Answered step by step

Verified Expert Solution

Question

1 Approved Answer

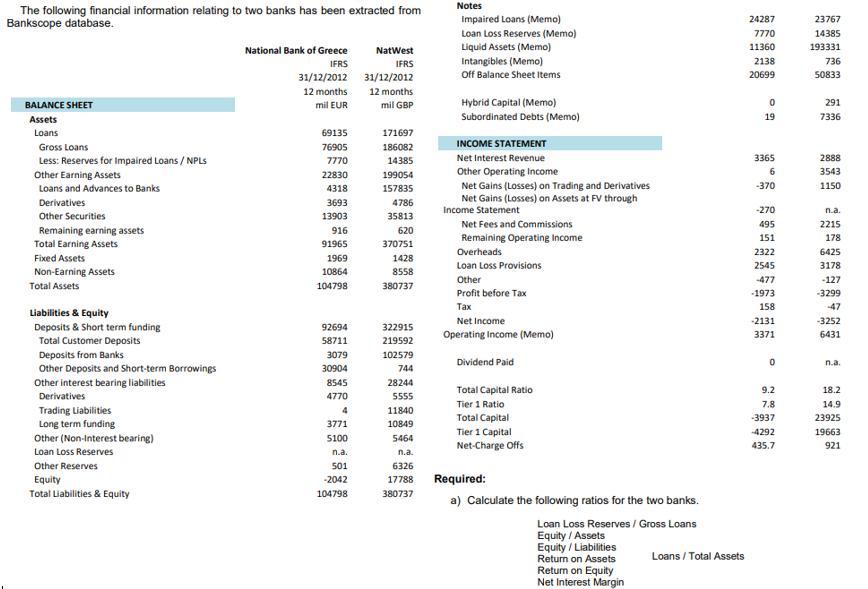

The following financial information relating to two banks has been extracted from Bankscope database. National Bank of Greece IFRS 31/12/2012 12 months mil EUR

The following financial information relating to two banks has been extracted from Bankscope database. National Bank of Greece IFRS 31/12/2012 12 months mil EUR NatWest IFRS 31/12/2012 12 months mil GBP BALANCE SHEET Assets Loans 69135 171697 Gross Loans 76905 186082 Less: Reserves for Impaired Loans / NPLs 7770 14385 Other Earning Assets 22830 199054 Loans and Advances to Banks 4318 157835 Derivatives 3693 4786 35813 Other Securities 13903 Remaining earning assets 620 370751 Total Earning Assets Fixed Assets 916 91965 1969 10864 1428 Non-Earning Assets 8558 Total Assets 104798 380737 Liabilities & Equity Deposits & Short term funding 92694 322915 Total Customer Deposits 58711 219592 Deposits from Banks 3079 102579 30904 Other Deposits and Short-term Borrowings Other interest bearing liabilities 8545 744 28244 5555 Derivatives 4770 Trading Liabilities 11840 4 3771 Long term funding 10849 Other (Non-Interest bearing) 5100 5464 Loan Loss Reserves n.a. n.a. Other Reserves 501 6326 Equity -2042 17788 Total Liabilities & Equity 104798 380737 Notes Impaired Loans (Memo) Loan Loss Reserves (Memo) Liquid Assets (Memo) Intangibles (Memo) Off Balance Sheet Items Hybrid Capital (Memo) Subordinated Debts (Memo) INCOME STATEMENT Net Interest Revenue Other Operating Income Net Gains (Losses) on Trading and Derivatives Net Gains (Losses) on Assets at FV through Income Statement Net Fees and Commissions Remaining Operating Income Overheads, Loan Loss Provisions Other Profit before Tax Tax Net Income Operating Income (Memo) Dividend Paid Total Capital Ratio Tier 1 Ratio Total Capital Tier 1 Capital Net-Charge Offs Required: a) Calculate the following ratios for the two banks. Loan Loss Reserves / Gross Loans Equity / Assets Equity / Liabilities Return on Assets Return on Equity Net Interest Margin Loans / Total Assets 24287 7770 11360 2138 20699 0 19 3365 6 -370 -270 495 151 2322 2545 -477 -1973 158 -2131 3371 0 9.2 7.8 -3937 -4292 435.7 23767 14385 193331 736 50833 291 7336 2888 3543 1150 n.a. 2215 178 6425 3178 -127 -3299 -47 -3252 6431 n.a. 18.2 14.9 23925 19663 921

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

National Bank Natwest Loan loss Reserves Gross Loans ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started