Answered step by step

Verified Expert Solution

Question

1 Approved Answer

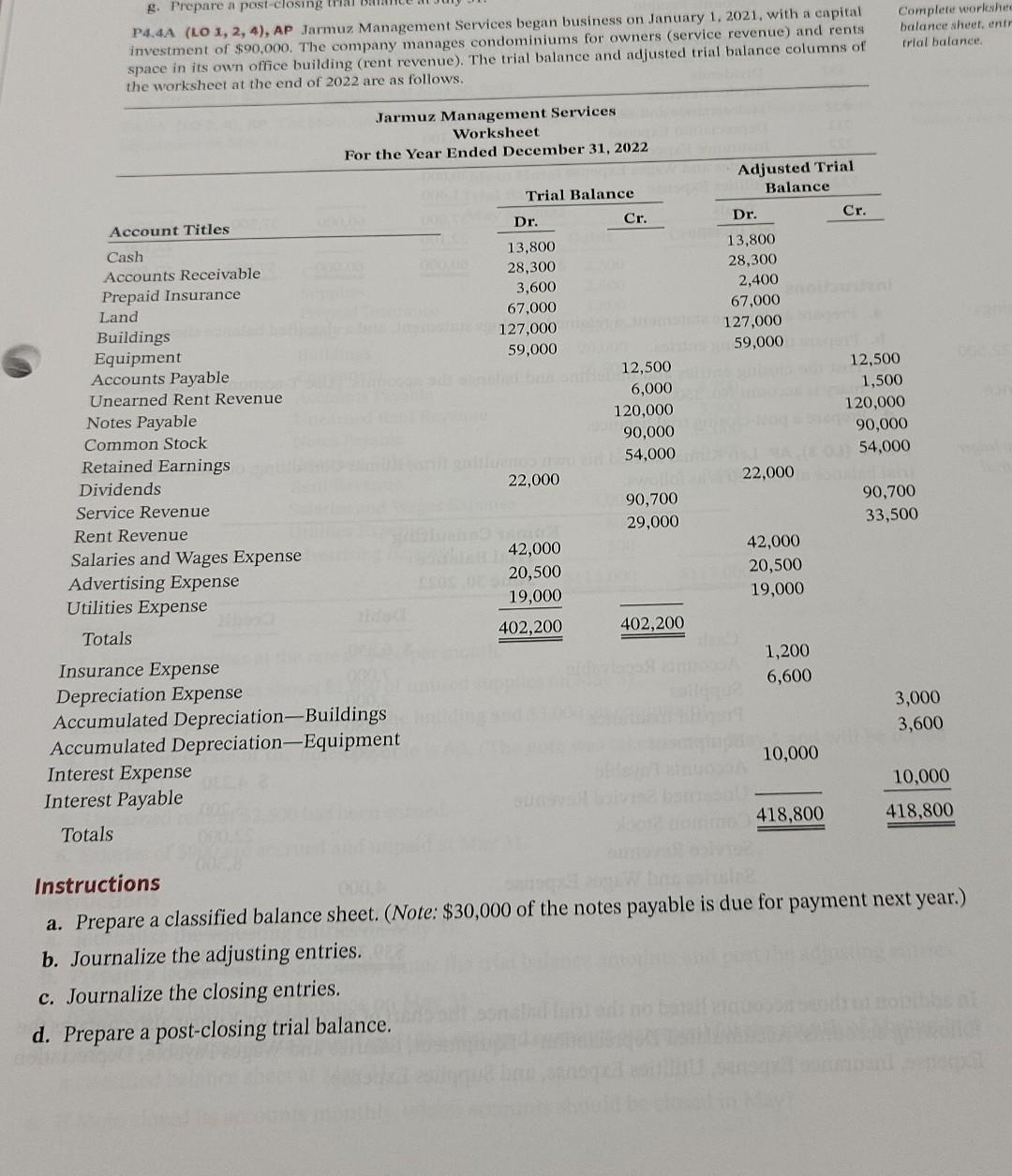

g. Prepare a post-closing that P4.4A (LO 1, 2, 4), AP Jarmuz Management Services began business on January 1, 2021, with a capital investment of

g. Prepare a post-closing that P4.4A (LO 1, 2, 4), AP Jarmuz Management Services began business on January 1, 2021, with a capital investment of $90,000. The company manages condominiums for owners (service revenue) and rents space in its own office building (rent revenue). The trial balance and adjusted trial balance columns of the worksheet at the end of 2022 are as follows. Complete workshee balance sheet, enir trial balance Jarmuz Management Services Worksheet For the Year Ended December 31, 2022 Account Titles Cash Accounts Receivable Prepaid Insurance Land Buildings Equipment Accounts Payable Unearned Rent Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense Advertising Expense Utilities Expense Totals Insurance Expense Depreciation Expense Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Interest Expense Interest Payable Totals Trial Balance Dr. Cr. 13,800 28,300 3,600 67,000 127,000 59,000 12,500 6,000 120,000 90,000 SE54,000 22,000 90,700 29,000 42,000 20,500 19,000 402,200 402,200 Adjusted Trial Balance Dr. Cr. 13,800 28,300 2,400 67,000 127,000 59,000 12,500 1,500 120,000 90,000 54,000 22,000 90,700 33,500 42,000 20,500 19,000 1,200 6,600 3,000 3,600 10,000 10,000 418,800 418,800 Instructions a. Prepare a classified balance sheet. (Note: $30,000 of the notes payable is due for payment next year.) b. Journalize the adjusting entries. c. Journalize the closing entries. d. Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started