nov 1S Nov 19 Credit sales made Rs.4,000. Debror paid us Rs.500 in cash. Business received Rs.400 in cash from a customer owing to business. Nov 20 Nov 21 Business paid Rs.200 through cheque owing to supplier of goods. A long term loan of Rs. 1000 was taken from HBL through cheque, 25% of loarn amount repaid though cash. Other income received in cash Rs.400. Nov 22 Nov 23 Nov 24 Nov 25 Required: Record the husiness transactions in journal.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

In the Books of Mr Aslam Journal Entry for the month of November 2015 Date Particulars LF Debit Amount Rs Credit Amount Rs 01112015 Cash AC Dr 50000 B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started